Here's What We Learned About The CEO Pay At Métropole Télévision S.A. (EPA:MMT)

Nicolás Bellet de Tavernost Abel is the CEO of Métropole Télévision S.A. (EPA:MMT), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Métropole Télévision

Comparing Métropole Télévision S.A.'s CEO Compensation With the industry

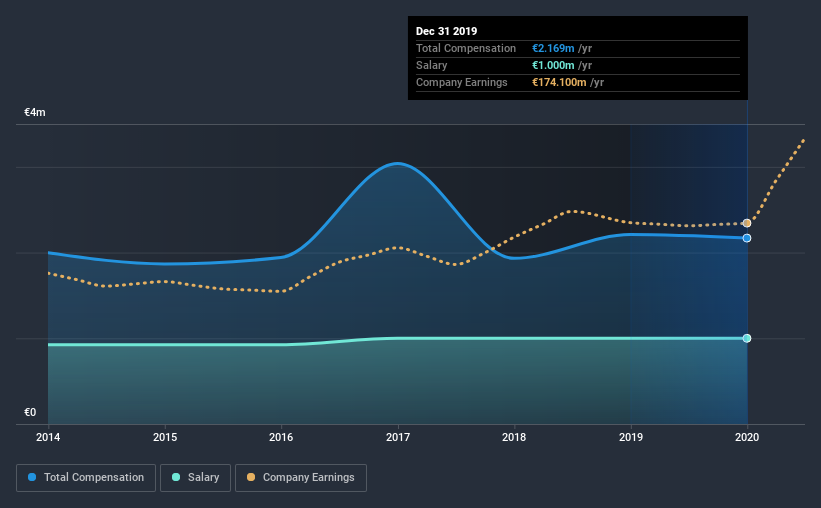

At the time of writing, our data shows that Métropole Télévision S.A. has a market capitalization of €1.7b, and reported total annual CEO compensation of €2.2m for the year to December 2019. That's mostly flat as compared to the prior year's compensation. We think total compensation is more important but our data shows that the CEO salary is lower, at €1.0m.

On comparing similar companies from the same industry with market caps ranging from €824m to €2.6b, we found that the median CEO total compensation was €2.2m. This suggests that Métropole Télévision remunerates its CEO largely in line with the industry average. Moreover, Nicolás Bellet de Tavernost Abel also holds €5.5m worth of Métropole Télévision stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | €1.0m | €1.0m | 46% |

| Other | €1.2m | €1.2m | 54% |

| Total Compensation | €2.2m | €2.2m | 100% |

Talking in terms of the industry, salary represented approximately 46% of total compensation out of all the companies we analyzed, while other remuneration made up 54% of the pie. There isn't a significant difference between Métropole Télévision and the broader market, in terms of salary allocation in the overall compensation package. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Métropole Télévision S.A.'s Growth Numbers

Métropole Télévision S.A. has seen its earnings per share (EPS) increase by 22% a year over the past three years. It saw its revenue drop 9.3% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Métropole Télévision S.A. Been A Good Investment?

With a three year total loss of 27% for the shareholders, Métropole Télévision S.A. would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As we noted earlier, Métropole Télévision pays its CEO in line with similar-sized companies belonging to the same industry. Meanwhile, shareholder returns paint a sorry picture for the company, finishing in the red over the last three years. But on the bright side, EPS growth is positive over the same period. It's tough for us to say CEO compensation is too generous when EPS growth is positive, but negative investor returns will irk shareholders and reduce any chances of a raise.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 3 warning signs for Métropole Télévision you should be aware of, and 1 of them is concerning.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Métropole Télévision or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:MMT

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)