- France

- /

- Life Sciences

- /

- ENXTPA:DIM

Sartorius Stedim Biotech (EPA:DIM) earnings and shareholder returns have been trending downwards for the last three years, but the stock advances 6.3% this past week

If you love investing in stocks you're bound to buy some losers. Long term Sartorius Stedim Biotech S.A. (EPA:DIM) shareholders know that all too well, since the share price is down considerably over three years. Regrettably, they have had to cope with a 56% drop in the share price over that period. Furthermore, it's down 11% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

While the last three years has been tough for Sartorius Stedim Biotech shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

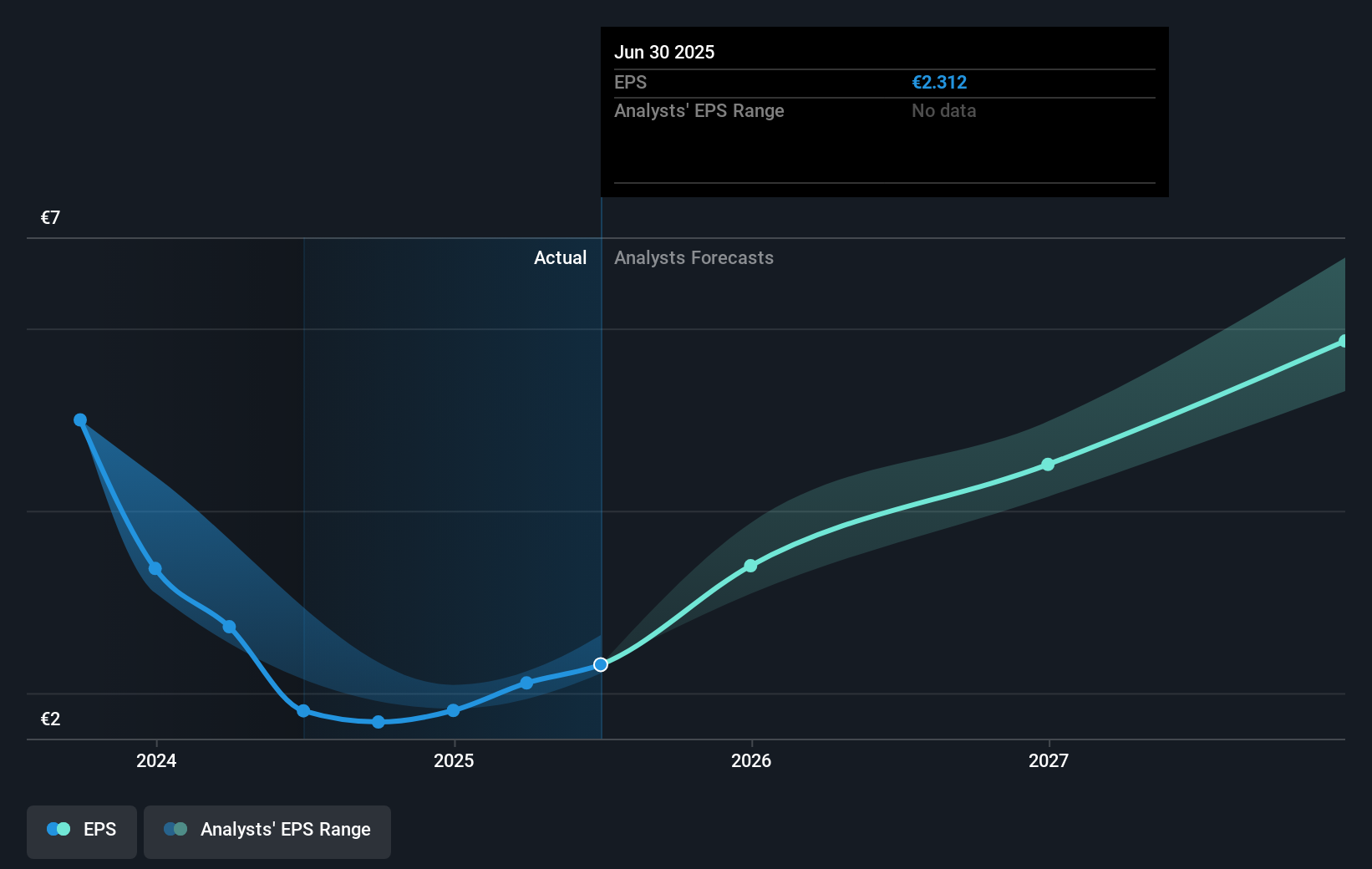

During the three years that the share price fell, Sartorius Stedim Biotech's earnings per share (EPS) dropped by 30% each year. In comparison the 24% compound annual share price decline isn't as bad as the EPS drop-off. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term. With a P/E ratio of 76.04, it's fair to say the market sees a brighter future for the business.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Sartorius Stedim Biotech has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Sartorius Stedim Biotech will grow revenue in the future.

A Different Perspective

Sartorius Stedim Biotech shareholders are up 4.0% for the year (even including dividends). Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 7% endured over half a decade. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Sartorius Stedim Biotech you should know about.

We will like Sartorius Stedim Biotech better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:DIM

Sartorius Stedim Biotech

Engages in the production and sale of instruments and consumables for the biopharmaceutical industry worldwide.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives