74Software (ENXTPA:74SW) Valuation: Are Shares Still Undervalued After Recent Gains?

Reviewed by Kshitija Bhandaru

See our latest analysis for 74Software.

After surging earlier this year, 74Software's share price has cooled a bit. Year-to-date gains remain strong at over 41%. The recent dip comes in the context of an impressive 1-year total shareholder return of 50.6% and an even more striking three-year total return of 144%. While this week's move was subdued, momentum for long-term investors is still very much alive.

If you're looking to capture similar growth stories, now is the perfect time to discover fast growing stocks with high insider ownership.

But with shares still trading well below analyst price targets and significant growth in profitability, the question remains: is 74Software undervalued, or is the market already factoring in all its future growth potential?

Most Popular Narrative: 24.2% Undervalued

Compared to the most closely followed narrative, 74Software's last close of €37.5 stands well below its fair value estimate, raising questions about what the market is missing. The valuation highlights a notable gap between current pricing and projected company performance. Here is the catalyst analysts are watching.

The ongoing shift by enterprises from on-premises to cloud-based solutions is expanding 74Software's recurring revenue base, evidenced by the increase in SaaS product adoption and recurring revenues rising from 71% to 75%. This transition is likely to further improve revenue predictability and gross margins as customers opt for managed services and subscriptions.

Want to unlock what’s fueling this value gap? The real driver: ambitious projections for future growth and a profit margin leap that underpins a premium rating. Curious about the specific numbers anchoring this bold outlook? Get the full story in the narrative.

Result: Fair Value of €49.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks from recent mergers and rising R&D costs could challenge profit growth. This may potentially undermine the optimism surrounding 74Software's future outlook.

Find out about the key risks to this 74Software narrative.

Another View: Market Multiples Tell a Different Story

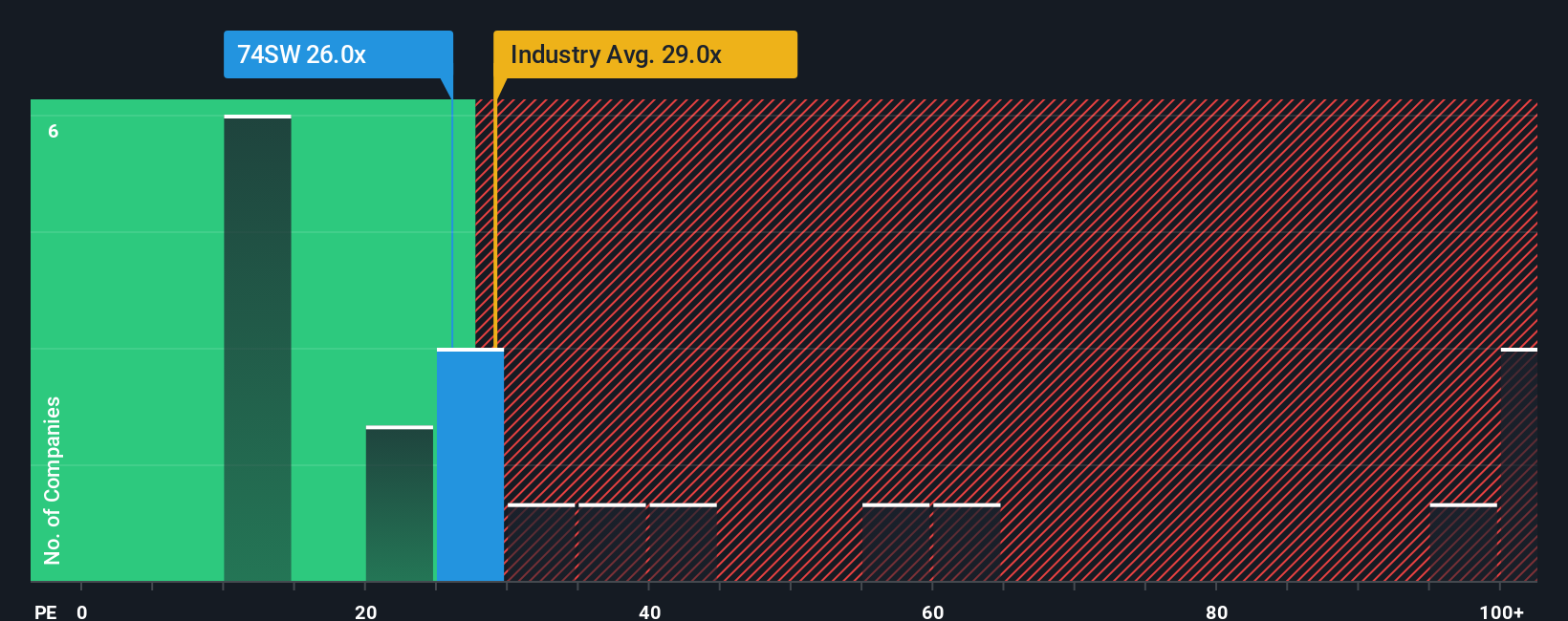

Looking beyond fair value estimates, the price-to-earnings ratio tells us 74Software trades at 26x, slightly below peers in the European software sector at 28.7x and close to the industry’s fair ratio of 24.9x. This suggests the stock isn’t a bargain but isn’t wildly expensive either. Could future growth push it toward that fair ratio, or is there more risk of the market holding back?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 74Software Narrative

If this view doesn't quite match your perspective or you'd rather dive deeper on your own, you can analyze the numbers in just a few minutes and shape your own view. Do it your way.

A great starting point for your 74Software research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Don't let great stocks pass you by when smarter options could be just a click away. Uncover new winners using these expert-curated lists today:

- Tap into the momentum of fast-growing digital coins and platforms by scanning these 79 cryptocurrency and blockchain stocks, where real innovation is reshaping finance.

- Spot high-yield opportunities for building reliable passive income with these 19 dividend stocks with yields > 3%, which puts attractive payout performance front and center.

- Seize the potential of truly undervalued companies driving future market returns by checking out these 892 undervalued stocks based on cash flows now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:74SW

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives