Ipsos SA's (EPA:IPS) Shares Lagging The Market But So Is The Business

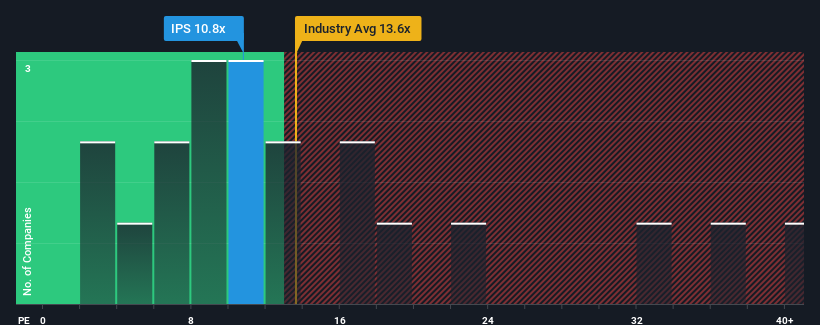

When close to half the companies in France have price-to-earnings ratios (or "P/E's") above 15x, you may consider Ipsos SA (EPA:IPS) as an attractive investment with its 10.8x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

The recently shrinking earnings for Ipsos have been in line with the market. It might be that many expect the company's earnings performance to degrade further, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

Check out our latest analysis for Ipsos

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Ipsos' to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Looking ahead now, EPS is anticipated to climb by 9.6% each year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the market is forecast to expand by 13% each year, which is noticeably more attractive.

With this information, we can see why Ipsos is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Ipsos maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Ipsos has 1 warning sign we think you should be aware of.

Of course, you might also be able to find a better stock than Ipsos. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:IPS

Ipsos

Through its subsidiaries, provides survey-based research services for companies and institutions in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026