- France

- /

- Personal Products

- /

- ENXTPA:OR

L'Oréal S.A. (EPA:OR) Investors Are Less Pessimistic Than Expected

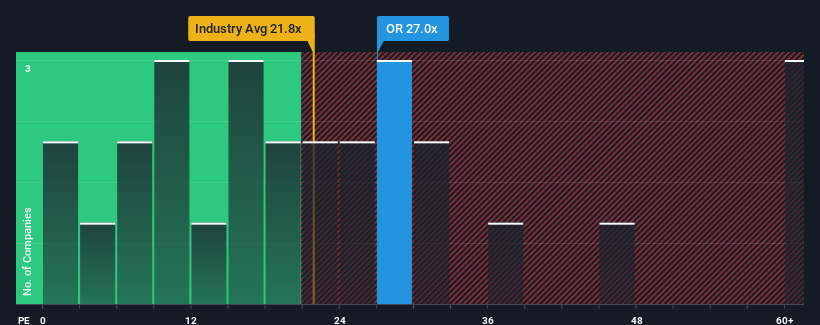

When close to half the companies in France have price-to-earnings ratios (or "P/E's") below 13x, you may consider L'Oréal S.A. (EPA:OR) as a stock to avoid entirely with its 27x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for L'Oréal as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for L'Oréal

How Is L'Oréal's Growth Trending?

In order to justify its P/E ratio, L'Oréal would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a decent 11% gain to the company's bottom line. Pleasingly, EPS has also lifted 65% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 7.4% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 14% per year, which is noticeably more attractive.

With this information, we find it concerning that L'Oréal is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Bottom Line On L'Oréal's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that L'Oréal currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for L'Oréal with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:OR

L'Oréal

Through its subsidiaries, manufactures and sells cosmetic products for women and men worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives