- France

- /

- Specialty Stores

- /

- ENXTPA:ARAMI

Even With A 28% Surge, Cautious Investors Are Not Rewarding Aramis Group SAS' (EPA:ARAMI) Performance Completely

Despite an already strong run, Aramis Group SAS (EPA:ARAMI) shares have been powering on, with a gain of 28% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 27% in the last year.

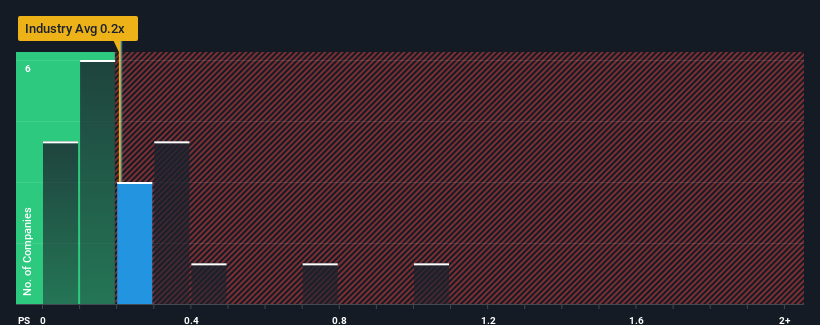

Even after such a large jump in price, there still wouldn't be many who think Aramis Group SAS' price-to-sales (or "P/S") ratio of 0.2x is worth a mention when it essentially matches the median P/S in France's Specialty Retail industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Aramis Group SAS

What Does Aramis Group SAS' Recent Performance Look Like?

Recent times have been advantageous for Aramis Group SAS as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Aramis Group SAS.How Is Aramis Group SAS' Revenue Growth Trending?

In order to justify its P/S ratio, Aramis Group SAS would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. Pleasingly, revenue has also lifted 121% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the five analysts following the company. With the industry only predicted to deliver 6.3%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Aramis Group SAS' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Aramis Group SAS' P/S

Its shares have lifted substantially and now Aramis Group SAS' P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at Aramis Group SAS' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Aramis Group SAS with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ARAMI

Aramis Group SAS

Engages in the online sale of used vehicles in France, Belgium, the United Kingdom, Austria, Italy, and Spain.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives