- France

- /

- Semiconductors

- /

- ENXTPA:STMPA

A Fresh Look at STMicroelectronics (ENXTPA:STMPA) Valuation Following €60M Panel-Level Packaging Investment

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 32.1% Undervalued

According to the most widely followed narrative, STMicroelectronics is seen as one of the more attractively priced stocks in the sector today, trading well below its estimated fair value. This outlook implies significant optimism about the company’s prospects over the next several years.

Electric Vehicles (EVs): SiC demand surging

IoT & AI expansion: Increased adoption in smart devices

Why is this high conviction call stirring up such a buzz? The case for upside is tied to bold forecasts about revenue growth, margin improvements, and a stronger earnings mix. The numbers backing this projected fair value might surprise you, hinting at underlying assumptions the market could be missing. If you want to uncover exactly what supports this steep discount, keep reading to see what could set STMicroelectronics apart from the crowd.

Result: Fair Value of $34.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, cost pressures and increasing competition from global semiconductor players could still challenge these bullish expectations in the years ahead.

Find out about the key risks to this STMicroelectronics narrative.Another View: What Do Market Comparisons Say?

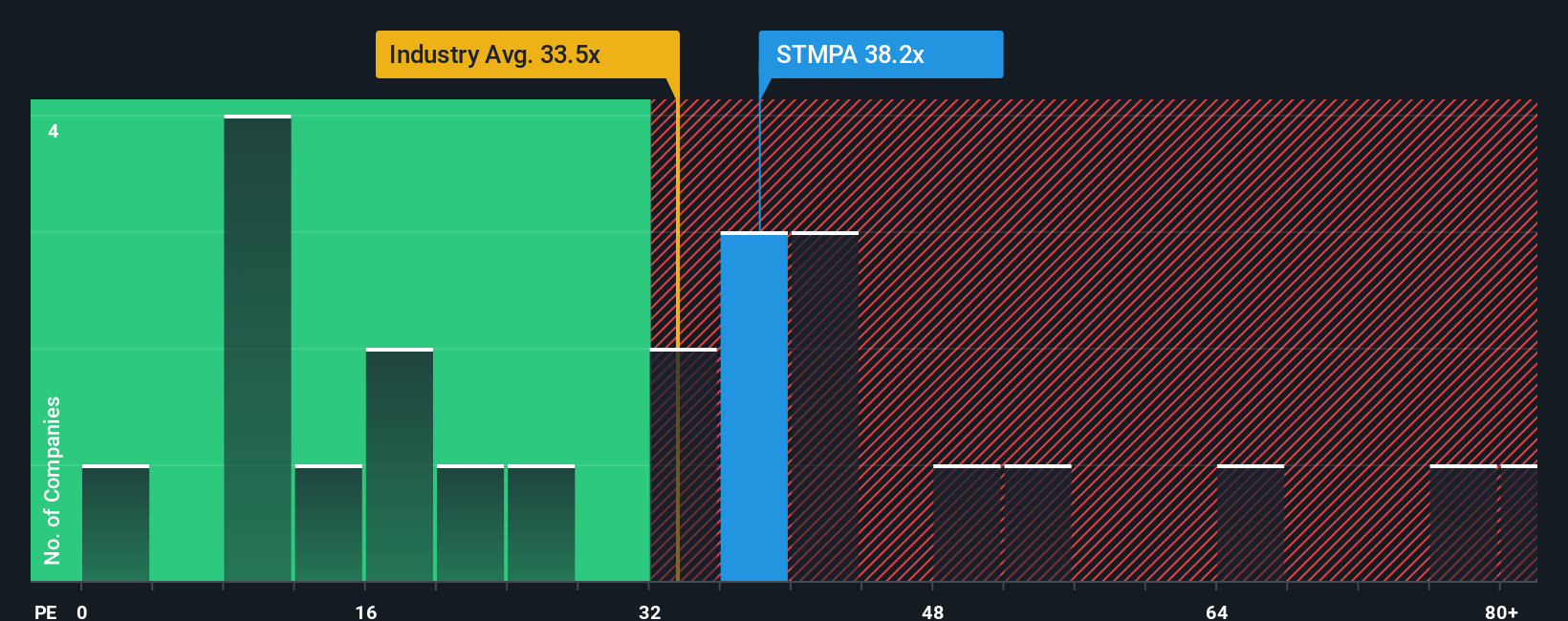

While our first look highlights significant upside from fair value, market-based comparisons tell a different story. The stock appears pricey compared to sector averages, which brings the bullish narrative into question. Which view will investors trust?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding STMicroelectronics to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own STMicroelectronics Narrative

Not every perspective will align, and if you’re curious to dig into the numbers on your own, you can assemble your own narrative in just a few minutes: Do it your way.

A great starting point for your STMicroelectronics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why stop at just one stock? Give yourself an edge by checking out top picks in areas where technology, value, and market momentum are changing fast.

- Unlock high-growth potential with companies shaping tomorrow’s tech, and see who’s making waves in the AI penny stocks space.

- Benefit from resilient cash flows and competitive pricing by scanning the market for businesses considered undervalued stocks based on cash flows right now.

- Target powerful income streams by zeroing in on dividend stocks with yields > 3% opportunities that could boost your returns well above market averages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:STMPA

STMicroelectronics

Designs, develops, manufactures, and sells semiconductor products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives