- France

- /

- Entertainment

- /

- ENXTPA:ALPUL

Little Excitement Around Pullup Entertainment Société anonyme's (EPA:ALPUL) Revenues As Shares Take 29% Pounding

The Pullup Entertainment Société anonyme (EPA:ALPUL) share price has softened a substantial 29% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 76% loss during that time.

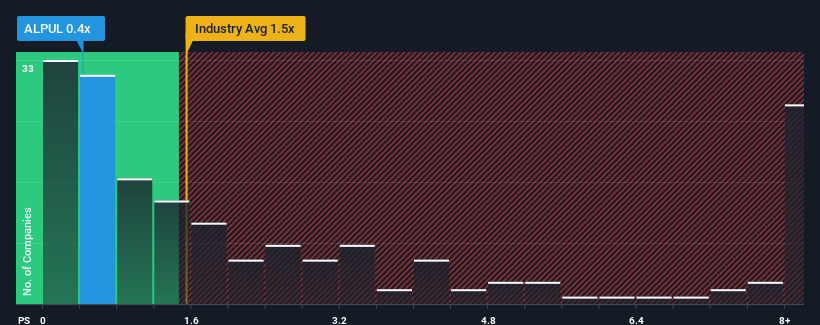

After such a large drop in price, when close to half the companies operating in France's Entertainment industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider Pullup Entertainment Société anonyme as an enticing stock to check out with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Pullup Entertainment Société anonyme

What Does Pullup Entertainment Société anonyme's P/S Mean For Shareholders?

Pullup Entertainment Société anonyme hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Pullup Entertainment Société anonyme's future stacks up against the industry? In that case, our free report is a great place to start.How Is Pullup Entertainment Société anonyme's Revenue Growth Trending?

In order to justify its P/S ratio, Pullup Entertainment Société anonyme would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 3.5% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 9.5% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 11% per annum over the next three years. With the industry predicted to deliver 17% growth per year, the company is positioned for a weaker revenue result.

With this information, we can see why Pullup Entertainment Société anonyme is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Pullup Entertainment Société anonyme's P/S

Pullup Entertainment Société anonyme's recently weak share price has pulled its P/S back below other Entertainment companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Pullup Entertainment Société anonyme maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Pullup Entertainment Société anonyme (2 can't be ignored) you should be aware of.

If you're unsure about the strength of Pullup Entertainment Société anonyme's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALPUL

Pullup Entertainment Société anonyme

Develops, publishes, and distributes games in France, the United States, Europe, the Middle East, Africa, Asia, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026