Coface (ENXTPA:COFA) Valuation in Focus Following Christina Montes De Oca’s Appointment as North America CEO

Reviewed by Simply Wall St

Most Popular Narrative: 15.6% Undervalued

According to the most widely followed narrative, COFACE is viewed as notably undervalued, with a fair value calculation suggesting the shares could be worth significantly more based on future earnings prospects and analyst expectations.

The company's high client retention rate of 92.3% and selective growth strategy are likely to stabilize and potentially increase revenue, contributing to consistent revenue streams. The deliberate investment in technology and data is expected to drive efficiencies and improve net margins over time, enhancing the overall profitability of the company.

Curious how this undervaluation could play out? There is a bigger story than just headline profit and growth rates. This narrative is built on some bold analyst assumptions, including margin trends, company-specific growth levers, and a future valuation multiple that may surprise even seasoned investors. Are you ready to discover what ambitious projections fuel that significant upside and why they could change your outlook for COFACE?

Result: Fair Value of €18.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing cost pressures and elevated insolvencies could threaten profitability and create challenges for the bullish outlook for COFACE’s long-term growth.

Find out about the key risks to this COFACE narrative.Another View: Our DCF Model Perspective

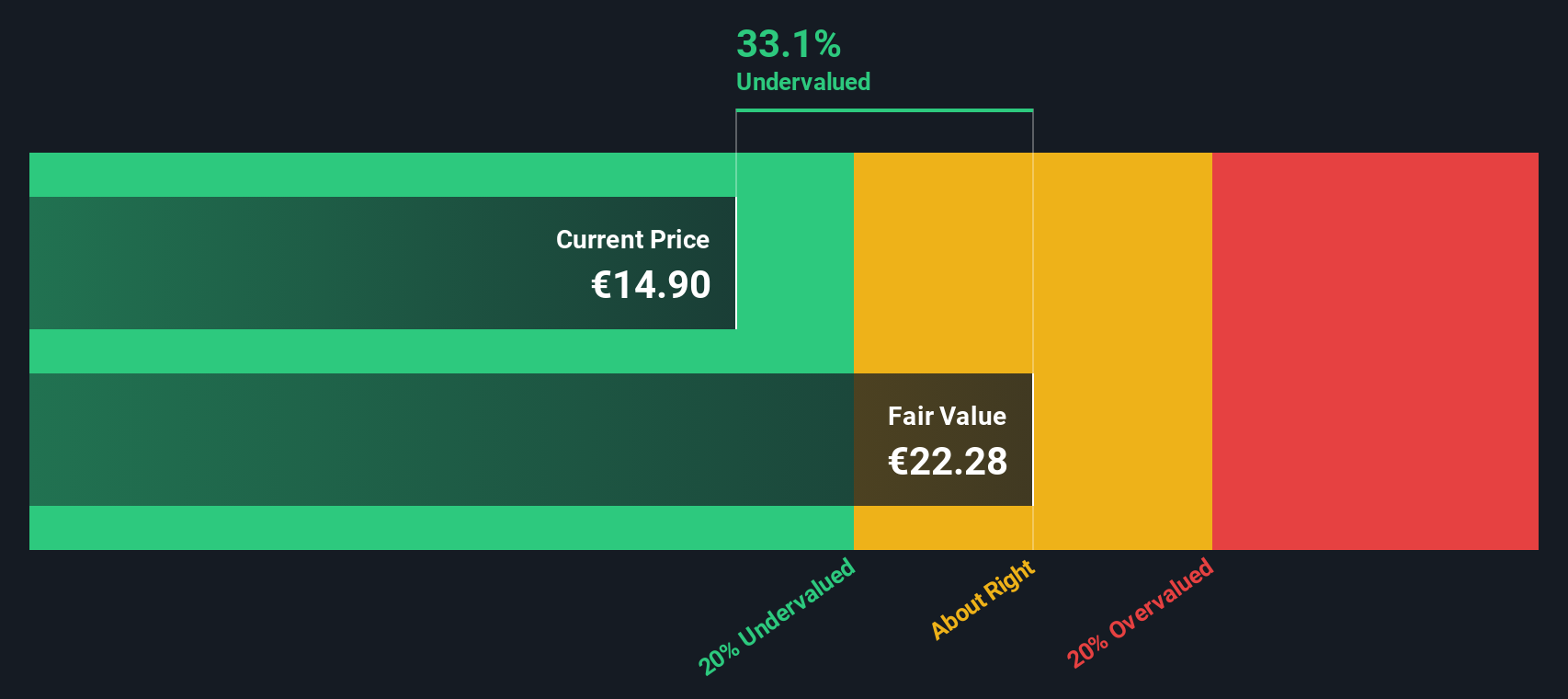

Looking at COFACE through the lens of our DCF model provides a different perspective. This method suggests an even greater degree of undervaluation than the first approach. Could the market be missing something important?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out COFACE for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own COFACE Narrative

If you see things differently, or want to dig deeper into the numbers yourself, you can develop your own take in just a few minutes. Do it your way

A great starting point for your COFACE research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let potential opportunities pass you by. Now is the time to take your investing to the next level. Maximize your strategy with handpicked stocks from themes shaping the future of markets.

- Boost your portfolio’s income by tapping into companies offering dividend stocks with yields > 3% and enjoy the steady rewards of strong dividend yields.

- Spot market movers with growth potential by tracking promising businesses trading below their true value via undervalued stocks based on cash flows before the rest of the crowd catches on.

- Jump on the innovation trend and join the wave of transformation with smart picks among next-gen healthcare disruptors using healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:COFA

COFACE

Through its subsidiaries, provides credit insurance products and related services for microenterprises, small and medium enterprises, mid-market companies, international corporations, financial institutions, and clients of distribution partners.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives