- France

- /

- Real Estate

- /

- ENXTPA:COUR

Here's Why Courtois (EPA:COUR) Can Manage Its Debt Despite Losing Money

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Courtois S.A. (EPA:COUR) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Courtois

How Much Debt Does Courtois Carry?

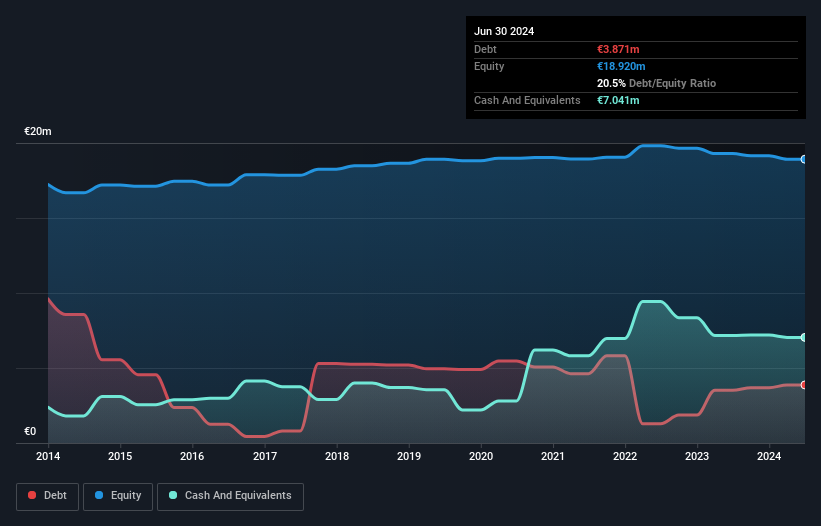

The image below, which you can click on for greater detail, shows that at June 2024 Courtois had debt of €3.87m, up from €3.52m in one year. However, it does have €7.04m in cash offsetting this, leading to net cash of €3.17m.

How Healthy Is Courtois' Balance Sheet?

We can see from the most recent balance sheet that Courtois had liabilities of €2.59m falling due within a year, and liabilities of €3.97m due beyond that. Offsetting this, it had €7.04m in cash and €224.0k in receivables that were due within 12 months. So it can boast €706.0k more liquid assets than total liabilities.

This short term liquidity is a sign that Courtois could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Courtois has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Courtois's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Courtois reported revenue of €1.4m, which is a gain of 53%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Courtois?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Courtois lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of €596k and booked a €288k accounting loss. But the saving grace is the €3.17m on the balance sheet. That means it could keep spending at its current rate for more than two years. Courtois's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. Pre-profit companies are often risky, but they can also offer great rewards. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Courtois (of which 1 is concerning!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:COUR

Courtois

Courtois S.A. renovates and sells real estate properties located in the Midi-Pyrenees and Paris regions in France.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026