Capgemini (ENXTPA:CAP): Valuation Insights After Securing Key Role in ECB’s Digital Euro Project

Reviewed by Kshitija Bhandaru

Capgemini (ENXTPA:CAP) is drawing attention after being selected, together with partners Giesecke+Devrient and Nexi, as the leading provider for the European Central Bank's digital euro offline payment solution. This collaboration highlights Capgemini’s role in reshaping digital payments across Europe.

See our latest analysis for Capgemini.

Capgemini's pivotal role in the ECB’s digital euro project comes as the company steps up its presence at influential industry conferences, including a keynote at ITC Vegas this month. Over the past year, the share price has faced real headwinds. A 1-year total shareholder return of -33.02% reveals a pronounced cooling in momentum, even as Capgemini remains a technology partner on groundbreaking European payments initiatives.

If moves in the digital payments sector have piqued your curiosity, it’s worth broadening your search. Now is a great time to discover fast growing stocks with high insider ownership.

With Capgemini trading nearly 40% below its analyst price target even after a year of sharp declines, is this a rare entry point for patient investors, or is the market already factoring in the company’s next chapter?

Most Popular Narrative: 30% Undervalued

Compared to Capgemini’s last close at €120.30, the most widely followed narrative sees fair value much higher, creating a wide valuation gap. Investors are left weighing whether this disconnect is a glaring opportunity or a warning sign about future growth and margins.

Capgemini's expanding leadership and strong deal wins in advanced cloud, data, and artificial intelligence (including Gen AI and Agentic AI) are positioning the company to benefit from the accelerating client demand for digital transformation. This supports a pipeline for higher-value, higher-margin contracts that could drive long-term revenue and margin expansion.

Want to know what powers this punchy price estimate? It comes down to ambitious projections for profit margins and a growth path that hinges on widespread digital transformation. What hidden assumptions are baked into this bullish outlook? The details may surprise you and crucial insights await in the full narrative.

Result: Fair Value of €172.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent revenue declines in key European regions or margin pressures from fierce competition could challenge the optimistic growth and valuation case for Capgemini.

Find out about the key risks to this Capgemini narrative.

Another View: Looking Through the Lens of Multiples

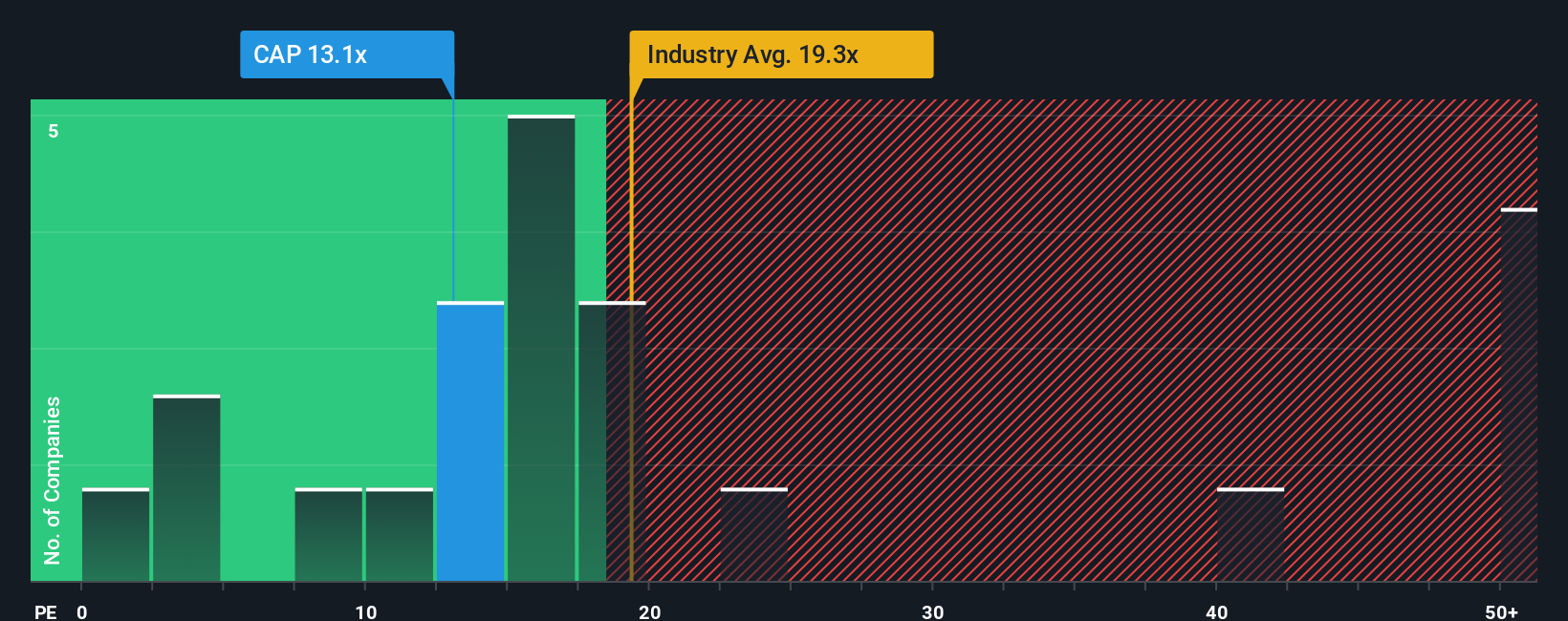

Taking a different approach from the narrative-based analyst outlook, Capgemini’s current price-to-earnings ratio sits at 13.1x. That is higher than its closest peers (11.2x), yet still much cheaper than the broader European IT industry average (19.0x). The fair ratio stands even further above at 25.7x, which is the level market sentiment could eventually lean toward. Does this gap reflect undiscovered value, or a warning about tough times still ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capgemini Narrative

If you have a different perspective or want to dive into the numbers yourself, crafting your own view takes less than three minutes. Do it your way

A great starting point for your Capgemini research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Act now to tap into proven stock screens that surface standout opportunities across today’s fast-moving markets. Don’t limit your portfolio. Smart investors seize what others overlook.

- Zero in on future blue chips by targeting these 3576 penny stocks with strong financials with strong financials and potential for explosive upside.

- Supercharge your returns from innovators transforming industries by acting on these 25 AI penny stocks making waves in artificial intelligence.

- Maximize your value hunt with these 894 undervalued stocks based on cash flows poised for growth based on solid cash flows and favorable discount rates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CAP

Capgemini

Provides consulting, digital transformation, technology, and engineering services primarily in North America, France, the United Kingdom, Ireland, the rest of Europe, the Asia-Pacific, and Latin America.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives