Is Eutelsat Set for More Gains After 31% Surge and European Tech Rally?

Reviewed by Bailey Pemberton

Thinking about what to do with Eutelsat Communications stock? You are not alone. All eyes are on the company after a dramatic resurgence in its share price, and with some big valuation questions still on the table, it is the kind of moment that makes both new investors and seasoned holders pause for a closer look. Over the last week, Eutelsat saw its share price climb 10.7%. Stretch that view out to one month, and the return balloons to 31.1%, fuelled by renewed optimism about satellite demand and recent market developments across the European tech sector. Year to date, the stock is up a stunning 68.2%. Although, let us be honest, it has been a rocky road. Just look at the longer-term picture: over the past year, shares are down 3.9%, and if you had invested three or five years ago, you would be nursing losses of 51.1% and 41.1% respectively.

That volatility has a lot of investors wondering if this means Eutelsat is actually undervalued or if this is a temporary rally. According to a valuation scorecard that checks six key measures, Eutelsat scores a 3 for being undervalued. Not bad, but not a slam dunk either. In the next section, we will dig into what those valuation checks are and how they stack up against real world market dynamics. And, before you draw any conclusions, stick around. There is a smarter, more insightful way to judge Eutelsat's true value that we will discuss at the end.

Approach 1: Eutelsat Communications Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to their present value. This approach helps investors understand whether a stock is trading above or below what its future profits could realistically justify.

For Eutelsat Communications, the current Free Cash Flow (FCF) reported is €18.1 million. Analyst projections cover the next five years, after which cash flow forecasts are extrapolated. Over the next decade, projections suggest substantial growth, with Free Cash Flow expected to reach €450.8 million in the year ending June 2030. The 10-year FCF outlook, prepared by both analysts and Simply Wall St, describes steadily climbing returns following a challenging few years.

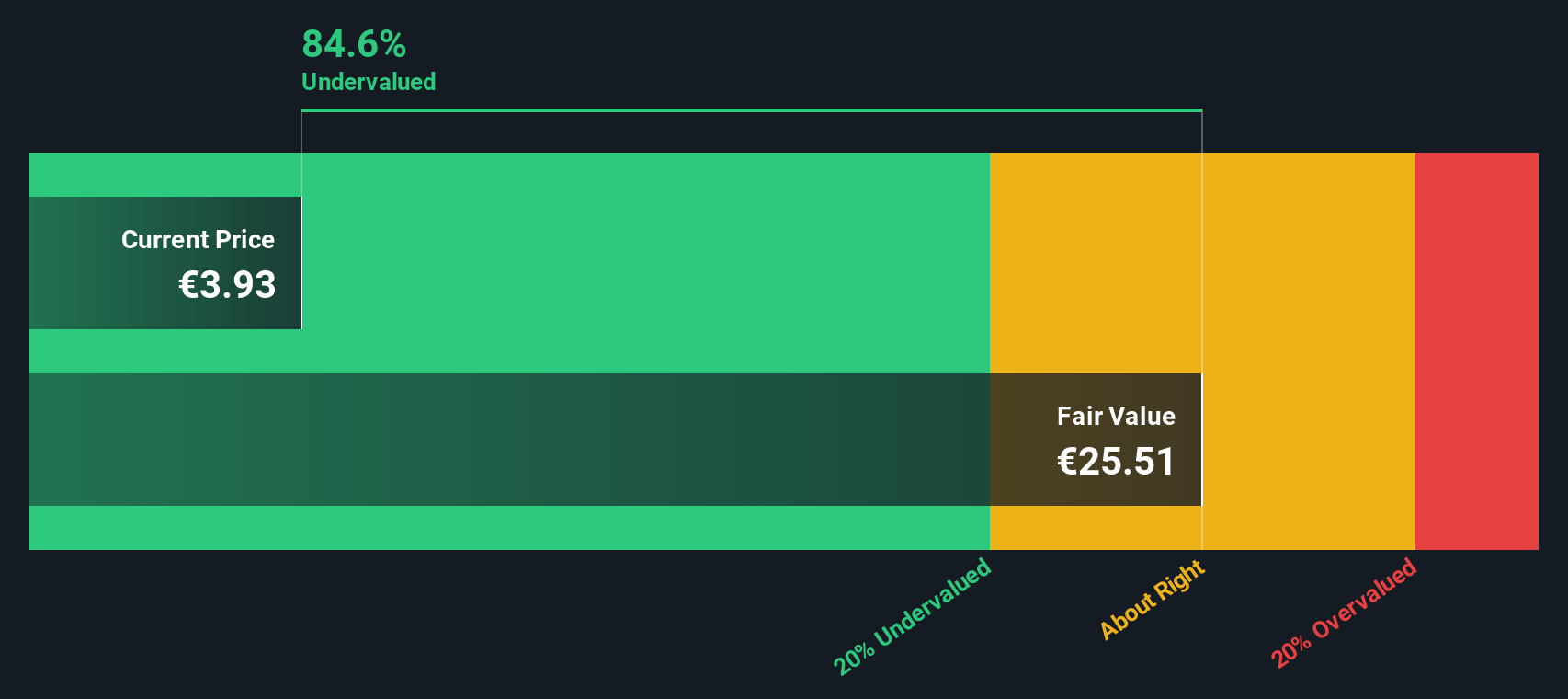

According to this DCF model, Eutelsat's estimated intrinsic value is €24.52 per share. This figure is 84.9% higher than the current share price, indicating that the stock may be significantly undervalued if these projections are accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eutelsat Communications is undervalued by 84.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Eutelsat Communications Price vs Sales

For companies like Eutelsat Communications, which are currently not profitable, using the Price-to-Sales (PS) multiple is a practical valuation approach. This metric allows investors to compare how much they are paying for each euro of the company’s sales. It provides a clearer picture of value than profit-based multiples when earnings are negative or highly volatile.

Growth expectations and risk play an important role in determining what a normal or fair PS ratio should look like. Generally, faster growing companies or those with less risk can justify higher PS multiples. Lower-growth or riskier companies should trade at a discount.

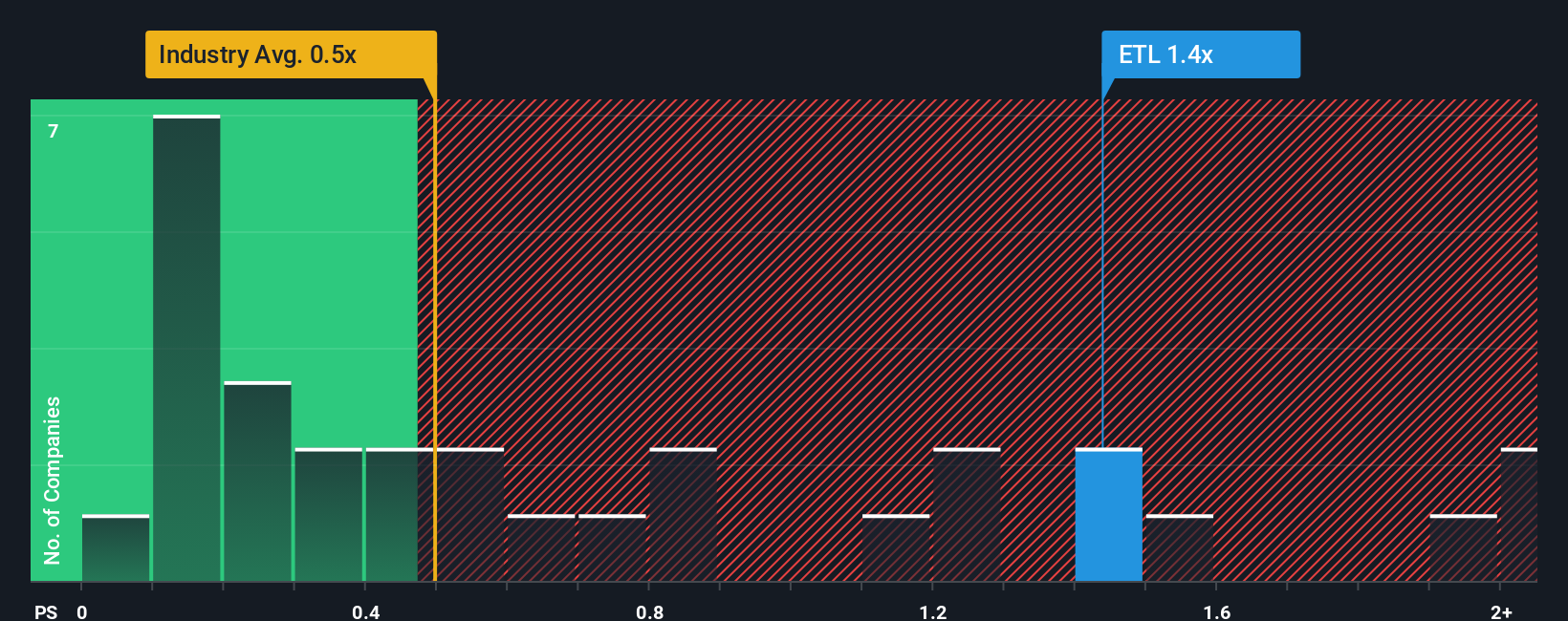

Eutelsat’s current PS ratio stands at 1.42x, putting it well above the Media industry average of 0.49x and the peer average of 0.70x. At first glance, this suggests the stock might be expensive compared to its direct competitors and broader sector trends.

This is where Simply Wall St’s “Fair Ratio” comes into play. The Fair Ratio methodology is designed to be more insightful than basic peer or industry comparisons. It incorporates company-specific factors like profit margin, expected growth, market capitalization, and risk profile to deliver a benchmark tailored precisely to Eutelsat’s business and circumstances.

According to this in-depth calculation, Eutelsat’s Fair Ratio is 1.82x. Since this is only slightly higher than the current PS ratio, the stock’s valuation appears to be about right, balancing growth prospects with the risks and realities of its sector.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Eutelsat Communications Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a powerful but simple concept, allowing you to express your own perspective on a company’s future by weaving together a story about its business outlook, financial forecasts, and what you believe is a fair value. Instead of only following the numbers, Narratives help you connect your investment thesis, such as Eutelsat expanding aggressively into LEO satellites or facing headwinds in the GEO market, to the potential future profits and the price you are willing to pay.

On Simply Wall St’s Community page, you will find Narratives shared by millions of investors, making it easy and accessible to see how stories drive decisions. These Narratives dynamically update with fresh news, results, or guidance, so your take evolves as the facts do. When deciding when to buy or sell, Narratives let you compare your fair value to the current price, giving clarity on if an opportunity looks attractive or not. For Eutelsat, for instance, one Narrative is optimistic, estimating a fair value as high as €6.7 per share based on rapid LEO infrastructure growth, while a more cautious view pegs fair value at just €1.2, citing competitive threats and financial strain.

Do you think there's more to the story for Eutelsat Communications? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eutelsat Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ETL

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion