- Italy

- /

- Commercial Services

- /

- BIT:FILA

European Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

As European markets show signs of recovery, with the pan-European STOXX Europe 600 Index gaining 3.93% and major indexes like Italy's FTSE MIB and Germany's DAX also making notable gains, investors are increasingly looking to dividend stocks as a reliable source of income amid economic uncertainties. In this environment, a good dividend stock is characterized by its ability to provide consistent payouts while maintaining financial stability, offering investors a potential buffer against market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.27% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.81% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.48% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.50% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.09% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.17% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.24% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.36% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.45% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.19% | ★★★★★☆ |

Click here to see the full list of 247 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

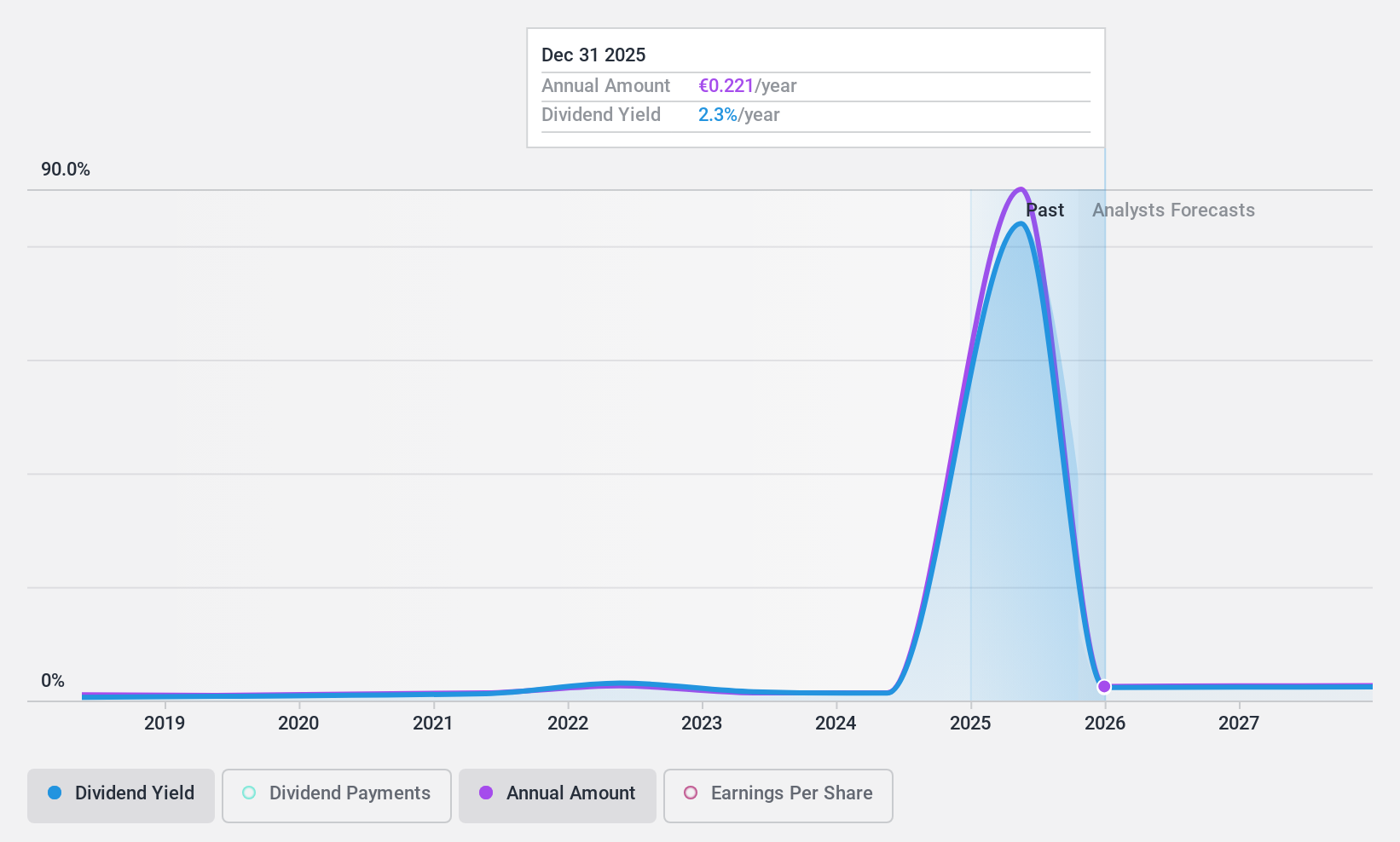

F.I.L.A. - Fabbrica Italiana Lapis ed Affini (BIT:FILA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: F.I.L.A. - Fabbrica Italiana Lapis ed Affini S.p.A. operates in the production and distribution of art materials, writing instruments, and related products with a market capitalization of €551.92 million.

Operations: F.I.L.A. - Fabbrica Italiana Lapis ed Affini S.p.A.'s revenue primarily comes from its Office Supplies segment, which generated €616.55 million.

Dividend Yield: 7.4%

F.I.L.A. recently announced a higher-than-expected annual dividend of €0.40 per share, reflecting a commitment to shareholder returns despite its historically volatile and unreliable dividend track record. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 49.6% and 43.4%, respectively, suggesting sustainability in the near term. Trading at a price-to-earnings ratio of 6.7x, it offers good relative value compared to the broader Italian market average of 14.2x.

- Take a closer look at F.I.L.A. - Fabbrica Italiana Lapis ed Affini's potential here in our dividend report.

- The valuation report we've compiled suggests that F.I.L.A. - Fabbrica Italiana Lapis ed Affini's current price could be quite moderate.

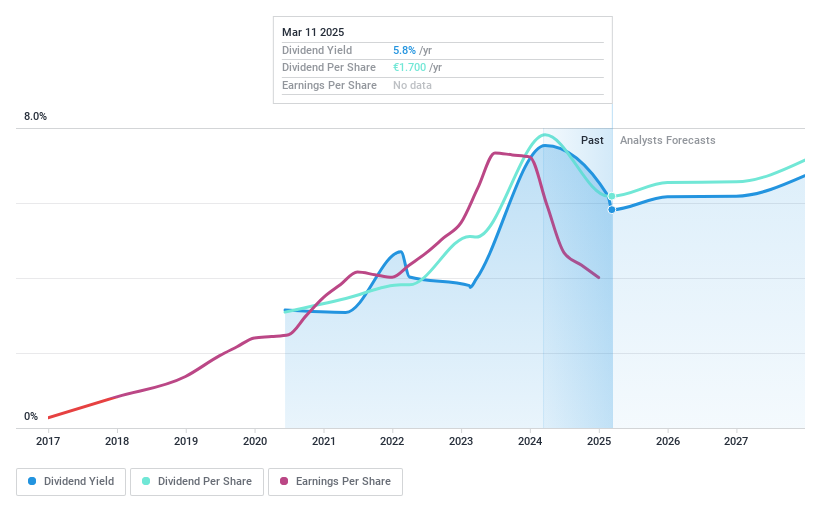

Verallia Société Anonyme (ENXTPA:VRLA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Verallia Société Anonyme manufactures and sells glass packaging products for beverages and food worldwide, with a market cap of €3.38 billion.

Operations: Verallia Société Anonyme generates revenue from three main segments: €428.30 million from Latin America, €762.90 million from Northern and Eastern Europe, and €2.28 billion from Southern and Western Europe.

Dividend Yield: 5.9%

Verallia Société Anonyme's dividends, though covered by earnings and cash flows with payout ratios of 84.7% and 76%, respectively, have been volatile over the past five years. The company's recent announcement to decrease its annual dividend to €1.70 per share highlights this instability. Despite trading at a discount to its estimated fair value, Verallia's high debt levels and declining profit margins from 12% to 6.8% may concern dividend-focused investors.

- Navigate through the intricacies of Verallia Société Anonyme with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Verallia Société Anonyme's share price might be too pessimistic.

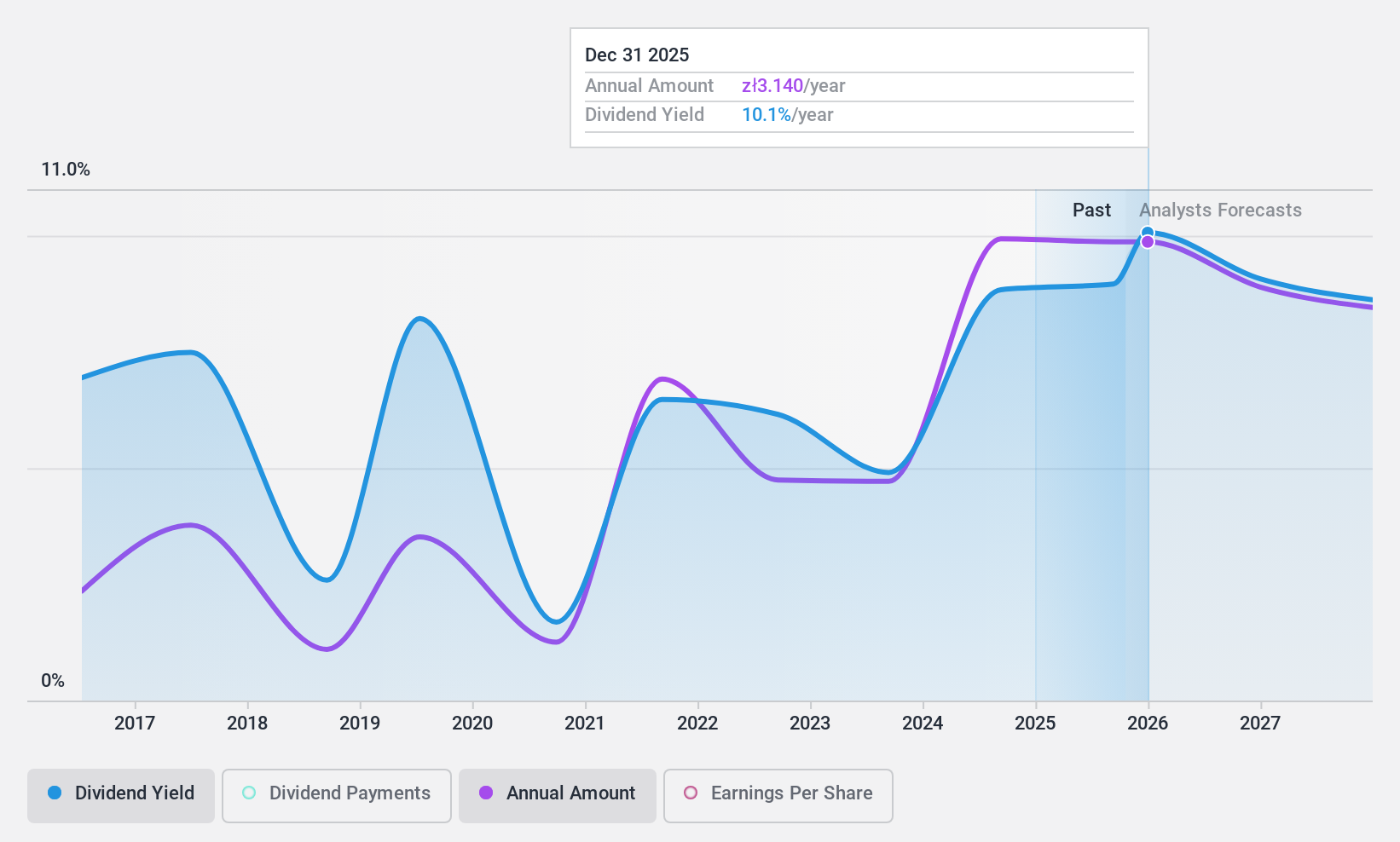

FERRO (WSE:FRO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FERRO S.A. manufactures and sells sanitary and plumbing fixtures in Poland and internationally, with a market cap of PLN703.13 million.

Operations: FERRO S.A.'s revenue is primarily derived from Sanitary Fittings (PLN371.37 million), Installation Fittings (PLN263.05 million), and Heat Sources (PLN132.49 million).

Dividend Yield: 9.5%

Ferro offers a high dividend yield of 9.55%, placing it in the top 25% of Polish dividend payers, with dividends covered by earnings (payout ratio: 88%) and cash flows (cash payout ratio: 43.1%). Although its earnings grew by 21.2% last year, Ferro's dividend history is marked by volatility and unreliability over the past decade, which may raise concerns about sustainability despite trading at a significant discount to estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of FERRO.

- In light of our recent valuation report, it seems possible that FERRO is trading behind its estimated value.

Summing It All Up

- Click through to start exploring the rest of the 244 Top European Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:FILA

F.I.L.A. - Fabbrica Italiana Lapis ed Affini

F.I.L.A. - Fabbrica Italiana Lapis ed Affini S.p.A.

Excellent balance sheet with moderate risk and pays a dividend.

Similar Companies

Market Insights

Community Narratives