Introducing COFACE (EPA:COFA), A Stock That Climbed 17% In The Last Three Years

Buying a low-cost index fund will get you the average market return. But in any diversified portfolio of stocks, you'll see some that fall short of the average. Unfortunately for shareholders, while the COFACE SA (EPA:COFA) share price is up 17% in the last three years, that falls short of the market return. Zooming in, the stock is actually down 13% in the last year.

Check out our latest analysis for COFACE

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years of share price growth, COFACE actually saw its earnings per share (EPS) drop 0.4% per year. Companies are not always focussed on EPS growth in the short term, and looking at how the share price has reacted, we don't think EPS is the most important metric for COFACE at the moment. Therefore, it makes sense to look into other metrics.

We note that the dividend is higher than it was preciously, so that may have assisted the share price. Sometimes yield-chasing investors will flock to a company if they think the dividend can grow over time.

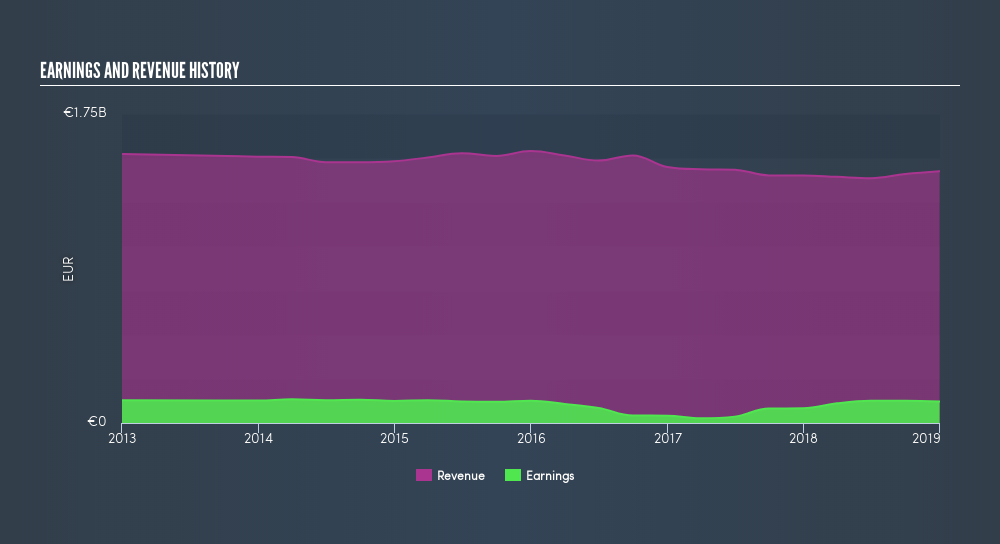

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We know that COFACE has improved its bottom line lately, but what does the future have in store? So we recommend checking out this freereport showing consensus forecasts

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for COFACE the TSR over the last 3 years was 32%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

COFACE shareholders are down 9.9% for the year (even including dividends), but the broader market is up 8.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Investors are up over three years, booking 9.7% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. Before forming an opinion on COFACE you might want to consider the cold hard cash it pays as a dividend. This freechart tracks its dividend over time.

But note: COFACE may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:COFA

COFACE

Through its subsidiaries, provides credit insurance products and related services for microenterprises, small and medium enterprises, mid-market companies, international corporations, financial institutions, and clients of distribution partners.

Good value with acceptable track record.

Market Insights

Community Narratives