Need To Know: The Consensus Just Cut Its Cellectis S.A. (EPA:ALCLS) Estimates For 2025

Market forces rained on the parade of Cellectis S.A. (EPA:ALCLS) shareholders today, when the analysts downgraded their forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

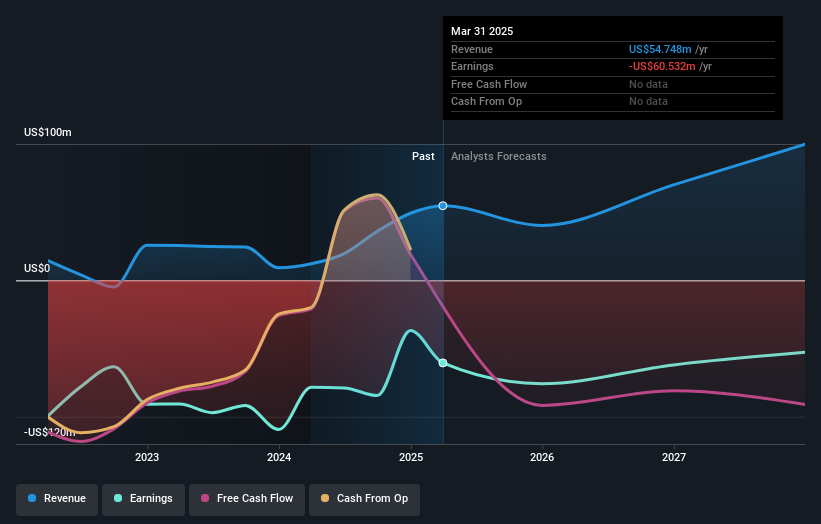

We've discovered 2 warning signs about Cellectis. View them for free.Following the latest downgrade, the current consensus, from the six analysts covering Cellectis, is for revenues of US$40m in 2025, which would reflect a disturbing 27% reduction in Cellectis' sales over the past 12 months. Losses are supposed to balloon 79% to US$1.50 per share. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$57m and losses of US$1.50 per share in 2025. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also making no real change to the loss per share numbers.

See our latest analysis for Cellectis

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. Over the past five years, revenues have declined around 23% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for an annualised 34% decline in revenue until the end of 2025. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 25% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect Cellectis to suffer worse than the wider industry.

The Bottom Line

Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Cellectis' revenues are expected to grow slower than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on Cellectis after today.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Cellectis going out to 2027, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies backed by insiders.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALCLS

Cellectis

A clinical stage biotechnological company, develops products based on gene-editing with a portfolio of allogeneic chimeric antigen receptor T-cells product candidates in the field of immuno-oncology and gene therapy product candidates in other therapeutic indications.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion