Eutelsat Group (EPA:ETL) Might Not Be As Mispriced As It Looks After Plunging 26%

To the annoyance of some shareholders, Eutelsat Group (EPA:ETL) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 49% in that time.

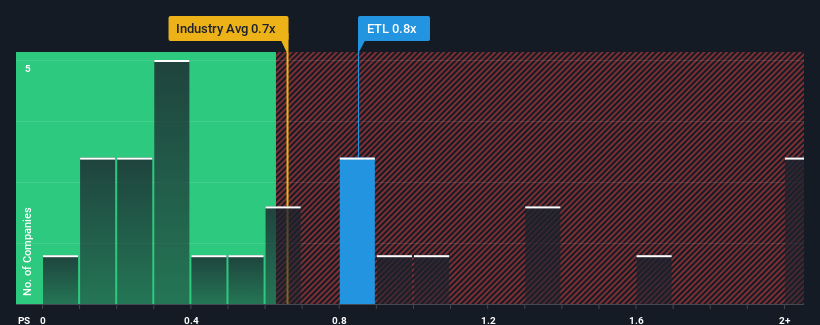

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Eutelsat Group's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Media industry in France is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Eutelsat Group

What Does Eutelsat Group's Recent Performance Look Like?

Eutelsat Group's revenue growth of late has been pretty similar to most other companies. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. Those who are bullish on Eutelsat Group will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Eutelsat Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Eutelsat Group's Revenue Growth Trending?

Eutelsat Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 7.2% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 1.7% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue growth will be highly resilient over the next three years growing by 7.8% each year. That would be an excellent outcome when the industry is expected to decline by 0.6% each year.

In light of this, it's peculiar that Eutelsat Group's P/S sits in-line with the majority of other companies. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Bottom Line On Eutelsat Group's P/S

With its share price dropping off a cliff, the P/S for Eutelsat Group looks to be in line with the rest of the Media industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We note that even though Eutelsat Group trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears some are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Eutelsat Group.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Eutelsat Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ETL

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026