As April 2025 unfolds, European markets have shown resilience, with the STOXX Europe 600 Index gaining ground amid positive investor sentiment following the European Central Bank's rate cuts and a temporary reprieve from tariff hikes. In this environment of cautious optimism, dividend stocks continue to attract attention for their potential to provide steady income streams and offer some stability against market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.27% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.81% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.54% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.50% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.09% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.17% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.24% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.36% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.45% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.64% | ★★★★★☆ |

Click here to see the full list of 241 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Gas Plus (BIT:GSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gas Plus S.p.A. is involved in the exploration and production of natural gas in Italy, with a market cap of €149.46 million.

Operations: Gas Plus S.p.A. generates revenue from several segments including Retail (€41.35 million), Network & Transportation (€22.25 million), Exploration & Production in Italy (€48.19 million), and Exploration & Production abroad (€37.88 million).

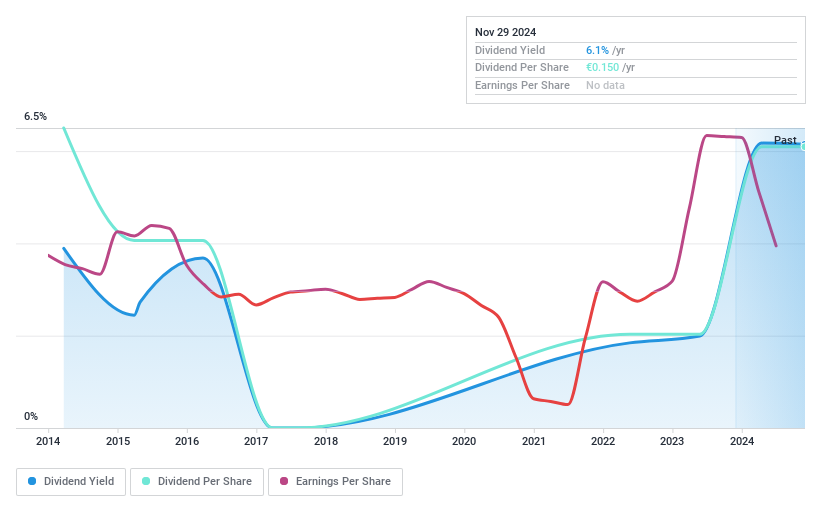

Dividend Yield: 5.8%

Gas Plus offers a dividend yield of 5.83%, placing it in the top 25% of Italian dividend payers, although its dividends have been volatile over the past decade with significant annual drops. The payout ratio is reasonably low at 44.7%, suggesting dividends are covered by earnings, but insufficient data exists to confirm coverage by cash flow. With a price-to-earnings ratio of 10.2x below the market average, it presents value potential despite declining profit margins and an unstable dividend history.

- Delve into the full analysis dividend report here for a deeper understanding of Gas Plus.

- According our valuation report, there's an indication that Gas Plus' share price might be on the expensive side.

Eiffage (ENXTPA:FGR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in construction, property and urban development, civil engineering, metallic construction, roads, energy systems, and concessions across France and internationally with a market cap of €10.48 billion.

Operations: Eiffage SA generates revenue through its diverse operations, including €4.14 billion from Concessions, €4.08 billion from Construction, €7.24 billion from Energy Systems, and €8.75 billion from Infrastructures.

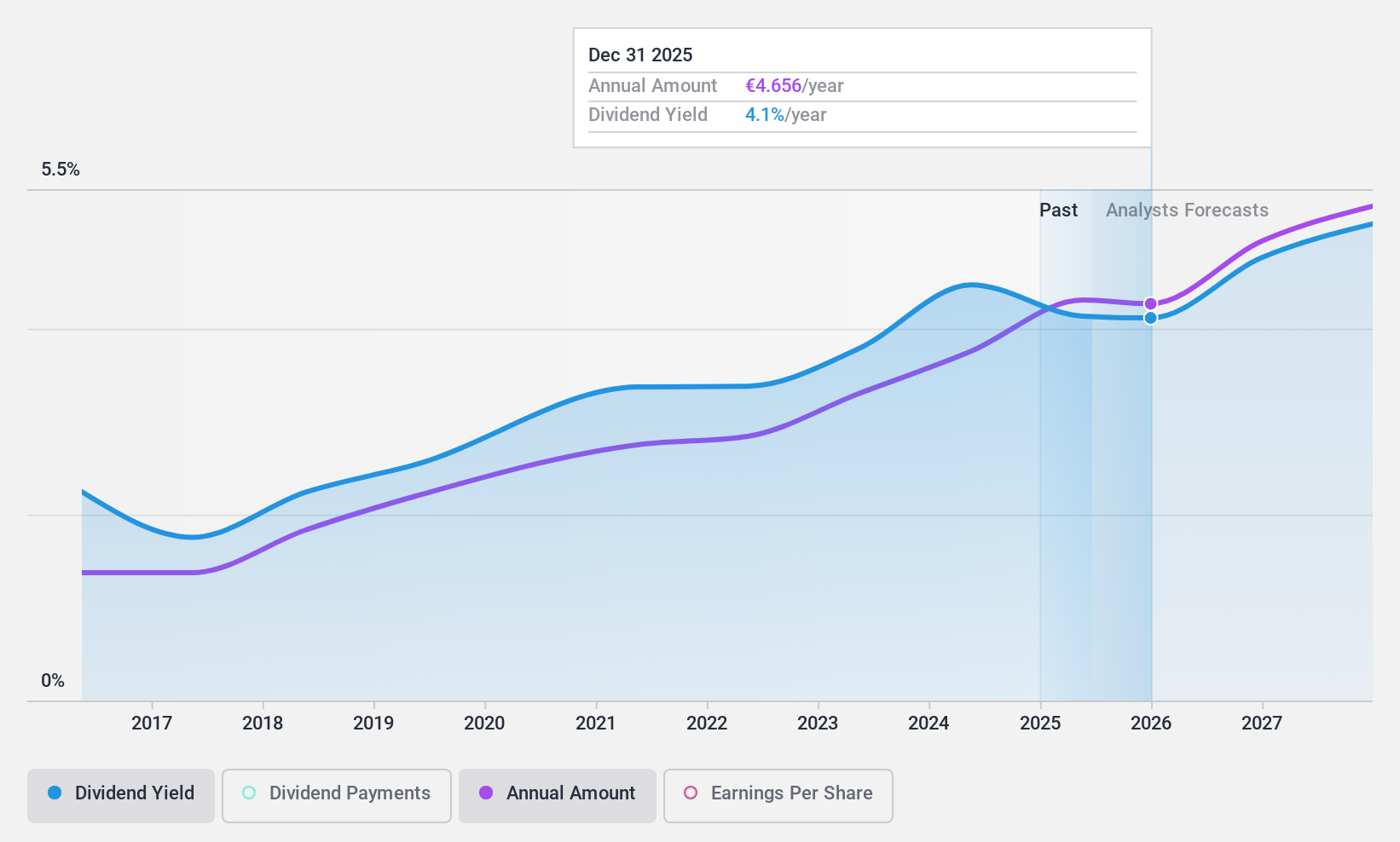

Dividend Yield: 4.1%

Eiffage's recent announcement of a €4.70 per share dividend highlights its commitment to returning value to shareholders, although its 4.14% yield is below the top quarter of French dividend payers. The company's dividends are well-covered by earnings and cash flow, with payout ratios at 42.5% and 15.6%, respectively, despite a volatile dividend track record over the past decade. Eiffage's strong financial performance in 2024, with sales reaching €24 billion and net income at €1.04 billion, supports its sustainable dividend payments amidst high debt levels.

- Take a closer look at Eiffage's potential here in our dividend report.

- The valuation report we've compiled suggests that Eiffage's current price could be quite moderate.

Oeneo (ENXTPA:SBT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oeneo SA operates in the wine industry worldwide and has a market capitalization of €590.64 million.

Operations: Oeneo SA generates revenue from its Breeding segment, which accounts for €85.56 million, and the Dont Capping segment, contributing €218.89 million.

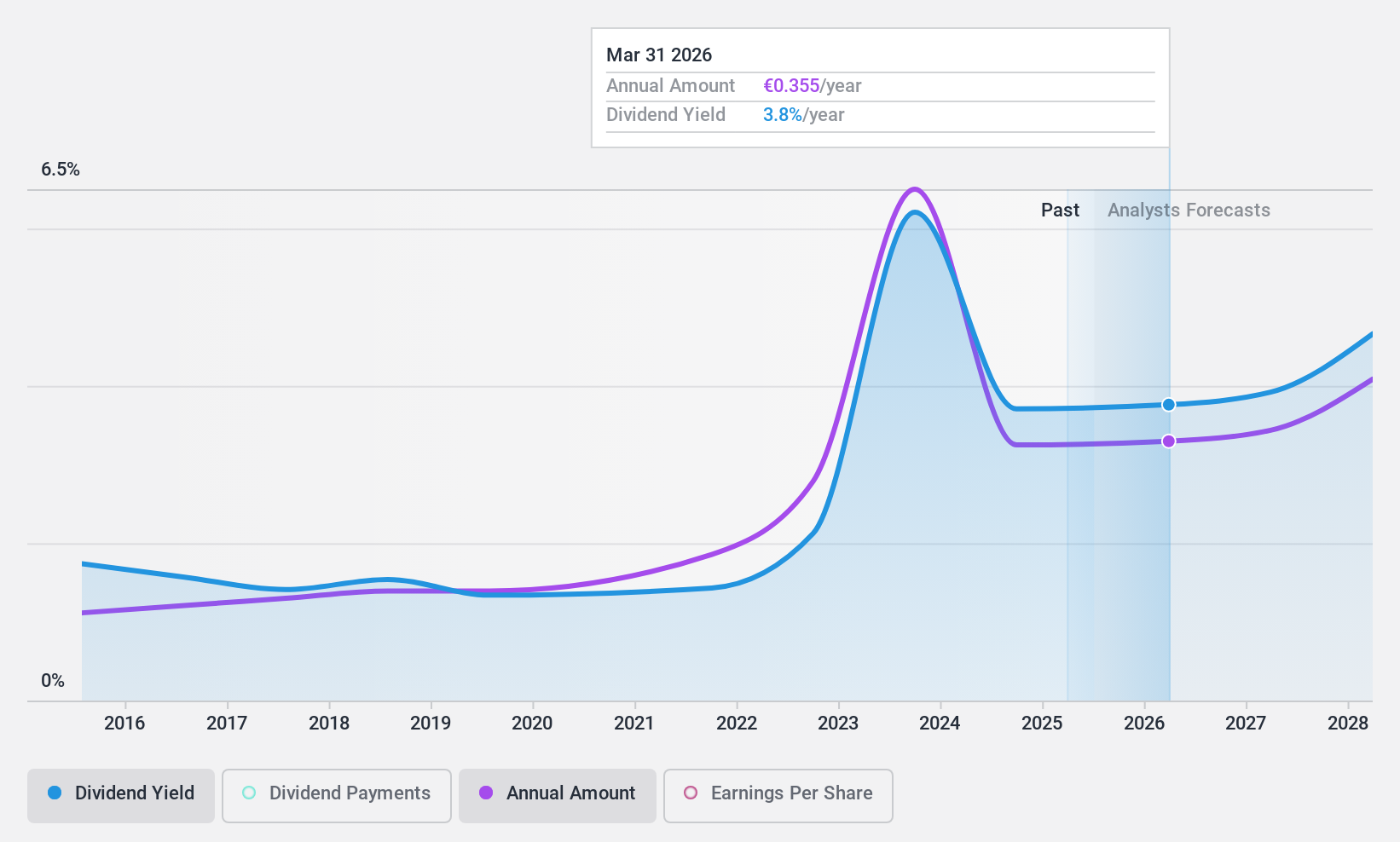

Dividend Yield: 3.8%

Oeneo's dividend payments have been inconsistent over the past decade, yet they are currently supported by earnings and cash flows with a payout ratio of 75%. While its 3.8% yield is lower than the top French dividend payers, analysts anticipate a stock price increase of 26.9%. Despite volatility in past dividends, Oeneo's projected earnings growth of 6.72% per year suggests potential for future stability in its dividend policy.

- Get an in-depth perspective on Oeneo's performance by reading our dividend report here.

- Our valuation report unveils the possibility Oeneo's shares may be trading at a premium.

Summing It All Up

- Gain an insight into the universe of 241 Top European Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SBT

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026