- France

- /

- Life Sciences

- /

- ENXTPA:ERF

Eurofins Scientific (ENXTPA:ERF): Exploring Valuation After Recent Share Price Momentum Cools

Reviewed by Kshitija Bhandaru

Eurofins Scientific (ENXTPA:ERF) stock has seen some movement recently, and investors are weighing up its recent performance numbers. Over the past month, shares have edged down by 3%, while the year-to-date gain remains a solid 27%.

See our latest analysis for Eurofins Scientific.

Eurofins Scientific’s share price momentum has cooled a bit after its strong run since the start of 2024. The company’s 27% year-to-date share price return still stands out against a modestly positive 1-year total shareholder return. Investors seem optimistic about the business’s ongoing profitability gains, though recent price dips remind us that sentiment can swing quickly as the outlook evolves.

If this shift in momentum has you thinking about broader opportunities, now is a great time to widen your search and discover fast growing stocks with high insider ownership

With Eurofins Scientific trading just below analyst targets and boasting a significant intrinsic value discount, are investors overlooking hidden value, or is the current price already capturing all the expected growth ahead?

Most Popular Narrative: 3% Undervalued

The prevailing narrative values Eurofins Scientific slightly higher than its last close of €62.02, indicating only a small disconnect between market price and perceived fair value. The stage is set for deeper questions about what could trigger a meaningful re-rating.

The company's significant investments in automation, digitalization, and its hub-and-spoke laboratory infrastructure are expected to materially improve operating efficiency and scalability by 2027. These measures should drive enhanced net margins and earnings growth as operational costs decrease and productivity improves.

Want to know which strategic bet drives this subtle undervaluation? The big reveal is how rapidly changing profit margins and future financial targets shape the narrative’s bullish stance. Curious which bold assumptions lie beneath? Dive into the full story to see which numbers analysts are betting on.

Result: Fair Value of €63.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in biopharma and integration risks from acquisitions could disrupt Eurofins Scientific’s anticipated earnings and margin improvements in the coming years.

Find out about the key risks to this Eurofins Scientific narrative.

Another View: Discounted Cash Flow Tells a Different Story

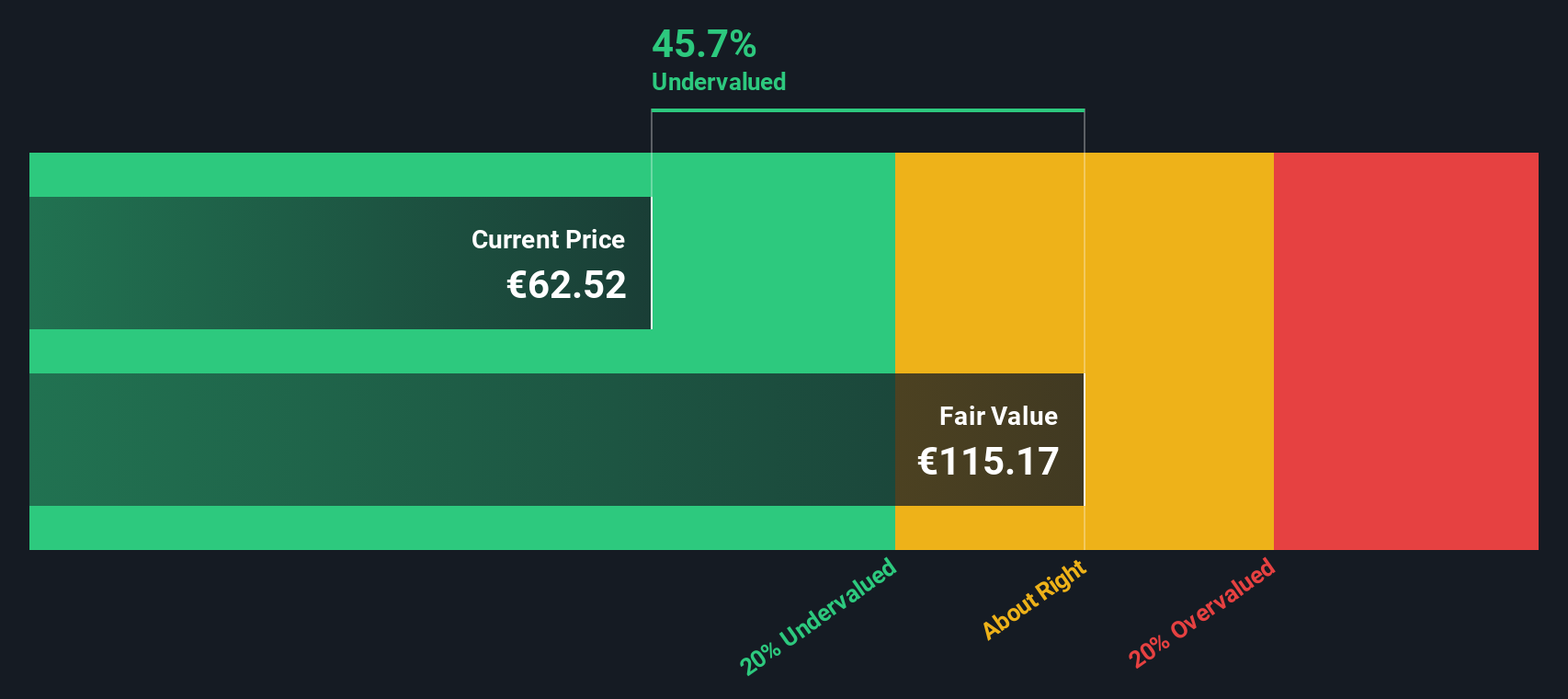

While the analyst consensus focuses on future earnings and multiples, the SWS DCF model presents a much higher fair value estimate of €115.17. This suggests Eurofins Scientific could be far more undervalued than traditional methods indicate. But is this optimistic model grounded in realistic assumptions?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Eurofins Scientific Narrative

If you think you see the story differently or want to run your own analysis, you can build a personalised narrative in just minutes. Do it your way

A great starting point for your Eurofins Scientific research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Your next great investment could be just one step away with our unique stock screeners. Don’t limit yourself to a single opportunity when so many await.

- Spot income potential by reviewing these 18 dividend stocks with yields > 3%, which offers attractive yields and robust financials for steady returns.

- Capitalize on technological shifts and spark your portfolio with these 25 AI penny stocks, companies driving innovation in artificial intelligence.

- Target undervalued gems with confidence by evaluating these 881 undervalued stocks based on cash flows, which is poised for strong growth based on solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Eurofins Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ERF

Eurofins Scientific

Provides various analytical testing and laboratory services worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)