Did Positive Phase 3 Obefazimod Data Just Shift ABIVAX Société Anonyme's (ENXTPA:ABVX) Investment Narrative?

Reviewed by Sasha Jovanovic

- Abivax recently announced new Phase 3 clinical data for obefazimod at the United European Gastroenterology Meeting, showing the therapy achieved clinically meaningful improvements in moderate-to-severely active ulcerative colitis and met its FDA primary endpoints for clinical remission at week 8 in both pivotal ABTECT trials.

- Additional safety findings highlighted a favorable profile with no new serious infection or malignancy signals across a large and diverse patient population, including those with prior treatment failures.

- We’ll review how this expanded efficacy evidence in difficult-to-treat patients influences Abivax’s overall investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is ABIVAX Société Anonyme's Investment Narrative?

To be a shareholder in ABIVAX, I believe one needs to be confident in the company's ability to translate promising clinical milestones into regulatory approvals and, ultimately, commercial returns. The latest Phase 3 data for obefazimod directly strengthens one of the company’s most critical short-term catalysts: regulatory submission plans for ulcerative colitis. The robust efficacy in hard-to-treat patients and a clean safety profile address two major investor concerns and could help accelerate key partnerships or licensing discussions. Before this news, large cash burn and widening losses were top-of-mind risks, and while this progress does not eliminate them, it may improve the company’s negotiating position or open near-term funding opportunities. However, much still hinges on the regulatory process, ongoing clinical success, and how future trial updates are received by the market.

However, funding needs and regulatory uncertainties remain crucial issues that investors should be aware of.

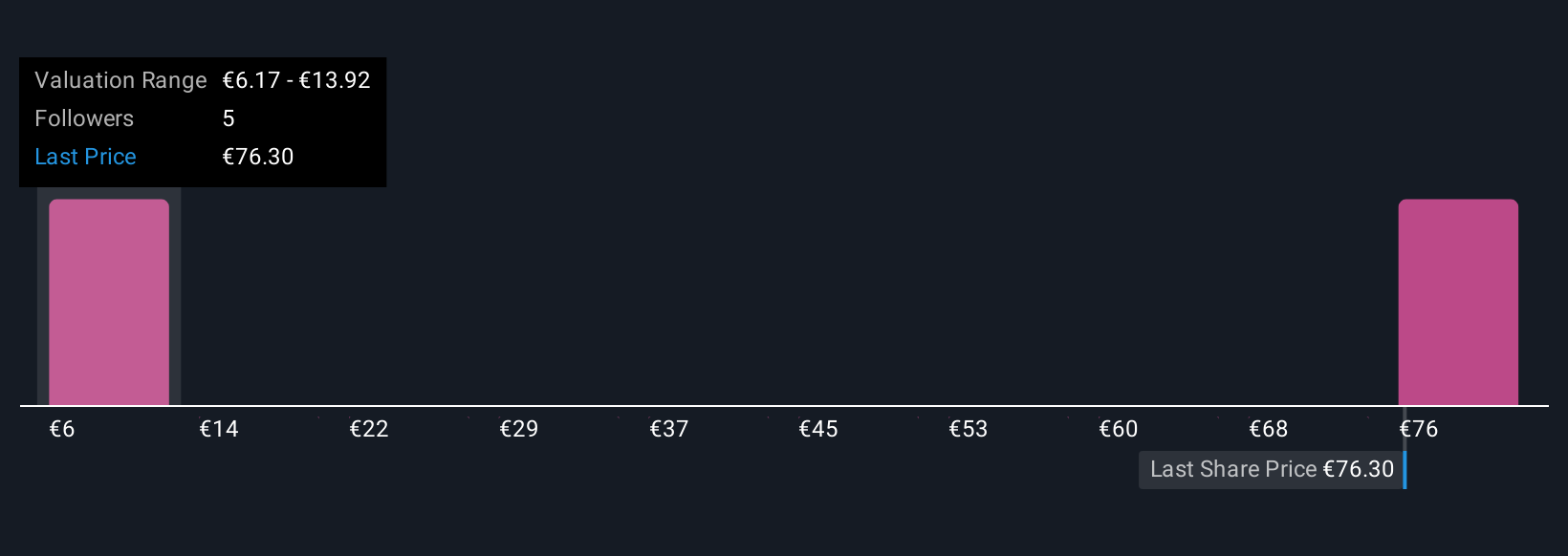

ABIVAX Société Anonyme's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 4 other fair value estimates on ABIVAX Société Anonyme - why the stock might be worth as much as 19% more than the current price!

Build Your Own ABIVAX Société Anonyme Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free ABIVAX Société Anonyme research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ABIVAX Société Anonyme's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ABVX

ABIVAX Société Anonyme

A clinical-stage biotechnology company, focuses on developing therapeutics that harness the body’s natural regulatory mechanisms to stabilize the immune response in patients with chronic inflammatory diseases.

Slight risk with limited growth.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)