- Israel

- /

- Capital Markets

- /

- TASE:ATRY

Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

Amid a backdrop of record highs in major U.S. indexes and broad-based gains across smaller-cap stocks, the global market is navigating through a mix of positive economic indicators such as falling jobless claims and rising home sales. This environment sets an intriguing stage for investors seeking opportunities in small-cap stocks, which often thrive on strong economic fundamentals and can be less impacted by geopolitical uncertainties. In this context, identifying promising companies with solid growth potential and sound financial health becomes crucial for uncovering undiscovered gems within the market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Aramis Group SAS (ENXTPA:ARAMI)

Simply Wall St Value Rating: ★★★★★☆

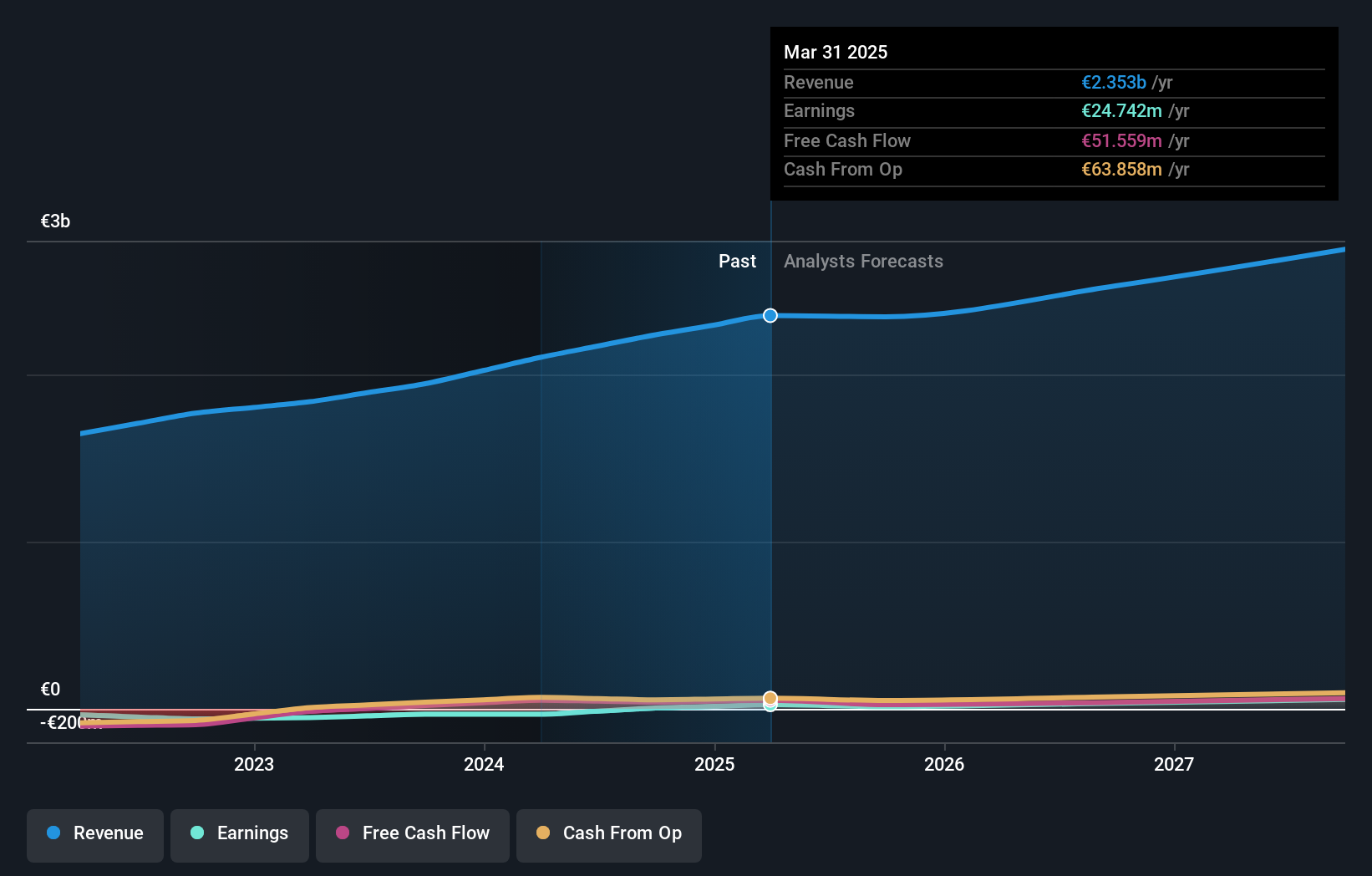

Overview: Aramis Group SAS operates in the online sale of used vehicles across several European countries including France, Belgium, the United Kingdom, Austria, Italy, and Spain with a market capitalization of €580.43 million.

Operations: Aramis Group generates revenue primarily through the online sale of used vehicles across several European countries. The company's financial performance includes a focus on managing its cost structure to optimize profitability. Notably, it has experienced fluctuations in net profit margin, reflecting varying levels of efficiency in converting revenue into profit over time.

In the world of specialty retail, Aramis Group SAS has emerged as a promising player, recently reporting sales of €2.24 billion, up from €1.94 billion last year. The company turned a corner with net income reaching €5.01 million compared to a previous loss of €32.33 million, showcasing its newfound profitability against an industry backdrop that saw earnings shrink by 17.9%. Despite satisfactory net debt to equity at 39.8%, interest coverage remains tight at 1.2x EBIT, indicating room for improvement in managing financial obligations while maintaining high-quality earnings and trading below fair value estimates by 33%.

TTW (SET:TTW)

Simply Wall St Value Rating: ★★★★★★

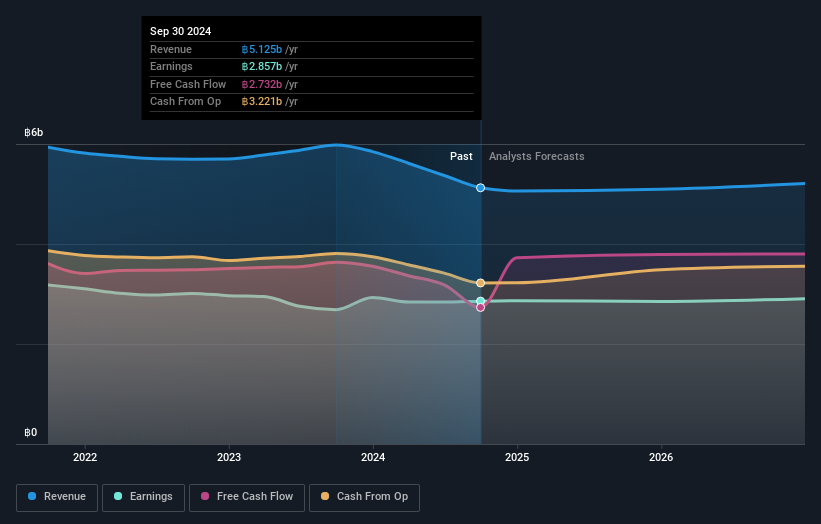

Overview: TTW Public Company Limited, with a market cap of THB35.91 billion, operates in Thailand focusing on the production and sale of treated water through its subsidiaries.

Operations: TTW generates revenue primarily from the production and sale of treated water, amounting to THB5.12 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

TTW, a water utility player, is showing promising signs with earnings growth of 6.3% over the past year, outpacing the industry's -2.2%. The company has significantly reduced its debt to equity ratio from 76.6% to 25.2% in five years, reflecting improved financial health. With EBIT covering interest payments by a robust 31.4 times and trading at 51.8% below estimated fair value, TTW appears undervalued. Despite a dip in quarterly sales to THB 1,287 million from THB 1,532 million last year, net income rose slightly to THB 916 million from THB 897 million due to high-quality earnings management strategies.

Atreyu Capital Markets (TASE:ATRY)

Simply Wall St Value Rating: ★★★★★★

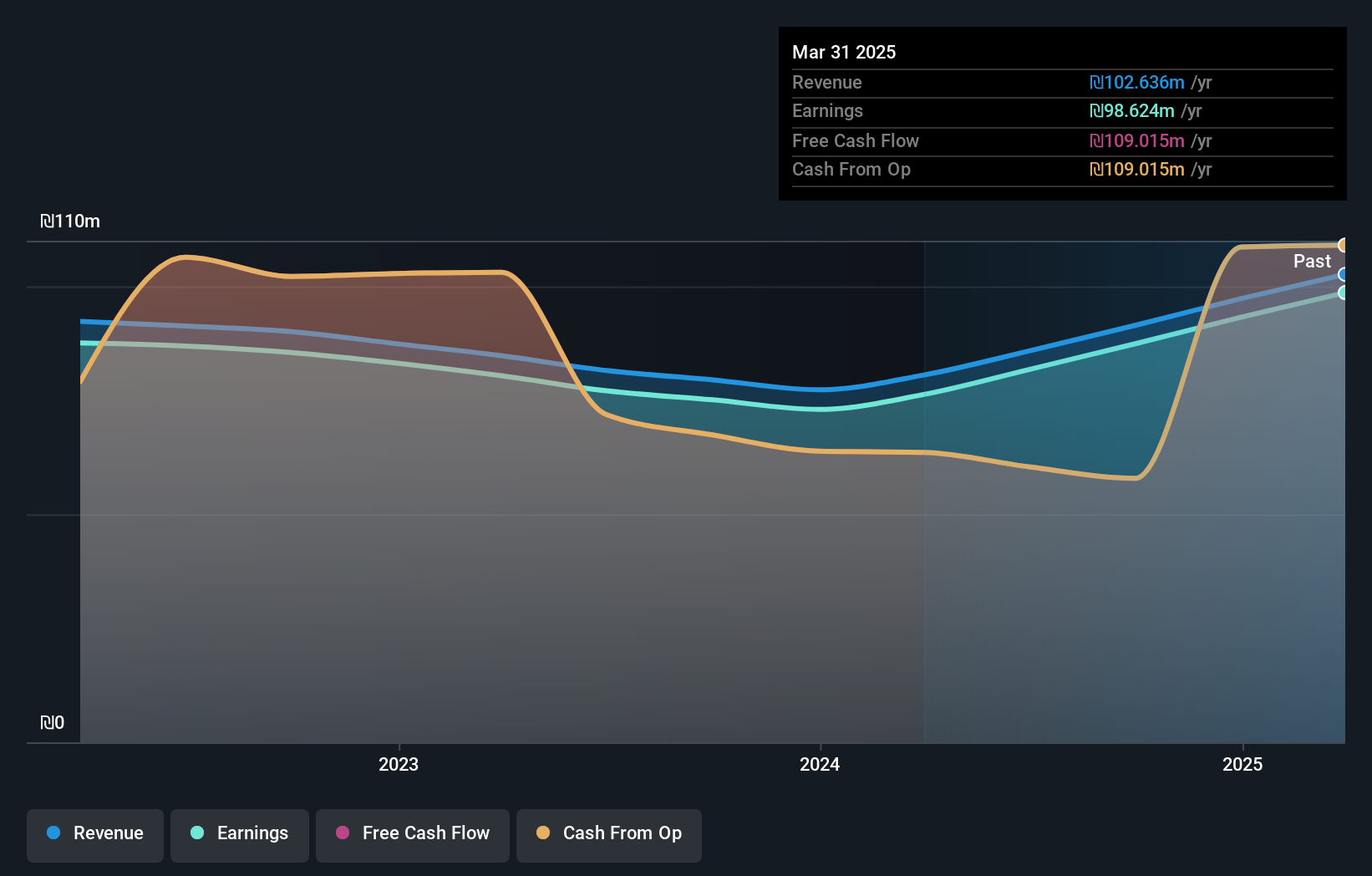

Overview: Atreyu Capital Markets Ltd provides investment management services both in Israel and internationally, with a market capitalization of ₪1.02 billion.

Operations: Atreyu Capital Markets generates revenue primarily from its investment management services, amounting to ₪85.82 million.

Atreyu Capital Markets, a nimble player in the financial sector, is debt-free and boasts high-quality earnings. Despite a slight 0.3% annual decline in earnings over the past five years, it remains profitable with positive free cash flow, reaching ILS 60.41 million recently. Trading at 31.8% below its estimated fair value suggests potential undervaluation for investors seeking opportunities in smaller entities. Recent performance highlights include increased revenue of ILS 46.88 million and net income of ILS 44.81 million for the first half of 2024, signaling robust operational efficiency despite not outpacing industry growth rates last year at just 6.1%.

Summing It All Up

- Gain an insight into the universe of 4634 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ATRY

Atreyu Capital Markets

Through its subsidiaries, provides investment management services in Israel.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives