Assessing Capgemini (ENXTPA:CAP) Valuation After Recent Subtle Share Price Shifts

Reviewed by Simply Wall St

If you have been tracking Capgemini (ENXTPA:CAP) lately, the recent share price movements might already have you pausing to consider your next move. With no major event shaking up the headlines, it is easy to wonder if subtle shifts in the stock’s value are signaling something deeper. This could suggest a change in market sentiment or a fresh reevaluation of where the company is headed. Investors frequently grapple with these moments, trying to make sense of what a modest move could mean for a stock that has seen sharper swings in the not-so-distant past.

Zooming out, Capgemini’s stock has cooled off over the past year, drifting down about 28% since this time last year and showing a similar trend when you step back a bit further. Even the past quarter has not provided much of a bounce, with momentum fading. Over the past five years, the shares are still up, but recent market action hints that confidence may be running low. It could also be that investors are simply waiting for clearer signals before moving back in.

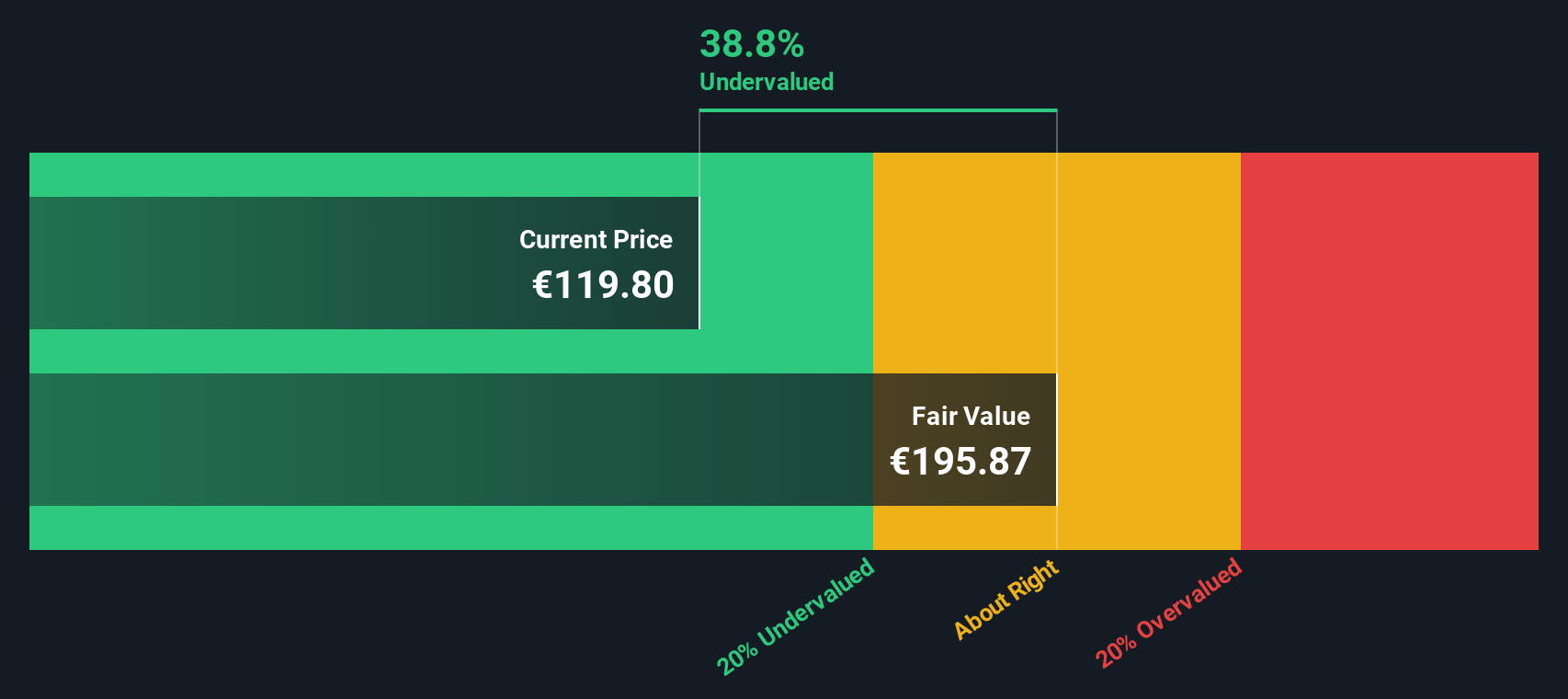

After such a stretch of underperformance, the big question now is whether Capgemini shares are actually undervalued, or if the current price already reflects its outlook for future growth.

Most Popular Narrative: 27.7% Undervalued

According to the most widely followed narrative, Capgemini currently trades well below its estimated fair value, suggesting it could be undervalued by the market given its projected earnings outlook and recent business transformations.

Capgemini's expanding leadership and strong deal wins in advanced cloud, data, and artificial intelligence (including Gen AI and Agentic AI) are positioning the company to benefit from the accelerating client demand for digital transformation. This supports a pipeline for higher-value and higher-margin contracts and may help drive long-term revenue and margin expansion.

Want to know the bold strategy behind this valuation? One key forecast could redefine the market’s expectations, relying on a future profit multiple that only industry heavyweights typically command. If you are curious which specific performance levers are shaping this valuation calculation, this narrative’s underlying numbers might surprise you. See what’s really driving the fair value call.

Result: Fair Value of €175.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in key European markets or ongoing margin pressure from tough competition could challenge the positive case for Capgemini in the future.

Find out about the key risks to this Capgemini narrative.Another Perspective: Discounted Cash Flow Check

From a different perspective, our DCF model also finds Capgemini trading below its estimated intrinsic value. This reinforces the view that the stock appears undervalued using both approaches. However, do these methods provide the complete picture, or is there more for investors to consider?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Capgemini for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Capgemini Narrative

If you see things differently or prefer to dig into the details yourself, you can easily craft a personal outlook in just a few minutes. Do it your way.

A great starting point for your Capgemini research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t just watch from the sidelines while fresh opportunities are emerging. Expand your horizons with stock ideas designed to fit your goals and spark your curiosity.

- Boost your portfolio’s earning power by grabbing potential high-yield picks in the market with our selection of dividend stocks with yields > 3%.

- Fuel your strategy with tomorrow’s tech giants by jumping into companies harnessing the power of artificial intelligence using our exclusive AI penny stocks.

- Secure hidden value before the crowd catches on by seeking out promising stocks trading beneath their intrinsic worth through our tailored undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:CAP

Capgemini

Provides consulting, digital transformation, technology, and engineering services primarily in North America, France, the United Kingdom, Ireland, the rest of Europe, the Asia-Pacific, and Latin America.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

SAP's Intrinsic and Historical Valuation

Nike: A Market Leader with Resilience and Long-Term Growth Potential

The Real Power Behind Alphabet’s Growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale