Sanofi (ENXTPA:SAN) Margin Jump to 14% Reinforces Bullish Narrative on Quality Earnings

Reviewed by Simply Wall St

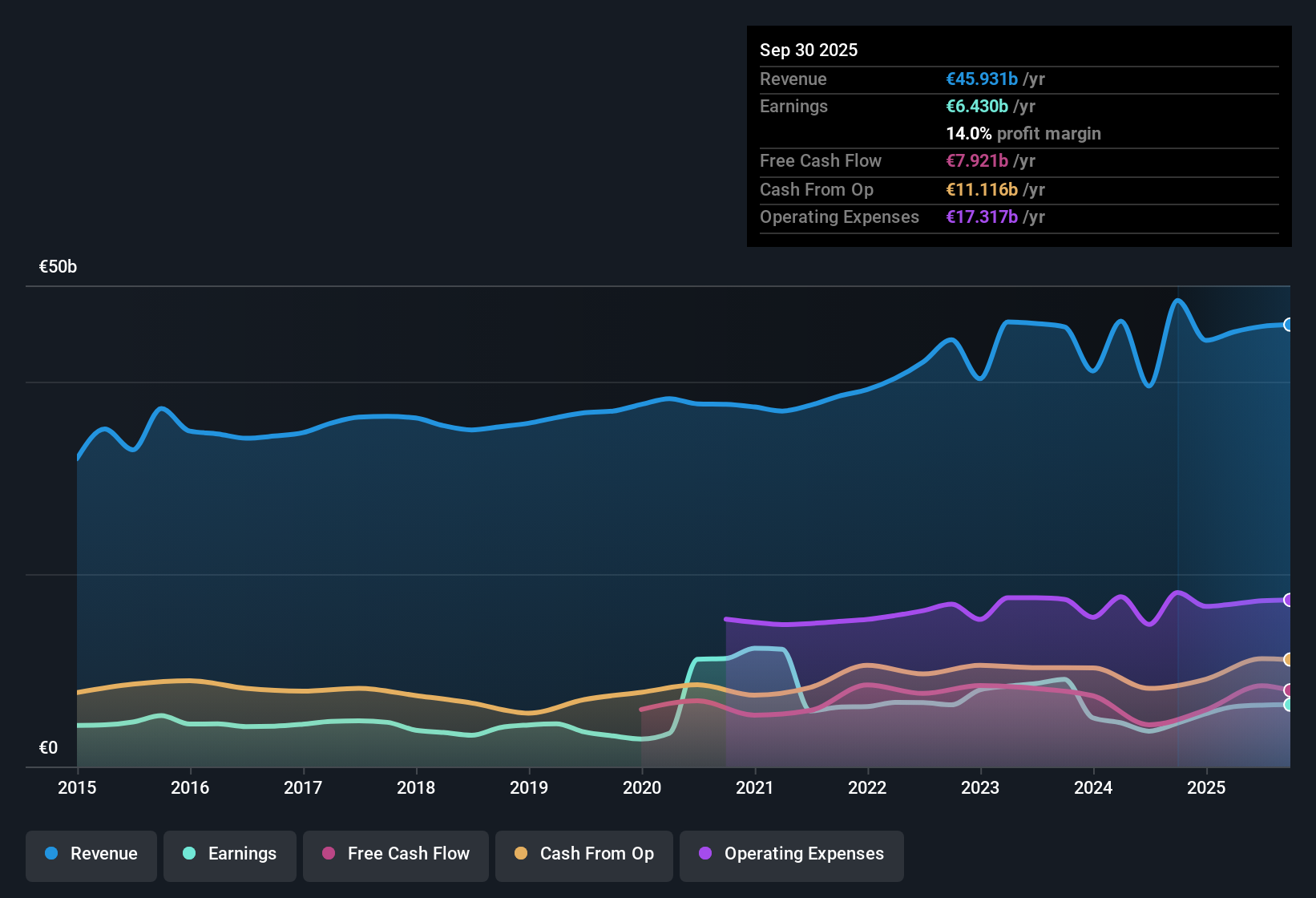

Sanofi (ENXTPA:SAN) delivered net profit margins of 14%, up from 9.3% a year ago, and last year’s earnings grew 73.6% after five years of average annual declines of 14.5%. With earnings now forecast to climb 12.48% per year and profit and revenue expected to outpace the broader French market, these headline numbers make a strong case for a shift in investor sentiment. Improved profitability, a six-reward indicator profile, and a substantially lower Price-To-Earnings Ratio compared to peers all combine to position the stock as high-quality and attractively valued following years of underwhelming earnings trends.

See our full analysis for Sanofi.Now, the big question is how these standout metrics measure up against the most widely held narratives. This is where the story gets interesting.

See what the community is saying about Sanofi

Margin Expansion Sets the Tone

- Net profit margins increased from 9.3% to 14% year-over-year, supported by ongoing operating efficiency initiatives highlighted in the consensus narrative.

- Analysts' consensus view points to Sanofi’s leadership in biologics and vaccines helping to maintain stable revenue, even as cost pressures and pricing challenges emerge.

- Portfolio streamlining through the sale of Opella and refocusing on higher growth pharmaceuticals have tightened overall cost controls and contributed to margin expansion.

- Strategic investments in next-generation products and regulatory incentives have further protected operating margins, even in the face of industry-wide pricing headwinds.

- Consensus analysts expect long-term sales growth as pipeline products, especially in immunology and rare diseases, help offset pressure on base business segments.

Consensus analysts argue that margin performance adds confidence to long-term targets, but highlight that profitability will hinge on continued cost discipline and strong R&D execution. 📊 Read the full Sanofi Consensus Narrative.

Pipeline and R&D Spending Accelerate

- Annual R&D and SG&A spending has increased alongside new launches and acquisitions, reflecting a push into high-value therapeutic areas with multiple Phase III readouts expected through 2026.

- Consensus narrative highlights both upside and risk: heavy investment in drug launches like Dupixent and the rare disease expansion offer growth, but analysts caution that R&D transformation will need several years to play out.

- The company’s ongoing focus on biologics, including anticipated launches in China and COPD indications, could substantially lift long-term sales if clinical milestones are met.

- Bears point out that recent high-profile pipeline setbacks, such as the mixed results in COPD trials, reinforce execution risk despite the broad pipeline.

Valuation Discount vs. Industry

- Sanofi’s current share price of €88.79 trades at a significant discount to its DCF fair value of €176.38, and its Price-To-Earnings ratio of 16.9x is notably lower than both the peer average (21.4x) and the broader European Pharmaceuticals industry (22.9x).

- Consensus view suggests this valuation gap draws attention from value-oriented investors, especially as Sanofi’s profit and revenue forecasts outpace much of the French market.

- Analyst price target stands at €107.54, a premium of almost 21% to the share price, which indicates continued optimism if margin momentum and pipeline milestones are maintained.

- The consistently improving reward profile, absence of elevated risk flags, and potential for margin expansion lend credibility to the premium implied by analyst consensus.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sanofi on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think there’s another angle to the numbers? You can shape your own view in just a few minutes and share your perspective, too. Do it your way

A good starting point is our analysis highlighting 6 key rewards investors are optimistic about regarding Sanofi.

See What Else Is Out There

Despite recent profit and margin gains, Sanofi’s growth trajectory still faces pressure from high R&D costs, pipeline execution risks, and revenue concentration in select products.

If steady and predictable performance is key for your portfolio, use stable growth stocks screener (2099 results) to discover companies consistently delivering reliable growth and less uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAN

Sanofi

Engages in the research, development, manufacture, and marketing of therapeutic solutions.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)