- France

- /

- Real Estate

- /

- ENXTPA:FIPP

European Penny Stocks To Consider In July 2025

Reviewed by Simply Wall St

As of early July 2025, the European markets have shown mixed results, with the pan-European STOXX Europe 600 Index remaining relatively flat and major indexes like France's CAC 40 and Italy's FTSE MIB posting modest gains. In such a climate, investors often turn their attention to penny stocks—an investment area that remains intriguing despite its somewhat outdated moniker. These stocks typically represent smaller or newer companies and can offer growth potential at lower price points when backed by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Maps (BIT:MAPS) | €3.44 | €45.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.49 | RON17.25M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.83 | €59.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.72 | €17.65M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.30 | PLN11.59M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.495 | SEK2.39B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.66 | SEK222.67M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.09 | €288.55M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.984 | €33.18M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 325 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

FIPP (ENXTPA:FIPP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FIPP S.A. operates in the real estate sector both in Paris and internationally, with a market cap of €14.19 million.

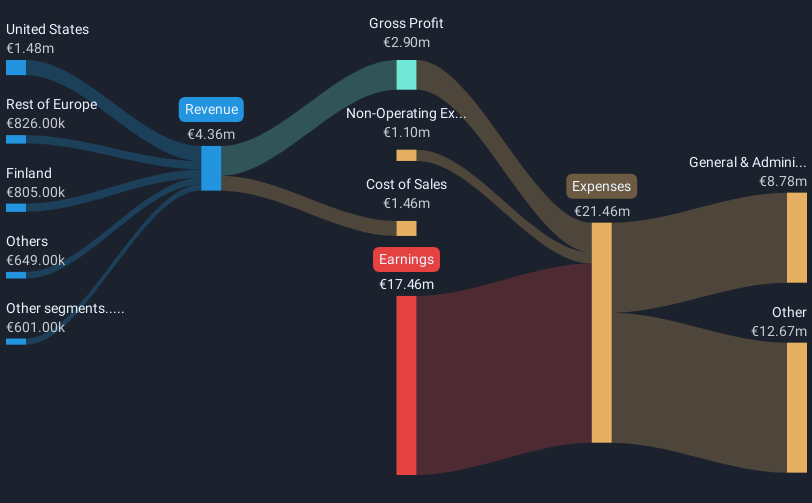

Operations: The company generates revenue from three primary segments: Shops (€0.06 million), Hotels (€1.69 million), and Housing (€0.50 million).

Market Cap: €14.19M

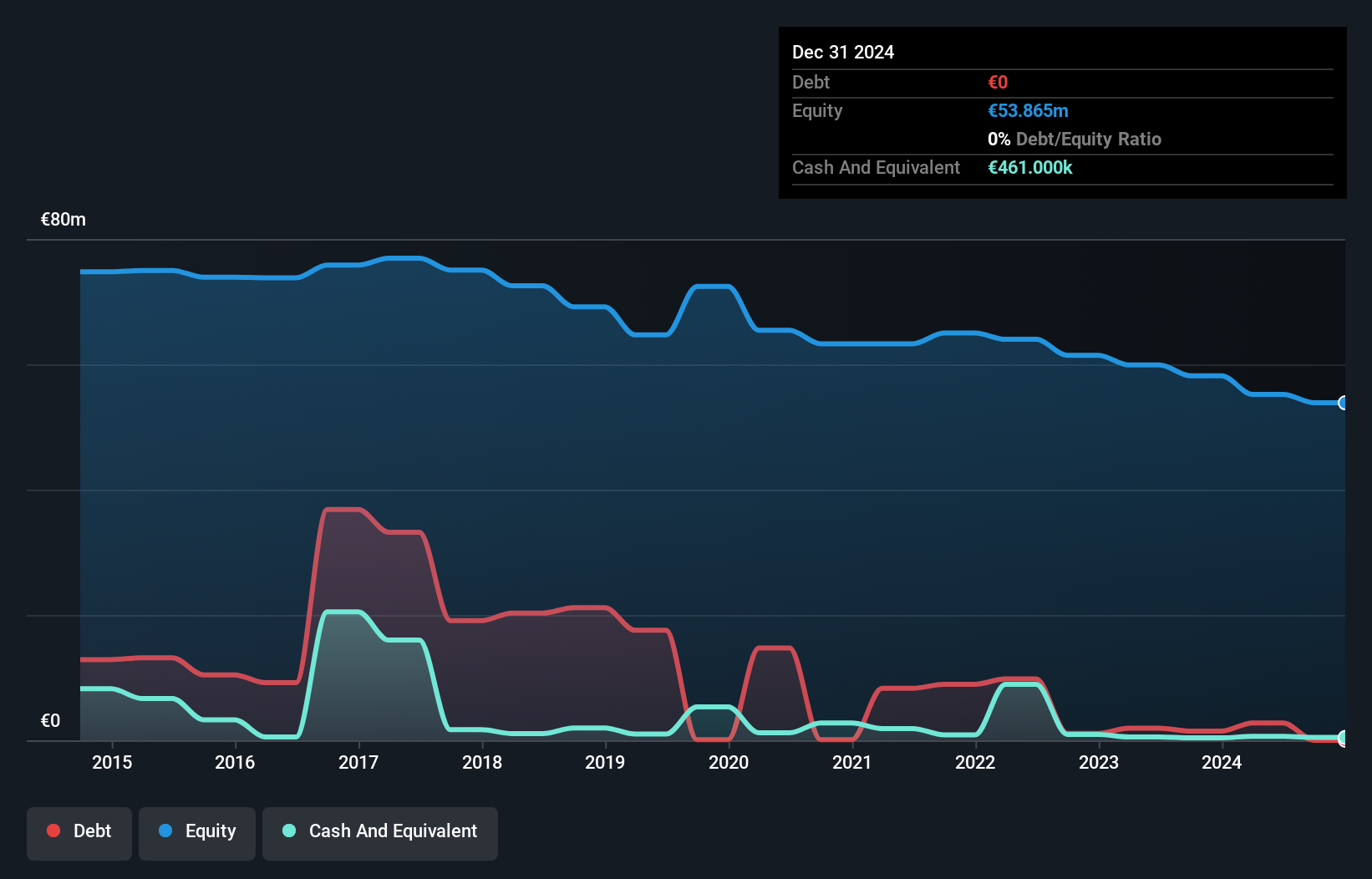

FIPP S.A., operating in the real estate sector, is currently pre-revenue with a total revenue of €2 million across its segments. Despite being debt-free and having a sufficient cash runway exceeding three years, FIPP remains unprofitable with increasing losses over the past five years. Its short-term assets (€2.7 million) are insufficient to cover both short-term (€22.2 million) and long-term liabilities (€4.1 million). The company's share price has experienced high volatility recently, though it trades significantly below estimated fair value. Recent earnings showed a net loss increase to €4.26 million for 2024 from €3.21 million in 2023.

- Click to explore a detailed breakdown of our findings in FIPP's financial health report.

- Examine FIPP's past performance report to understand how it has performed in prior years.

Nightingale Health Oyj (HLSE:HEALTH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nightingale Health Oyj is a health technology company that provides a health data platform for detecting disease risks across Finland, the United Kingdom, Europe, the United States, and other international markets, with a market cap of €162.64 million.

Operations: The company's revenue is primarily generated from its Medical Labs & Research segment, amounting to €4.95 million.

Market Cap: €162.64M

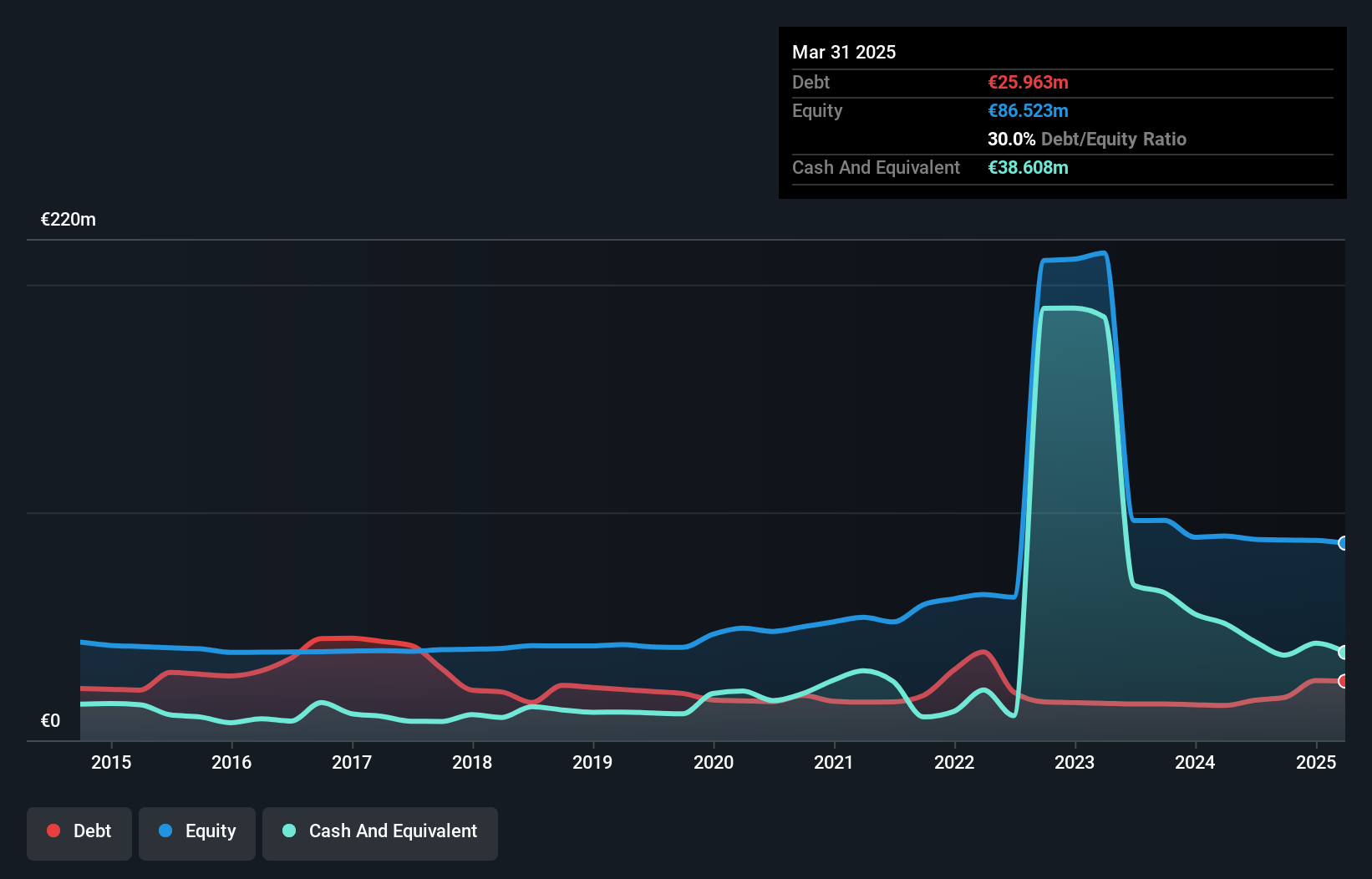

Nightingale Health Oyj, with a market cap of €162.64 million, is unprofitable but has a solid cash runway exceeding three years and more cash than debt. Its recent U.S. laboratory opening in New York marks a significant step in its expansion strategy, enhancing its service offerings like CoreMetabolomics™ and RemoteOmics™ for medical research customers. The company's revenue from Medical Labs & Research stands at €4.95 million, with forecasts indicating robust growth potential at 42.93% annually. Recent management changes aim to bolster regional commercial activities across EMEA and APAC regions as part of their strategic focus on scalability and innovation in health technology services.

- Navigate through the intricacies of Nightingale Health Oyj with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Nightingale Health Oyj's future.

3U Holding (XTRA:UUU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 3U Holding AG, with a market cap of €56.41 million, operates in the telecommunication and information technology sectors both in Germany and internationally through its subsidiaries.

Operations: The company's revenue is primarily derived from its HVAC segment (€34.57 million), Information and Telecommunications Technology (€18.06 million), and Renewable Energies excluding SHAC (€4.81 million).

Market Cap: €56.41M

3U Holding AG, with a market cap of €56.41 million, operates in telecommunications and IT sectors while being unprofitable. Its short-term assets (€60.7M) exceed both short-term (€14.1M) and long-term liabilities (€26.3M), indicating strong liquidity management, supported by more cash than total debt. Despite a net loss of €1.32 million in Q1 2025, the company anticipates annual revenues between €62 million and €66 million for 2025, driven by its HVAC segment's expansion through strategic property acquisition for EMPUR Produktionsgesellschaft mbH and Calefa GmbH, which may also yield additional lease revenue opportunities.

- Unlock comprehensive insights into our analysis of 3U Holding stock in this financial health report.

- Examine 3U Holding's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Get an in-depth perspective on all 325 European Penny Stocks by using our screener here.

- Want To Explore Some Alternatives? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FIPP

FIPP

FIPP S.A. is involved in the real estate business in Paris and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives