How Investors Are Reacting To Capgemini (ENXTPA:CAP) Securing Key Role in ECB Digital Euro Project

Reviewed by Sasha Jovanovic

- On October 2, 2025, the European Central Bank announced that the consortium led by Giesecke+Devrient (G+D), with Nexi and Capgemini, was selected as the first-ranked tenderer to develop and implement the offline payments infrastructure for the digital euro across Europe.

- This collaboration positions Capgemini at the forefront of advancing secure, privacy-focused digital payment solutions, reflecting the company's engineering and technology consulting strengths in large-scale, EU-wide digital transformation projects.

- We'll examine how Capgemini's pivotal role in the ECB digital euro initiative could influence its long-term digital transformation outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Capgemini Investment Narrative Recap

Capgemini’s ability to convert industry digitalization trends into sustainable, profitable growth has been a central theme for shareholders, with expanding cloud, AI, and payments wins considered essential catalysts. The recent selection for the ECB digital euro project, while enhancing Capgemini’s visibility in European payments transformation, does not fundamentally change the near-term catalyst: the need for a consistent rebound in core revenue and margin growth across key geographies. The main risk remains persistent weakness in demand from European clients, which could continue to affect growth and margins.

Among recent announcements, Capgemini’s €4.0 billion bond issuance in September 2025 stands out, as it supports both the WNS acquisition and refinances existing debt. While this reinforces investment in higher-value services and M&A-led growth, it also raises questions about short-term cost management and integration risks amid margin pressures. The move highlights how financial flexibility is being prioritized to support digital transformation objectives, while the core business remains subject to regional volatility.

But with margin pressures shown to persist, investors should be aware of the potential impact if demand in key European markets does not recover as expected...

Read the full narrative on Capgemini (it's free!)

Capgemini's outlook sees €24.5 billion in revenue and €2.0 billion in earnings by 2028. This is based on analysts’ assumptions of 3.6% annual revenue growth and a €0.4 billion increase in earnings from €1.6 billion today.

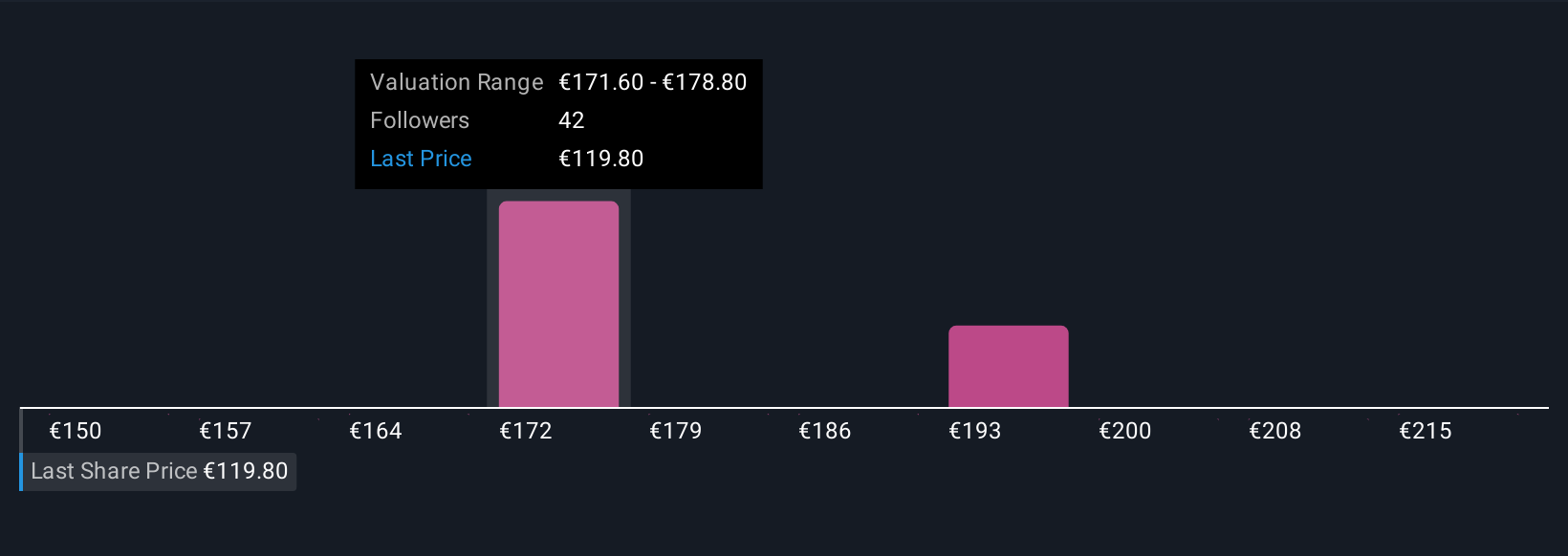

Uncover how Capgemini's forecasts yield a €172.07 fair value, a 45% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community have set fair value estimates for Capgemini between €150 and €222, reflecting contrasting views on the stock’s potential. The company’s continued margin pressures and slow core regional growth remain central to the broader debate over long-term earnings prospects.

Explore 8 other fair value estimates on Capgemini - why the stock might be worth as much as 87% more than the current price!

Build Your Own Capgemini Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capgemini research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Capgemini research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capgemini's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CAP

Capgemini

Provides consulting, digital transformation, technology, and engineering services primarily in North America, France, the United Kingdom, Ireland, the rest of Europe, the Asia-Pacific, and Latin America.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives