- France

- /

- Diversified Financial

- /

- ENXTPA:MF

Top Dividend Stocks To Watch On Euronext Paris September 2024

Reviewed by Simply Wall St

As the rally triggered by the U.S. Federal Reserve’s interest rate cut begins to fade, investors in France are closely watching the CAC 40 Index, which has shown a modest gain of 0.47%. With this cautious optimism in mind, it's an opportune moment to consider dividend stocks that offer both stability and income. In light of current market conditions, a good dividend stock typically combines strong fundamentals with consistent payout history, making it an attractive option for those looking to navigate economic uncertainties while securing steady returns.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.70% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.22% | ★★★★★★ |

| Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 8.04% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.87% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.12% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.72% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.79% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.31% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.69% | ★★★★★☆ |

| Trigano (ENXTPA:TRI) | 3.26% | ★★★★☆☆ |

Click here to see the full list of 34 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Vinci (ENXTPA:DG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vinci SA, with a market cap of €62.68 billion, operates in concessions, energy, and construction sectors both in France and internationally through its subsidiaries.

Operations: Vinci SA's revenue segments include Cobra IS (€6.74 billion), VINCI Energies (€19.76 billion), Concessions - VINCI Airports (€4.57 billion), Concessions - VINCI Autoroutes (€6.98 billion), VINCI Construction (Including Eurovia) (€31.83 billion), and VINCI Immobilier and Holding Companies (€1.18 billion).

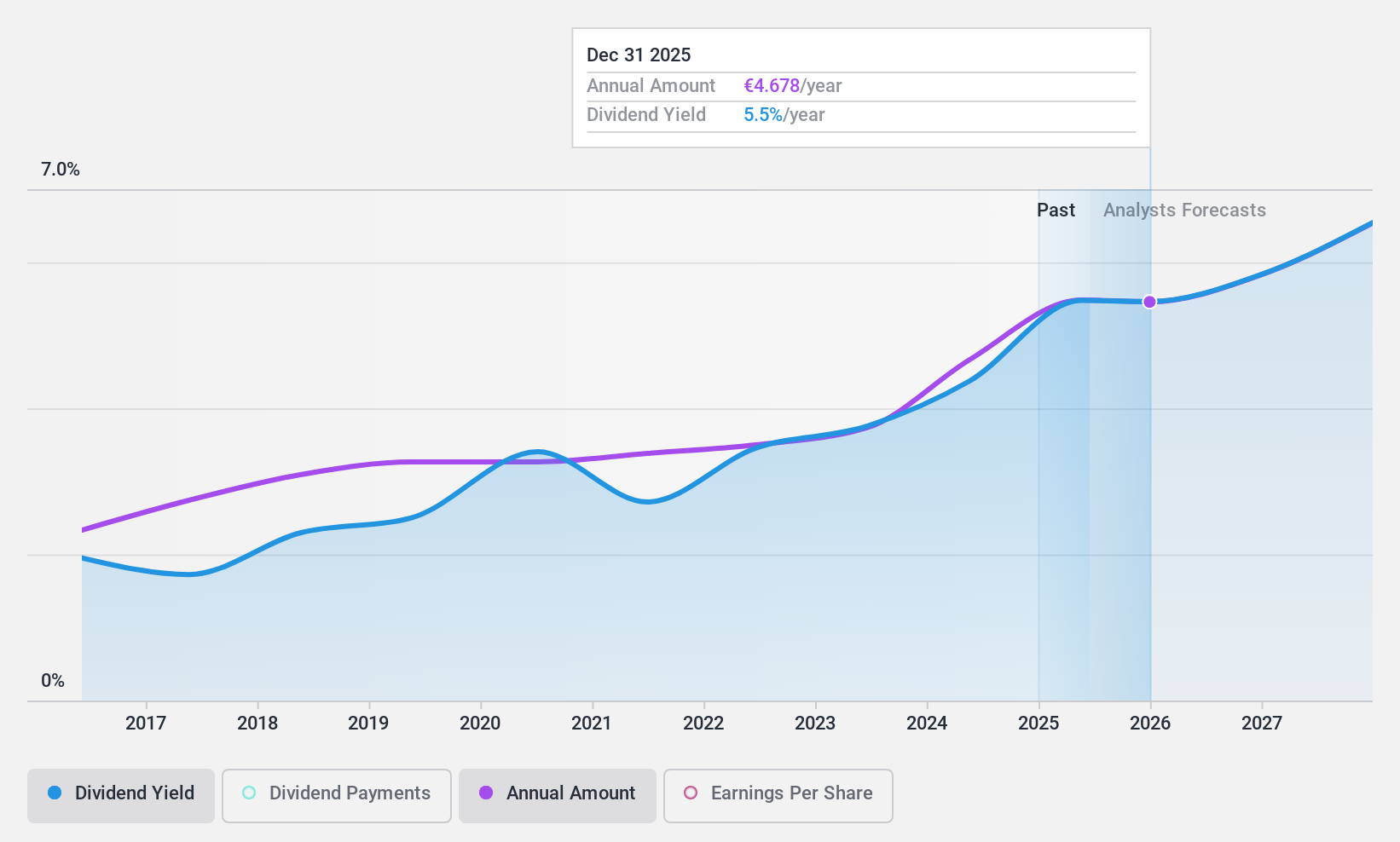

Dividend Yield: 4.1%

Vinci SA's interim dividend of €1.05 per share, payable on 17 October 2024, reflects its commitment to returning capital to shareholders despite a mixed financial performance. For the half year ended June 30, 2024, Vinci reported sales of €34.25 billion and net income of €1.99 billion, slightly down from last year. The company's dividend payments are well-covered by earnings (55.8% payout ratio) and cash flows (34.7% cash payout ratio), though its high debt level remains a concern for long-term sustainability.

- Click to explore a detailed breakdown of our findings in Vinci's dividend report.

- Our valuation report unveils the possibility Vinci's shares may be trading at a discount.

Wendel (ENXTPA:MF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wendel is a private equity firm focusing on equity financing in middle markets and later stages through leveraged buy-outs, transactions, and acquisitions, with a market cap of €3.95 billion.

Operations: Wendel generates revenue through its investments in CPI (€136 million), ACAMS (€93.60 million), Stahl (€935.20 million), and Bureau Veritas (€5.99 billion).

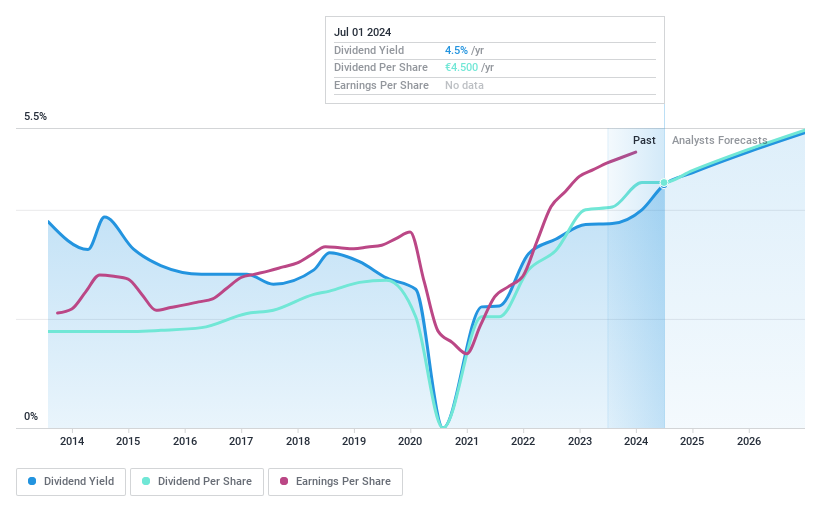

Dividend Yield: 4.3%

Wendel's dividend payments have grown steadily over the past decade, showing reliability with minimal volatility. Despite a 4.3% yield, which is lower than the top 25% of French dividend payers, its dividends are thoroughly covered by a low cash payout ratio of 14.2%. However, current earnings do not cover the dividends, raising sustainability concerns. Recent half-year results showed significant sales growth to €3.99 billion and net income improvement to €388.2 million despite reporting a basic loss per share from continuing operations at €0.7.

- Take a closer look at Wendel's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Wendel is trading behind its estimated value.

Oeneo (ENXTPA:SBT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oeneo SA operates in the wine industry worldwide and has a market cap of €666.32 million.

Operations: Oeneo SA generates revenue primarily from its Corking segment (€211.57 million) and Breeding segment (€94.17 million).

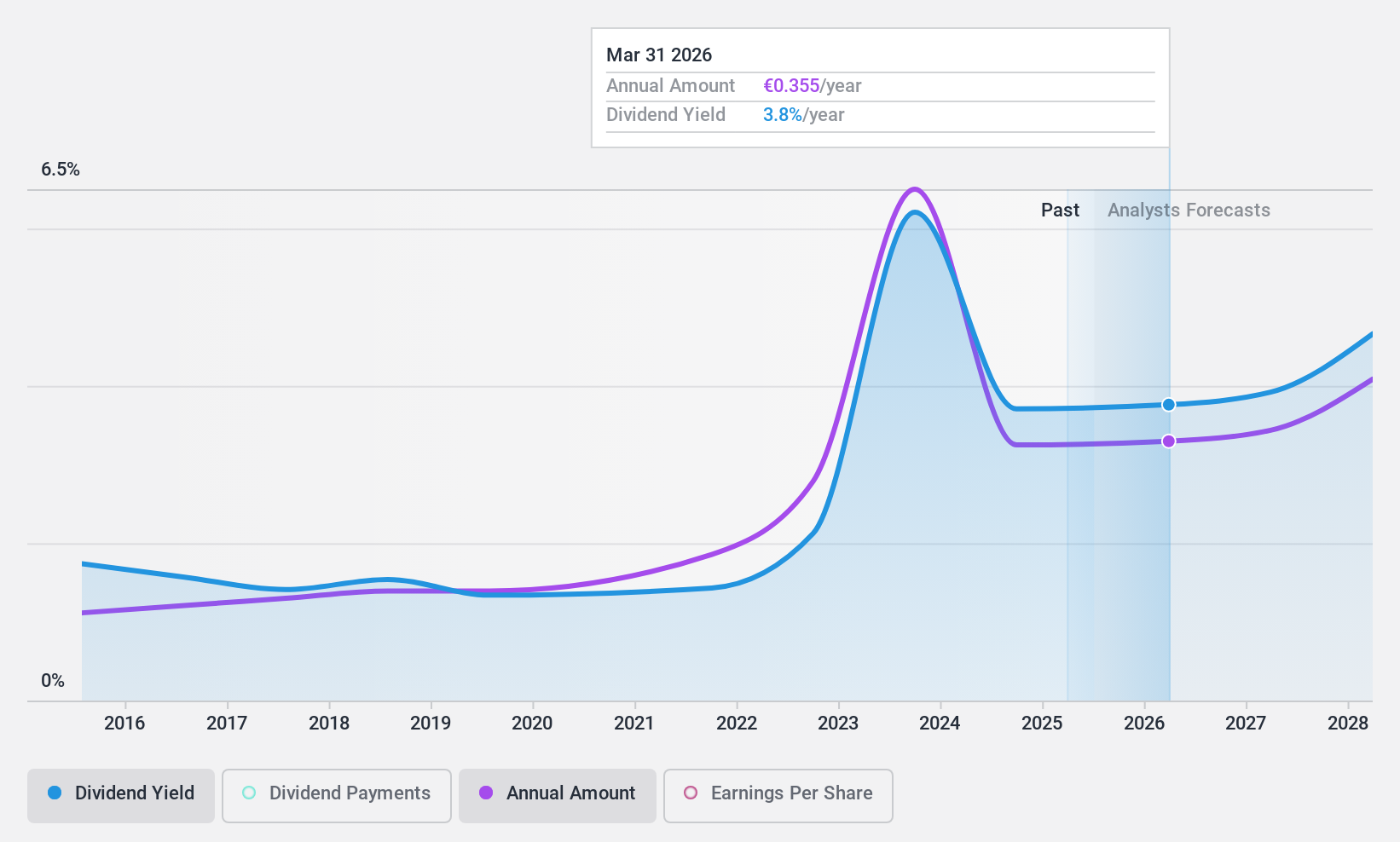

Dividend Yield: 3.4%

Oeneo's dividend payments are well-covered by both earnings (78.2% payout ratio) and free cash flows (83.3% cash payout ratio). Despite a relatively low yield of 3.4%, its dividends have grown over the past decade, although they have been somewhat volatile. The stock is currently trading at 14.7% below its estimated fair value, with analysts predicting a 21% price increase, indicating potential for capital appreciation alongside dividend income.

- Navigate through the intricacies of Oeneo with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Oeneo's share price might be too optimistic.

Next Steps

- Reveal the 34 hidden gems among our Top Euronext Paris Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wendel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MF

Wendel

A private equity firm specializing in equity financing in middle markets and later stages through leveraged buy-out and transactions and acquisitions.

Very undervalued with adequate balance sheet and pays a dividend.