- France

- /

- Personal Products

- /

- ENXTPA:OR

L'Oréal (ENXTPA:OR) Valuation in Focus Following Women of Worth 20th Anniversary Spotlight

Reviewed by Kshitija Bhandaru

L'Oréal (ENXTPA:OR) has been capturing attention following its celebration of the 20th anniversary of the Women of Worth program. The event highlighted new honorees and expanded initiatives. These high-profile events are increasing both media coverage and public interest in the brand.

See our latest analysis for L'Oréal.

L'Oréal’s series of high-impact stories, ongoing innovation in digital retail, and social initiatives like the Women of Worth anniversary have kept the spotlight firmly on the brand. That momentum has translated into a 12.4% year-to-date share price return. Its 1-year total shareholder return of 5.1% suggests longer-term investors have seen steadier, if modest, gains.

If strong brand momentum has sparked your curiosity, it could be the ideal time to see what’s ahead for fast growing stocks with high insider ownership.

With shares near record highs and a robust track record, investors now face a key question: is L'Oréal still trading at an attractive entry point, or is its impressive growth story already fully reflected in the price?

Most Popular Narrative: Fairly Valued

With L'Oréal closing at €380.05 versus the narrative fair value of €387.55, the consensus signals shares are neither strongly discounted nor richly priced. This creates a high-stakes backdrop as the market weighs future catalysts, given the recent strong momentum.

Major capital allocation to strategic acquisitions (for example, Medik8 and Color Wow) and digital/AI-driven innovation (such as AI personalization and beauty tech partnerships) is expected to increase category leadership, fuel product differentiation, and raise future revenue and net margins.

Want to know what bold financial bets analysts think will transform L'Oréal? The big reveal: this narrative is powered by game-changing growth moves and future profit assumptions worthy of an industry leader. Think you know the critical number that underpins this valuation? You might be surprised to learn what has analysts pointing to a fair value just above the current share price.

Result: Fair Value of €387.55 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from digital-native brands and volatile economic conditions in key markets could quickly shift L'Oréal’s growth outlook and valuations.

Find out about the key risks to this L'Oréal narrative.

Another View: Premium Price Tag Raises Questions

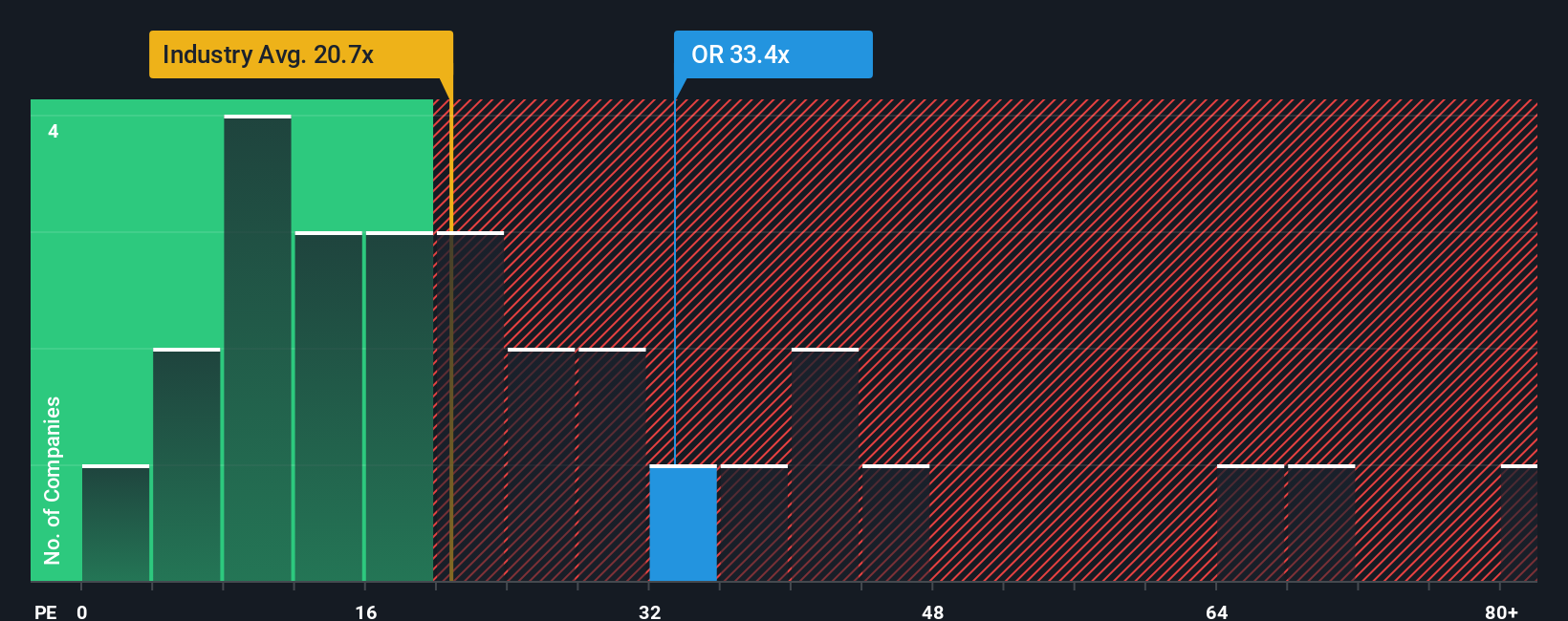

Taking a multiples approach, L'Oréal trades at a price-to-earnings ratio of 33.1x, noticeably above both the European personal products industry average (20.5x) and its own fair ratio of 30.4x. This signals investors are paying a premium for growth, but could that price premium carry extra risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own L'Oréal Narrative

If you see the story differently or want to dig into the numbers yourself, you can build your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding L'Oréal.

Looking for More Investment Ideas?

Don’t miss your chance to power up your investing strategy. There are exciting opportunities ahead, and finding the right stocks is easier than you might think.

- Boost passive income potential by tapping into these 18 dividend stocks with yields > 3%, a selection of companies offering solid yields above 3%.

- Capitalize on rapid healthcare innovation when you review these 33 healthcare AI stocks to see which companies are transforming medicine with breakthroughs in artificial intelligence.

- Stay ahead of the curve and uncover value by checking out these 874 undervalued stocks based on cash flows, which highlights companies based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OR

L'Oréal

Through its subsidiaries, manufactures and sells cosmetic products for women and men worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives