As European markets continue to navigate the complexities of global trade tensions, the pan-European STOXX Europe 600 Index has shown resilience, rising for a fourth consecutive week. Amid this backdrop, investors are increasingly looking towards dividend stocks as a way to potentially generate income and add stability to their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.36% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.47% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.42% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.40% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.66% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.60% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.75% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.22% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

JCDecaux (ENXTPA:DEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JCDecaux SE is a global outdoor advertising company with a market cap of €3.33 billion.

Operations: JCDecaux SE generates revenue through three main segments: Street Furniture (€1.99 billion), Transport (€1.39 billion), and Billboard (€546.60 million).

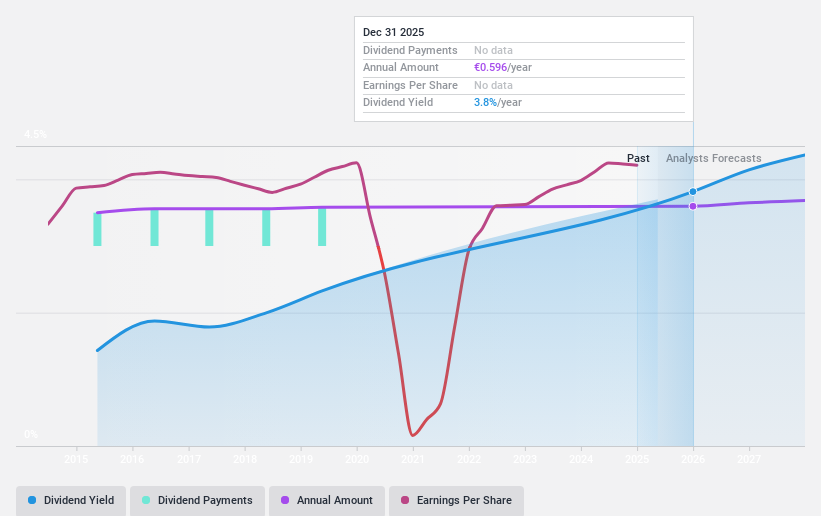

Dividend Yield: 3.5%

JCDecaux's dividend payments have been volatile over the past decade, yet they are well-covered by earnings and cash flows with a payout ratio of 45.4% and a cash payout ratio of 14.5%. The company reported strong earnings growth last year, with net income rising to €258.9 million. Despite being dropped from the FTSE All-World Index recently, JCDecaux plans to gradually increase its dividend while balancing investments in capex and M&A activities.

- Click here and access our complete dividend analysis report to understand the dynamics of JCDecaux.

- The analysis detailed in our JCDecaux valuation report hints at an inflated share price compared to its estimated value.

Bank of Ireland Group (ISE:BIRG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Ireland Group plc offers banking and financial services in the Republic of Ireland, the United Kingdom, and internationally, with a market cap of €11.49 billion.

Operations: Bank of Ireland Group plc generates revenue from several segments, including Retail UK (€550 million), Retail Ireland (€1.62 billion), Wealth and Insurance (€340 million), and Corporate and Commercial (€1.96 billion).

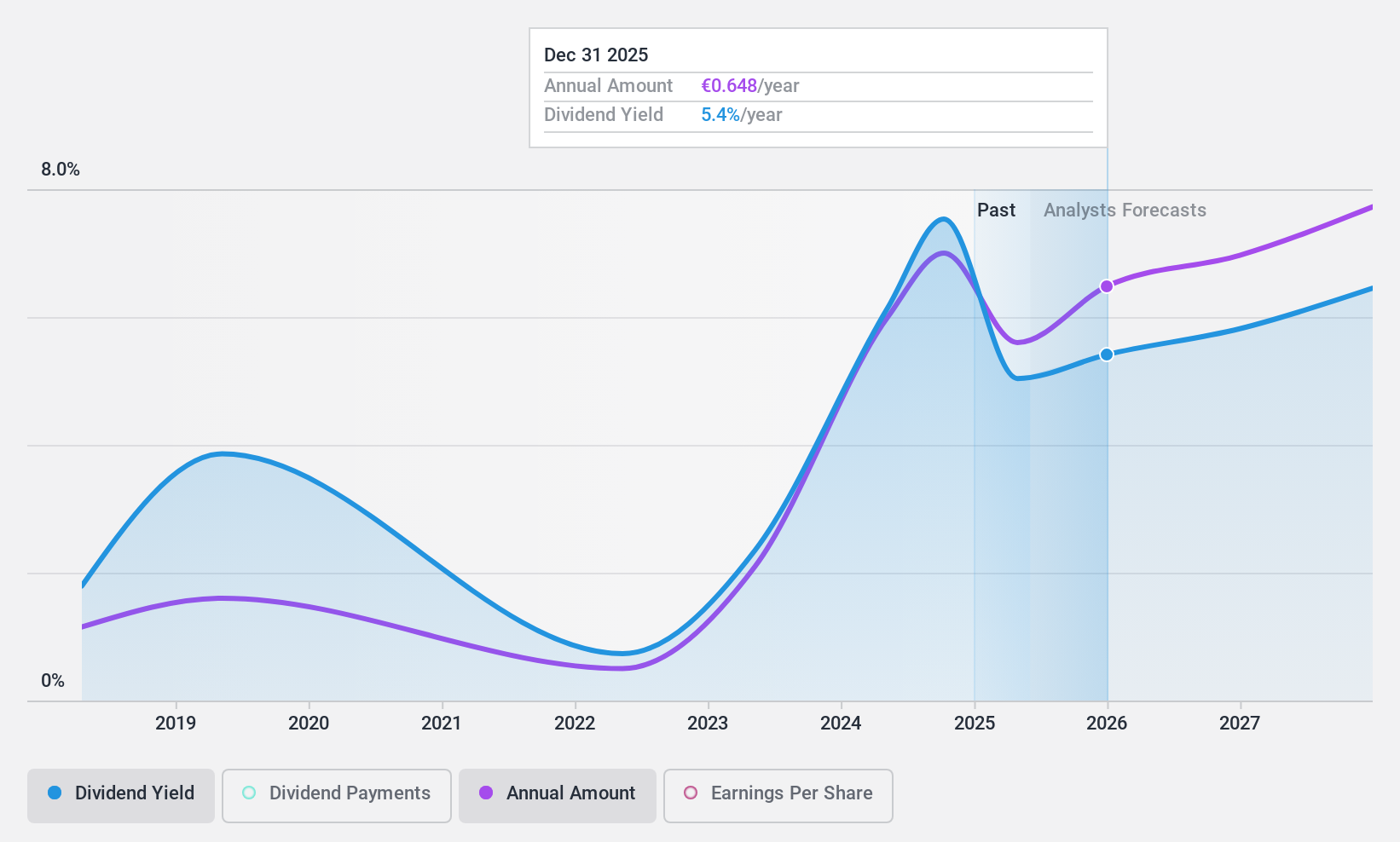

Dividend Yield: 4.8%

Bank of Ireland Group's dividend payments have been inconsistent over the past seven years, with a history of volatility. Despite this, the dividends are well-covered by earnings, maintaining a payout ratio of 44.4%. The bank's net interest income is projected to exceed €3.25 billion in 2025, indicating robust financial performance. However, challenges include a high level of non-performing loans at 2.2% and a low allowance for bad loans at 55%, which could impact future stability and dividend reliability.

- Click to explore a detailed breakdown of our findings in Bank of Ireland Group's dividend report.

- Our comprehensive valuation report raises the possibility that Bank of Ireland Group is priced lower than what may be justified by its financials.

Schoeller-Bleckmann Oilfield Equipment (WBAG:SBO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Schoeller-Bleckmann Oilfield Equipment Aktiengesellschaft manufactures and sells steel products worldwide, with a market cap of €515.33 million.

Operations: Schoeller-Bleckmann Oilfield Equipment's revenue is primarily derived from its Oilfield Equipment segment, generating €304 million, and Advanced Manufacturing & Services, contributing €395.40 million.

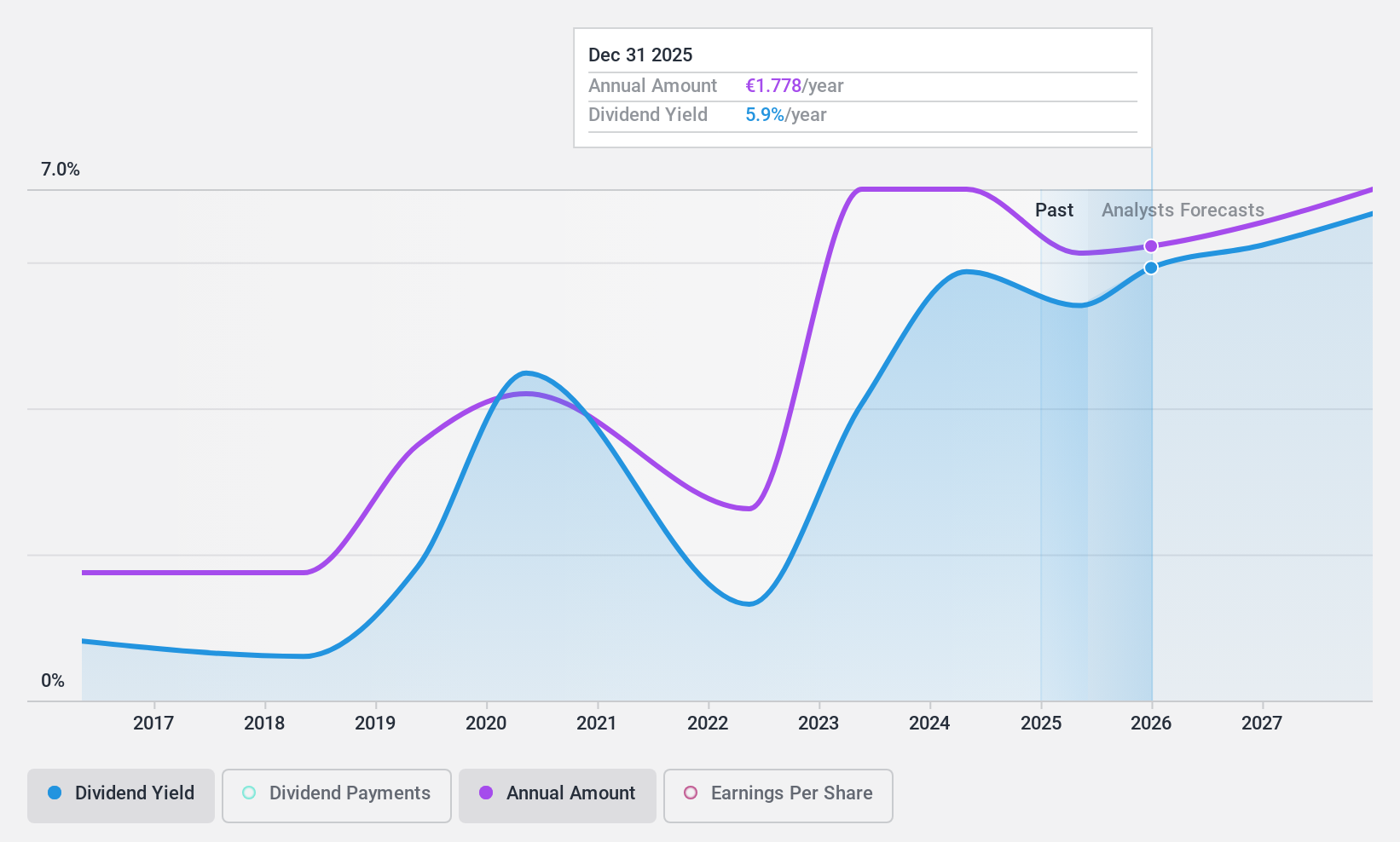

Dividend Yield: 5.4%

Schoeller-Bleckmann Oilfield Equipment's dividend yield is among the top 25% in Austria, supported by a reasonable payout ratio of 60.9% and cash flow coverage at 43.2%. However, its dividend history is marked by volatility, with a recent reduction to €1.75 per share. The company has expanded its Saudi operations, enhancing strategic growth and sustainability efforts with a new solar-equipped facility that aligns with ESG goals to cut emissions significantly by 2030.

- Click here to discover the nuances of Schoeller-Bleckmann Oilfield Equipment with our detailed analytical dividend report.

- The analysis detailed in our Schoeller-Bleckmann Oilfield Equipment valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Reveal the 229 hidden gems among our Top European Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DEC

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives