- Finland

- /

- Real Estate

- /

- HLSE:OVARO

European Penny Stocks Spotlight: Xilam Animation And Two Others To Watch

Reviewed by Simply Wall St

As European markets experience a lift from hopes of lower U.S. borrowing costs, the pan-European STOXX Europe 600 Index has seen gains alongside major stock indexes like Italy’s FTSE MIB and France’s CAC 40. In this context, penny stocks—often representing smaller or newer companies—continue to attract attention for their potential value and growth opportunities. Despite being an older term, penny stocks remain relevant as they offer investors a chance to explore underappreciated growth opportunities at lower price points. This article will spotlight three European penny stocks that stand out for their financial resilience and potential upside in today’s market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 5 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.06 | €15.75M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.40 | €45.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €253.45M | ✅ 2 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.498 | RON16.84M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €3.15 | €66.44M | ✅ 4 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.81 | €424.69M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.105 | €290.95M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.942 | €31.77M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 345 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Xilam Animation (ENXTPA:XIL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xilam Animation is an integrated animation studio that creates, produces, and distributes original programs for children and adults both in France and internationally, with a market cap of €21.18 million.

Operations: The company generates €26.6 million in revenue from the production of audiovisual works and related products.

Market Cap: €21.18M

Xilam Animation, with a market cap of €21.18 million, is navigating a challenging period as it transitions to a proprietary model. Despite being unprofitable and experiencing a significant revenue decline in the first half of 2025 compared to the previous year, Xilam forecasts improved second-half revenues driven by new series deliveries like Piggy Builders and Captain Jim. The company has reduced its debt-to-equity ratio significantly over five years and maintains strong interest coverage by EBIT. A strategic alliance with TF1 for Turbo Twins highlights potential future growth avenues, although profitability remains elusive in the short term.

- Get an in-depth perspective on Xilam Animation's performance by reading our balance sheet health report here.

- Gain insights into Xilam Animation's future direction by reviewing our growth report.

Ovaro Kiinteistösijoitus Oyj (HLSE:OVARO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ovaro Kiinteistösijoitus Oyj focuses on investing in apartments and commercial premises in Finland, with a market cap of €27.41 million.

Operations: The company's revenue segment primarily consists of €6.19 million from its residential real estate investment trust (REIT) activities.

Market Cap: €27.41M

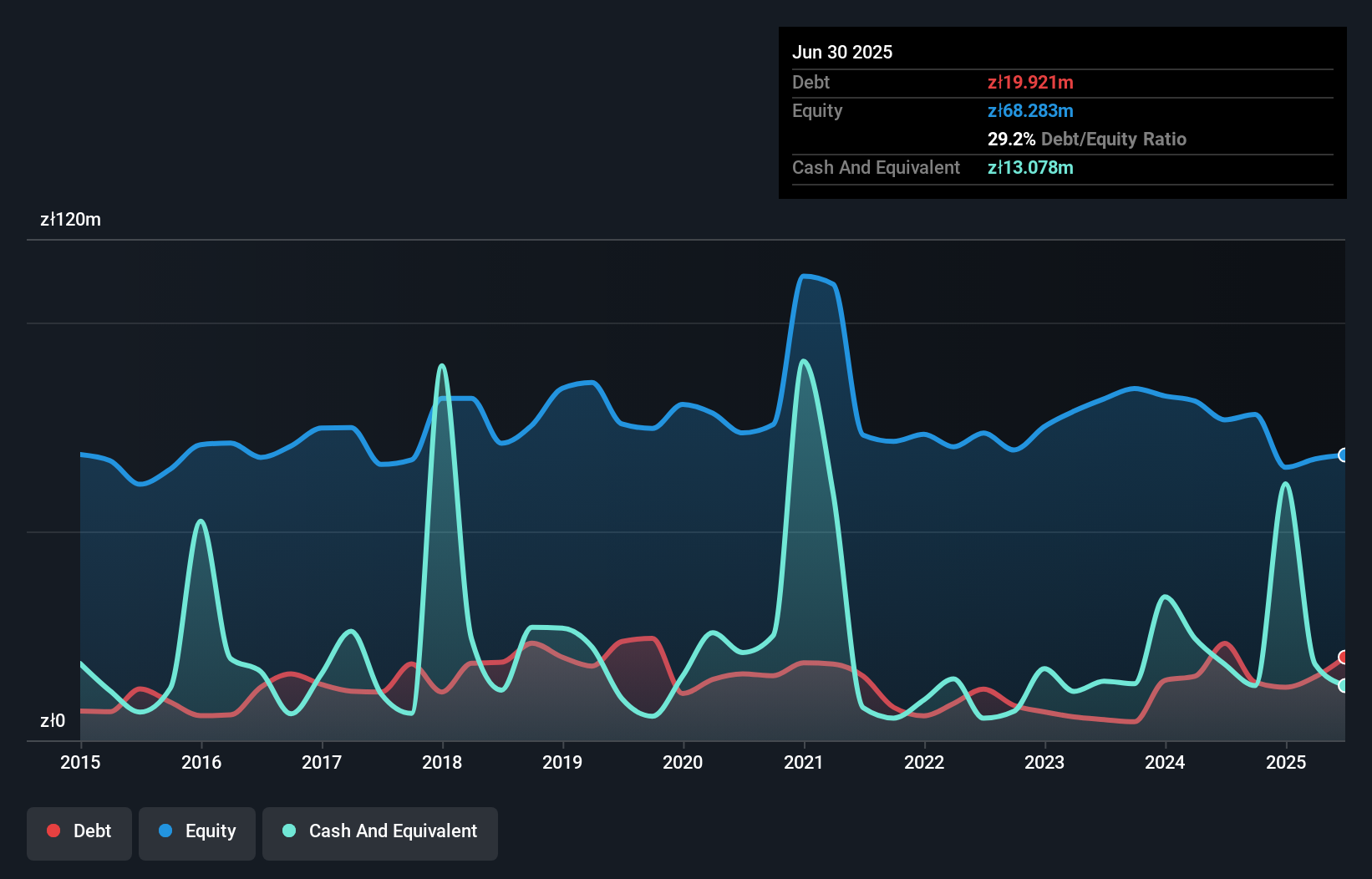

Ovaro Kiinteistösijoitus Oyj, with a market cap of €27.41 million, has shown signs of financial improvement despite challenges. The company became profitable recently, reporting a net income increase to €1.85 million for Q2 2025 from €0.695 million the previous year, although sales declined to €1.01 million from €1.64 million year-over-year for the same period. It maintains a strong balance sheet with short-term assets exceeding both its short and long-term liabilities and has reduced its debt-to-equity ratio over five years significantly while keeping interest payments well-covered by EBIT at 3.3 times coverage.

- Click here to discover the nuances of Ovaro Kiinteistösijoitus Oyj with our detailed analytical financial health report.

- Gain insights into Ovaro Kiinteistösijoitus Oyj's outlook and expected performance with our report on the company's earnings estimates.

Atende (WSE:ATD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atende S.A. specializes in IT systems integration and ICT infrastructure development in Poland, with a market cap of PLN126.47 million.

Operations: The company generates revenue primarily from the integration of ICT systems, including technical infrastructure, amounting to PLN320.51 million, and the integration of tele-information systems of subsidiary entities, contributing PLN49.90 million.

Market Cap: PLN126.47M

Atende S.A., with a market cap of PLN126.47 million, faces challenges despite its seasoned management and board. The company's short-term assets exceed both its short and long-term liabilities, indicating strong liquidity. However, Atende's earnings have declined by 41.2% annually over the past five years, with recent negative earnings growth making it difficult to match industry averages. Although debt is well-covered by operating cash flow and no significant shareholder dilution occurred last year, the dividend yield of 4.02% isn't well-supported by earnings or free cash flow, raising concerns about sustainability amidst declining profit margins and low return on equity at -13.1%.

- Jump into the full analysis health report here for a deeper understanding of Atende.

- Gain insights into Atende's past trends and performance with our report on the company's historical track record.

Summing It All Up

- Take a closer look at our European Penny Stocks list of 345 companies by clicking here.

- Curious About Other Options? Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:OVARO

Ovaro Kiinteistösijoitus Oyj

Invests in apartments and commercial premises in Finland.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)