- France

- /

- Healthcare Services

- /

- ENXTPA:CLARI

Does Clariane’s 100% Rally Signal Room for Growth After Restructuring News?

Reviewed by Simply Wall St

Thinking about what to do with Clariane stock? You are certainly not alone. This year alone, Clariane has been on a wild ride, with the share price climbing an eye-catching 101.9% year-to-date and an astonishing 154.1% over the past twelve months. Yet, these headline numbers only tell part of the story. Digging deeper, you might notice some hesitancy creeping in during the last month, with shares down 6.0%. Does that mean the rally is over, or is this just a pause before another leg higher?

These big moves have caught the attention of many investors, and not just because of the volatility. Some of the surge reflects renewed optimism after recent market developments, as well as a shift in sentiment toward Clariane’s sector as risk perception has improved. But how should you judge if the current price offers real value? That is where a closer look at valuation comes in.

On that front, Clariane’s current value score lands at 5 out of 6, meaning the stock screens as undervalued using five of the six checks we use to assess companies. That is a strong signal worth examining in more detail. Next up, we will break down how each core valuation method views Clariane at today’s price, and at the end, share a more effective framework to tie it all together, moving beyond just the numbers.

Clariane delivered 154.1% returns over the last year. See how this stacks up to the rest of the Healthcare industry.Approach 1: Clariane Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by extrapolating future free cash flow projections, then discounting those cash flows back to today’s value. This approach helps investors understand what a company’s shares could be worth if the projected cash generation materializes as expected.

For Clariane, its latest reported Free Cash Flow stands at €444.8 Million. Analyst forecasts extend five years out, with projections reaching €1.02 Billion by 2029, followed by more gradual, extrapolated growth for future estimates. These projections, all denominated in euros, are at the heart of the DCF model’s calculation.

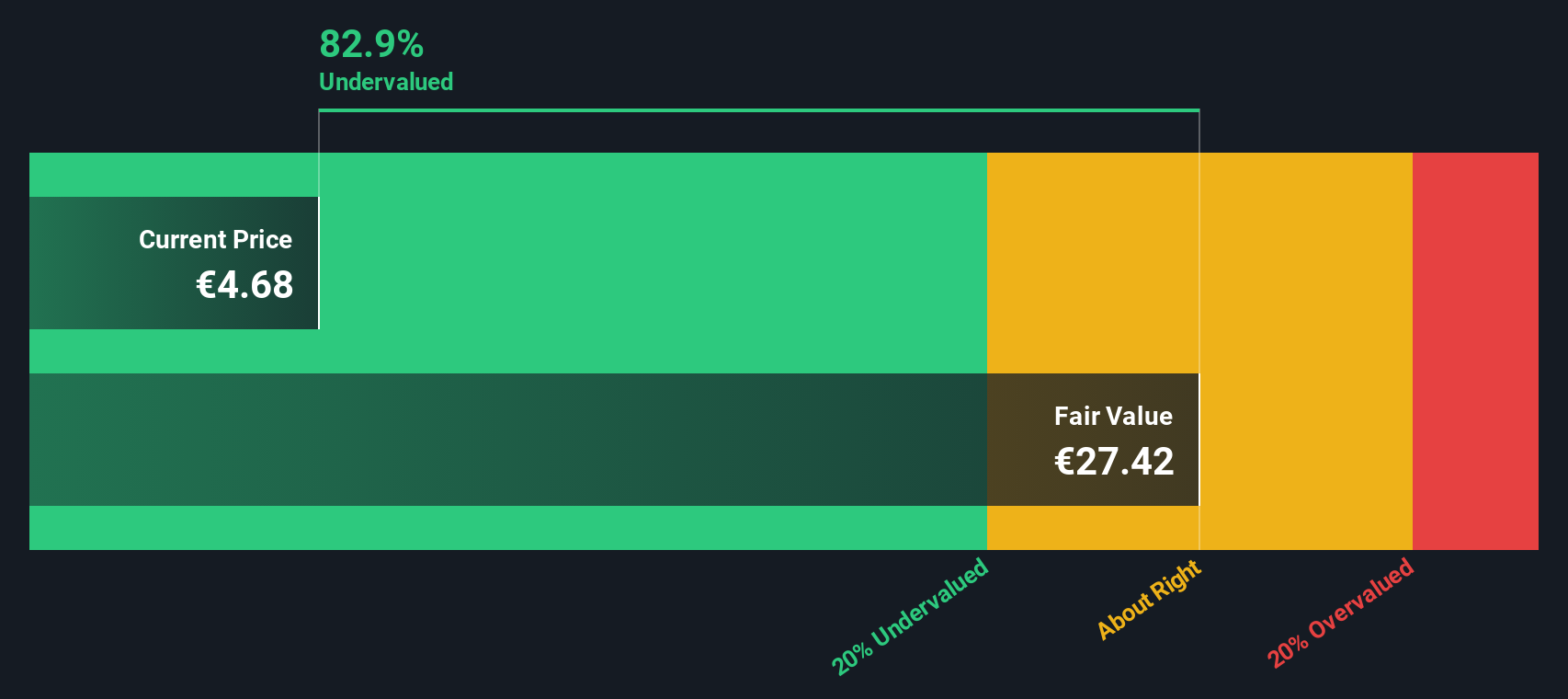

When these cash flows are brought back to present value using a standard discount rate, the model arrives at an intrinsic value of €26.56 per share. Based on the stock’s current share price, this implies Clariane is trading at a steep 83.6% discount to its estimated fair value. This means the market is pricing in far less than what the underlying cash flows suggest.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Clariane.

Approach 2: Clariane Price vs Sales (P/S)

The Price-to-Sales (P/S) ratio is a widely used valuation yardstick for companies like Clariane, especially when profits may be volatile or negative, but revenue remains steady and meaningful. Sales serve as a more stable indicator than earnings, allowing for a cleaner peer comparison, particularly in sectors where consistent profitability is a challenge.

Growth prospects and risk levels are key factors that shape what counts as a “normal” P/S ratio. Fast-growing companies or those with lower perceived risks can often justify higher multiples, since investors expect future sales to translate into better profits down the line.

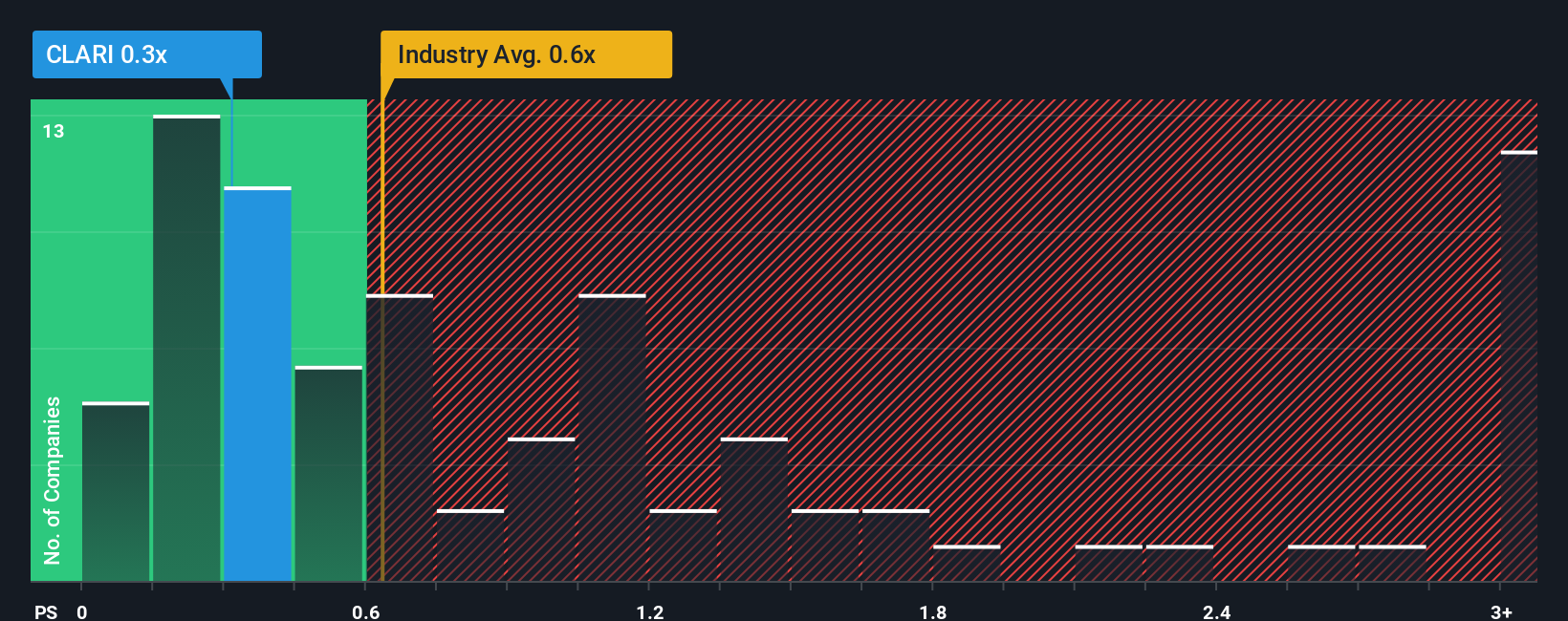

Currently, Clariane trades at a P/S ratio of just 0.29x. This stands out when compared to the Healthcare industry average of 1.40x and a peer average of 0.98x. On the surface, this suggests the stock is particularly cheap relative to its sales base.

However, Simply Wall St’s Fair Ratio adds a crucial layer to this assessment. The Fair Ratio, calculated based on Clariane’s unique combination of profit margins, industry dynamics, growth potential, risk, and company size, provides a more tailored view of what would truly be a reasonable valuation. This approach goes beyond simple benchmarks and offers deeper context that helps avoid the pitfalls of generic comparisons.

Clariane’s Fair Ratio stands at 1.11x. Since its actual P/S ratio of 0.29x is well below this fair benchmark, the evidence strongly points to Clariane being undervalued on a sales basis.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Clariane Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is the personal story or perspective investors use to connect what they know about a company, such as its strategy, risks, or industry trends, to their own forecasts for revenue, earnings, and margins, and ultimately a fair value estimate. Instead of simply relying on raw numbers or analyst targets, Narratives link Clariane’s business outlook to a financial forecast, helping you see how a company’s journey could translate into share price potential.

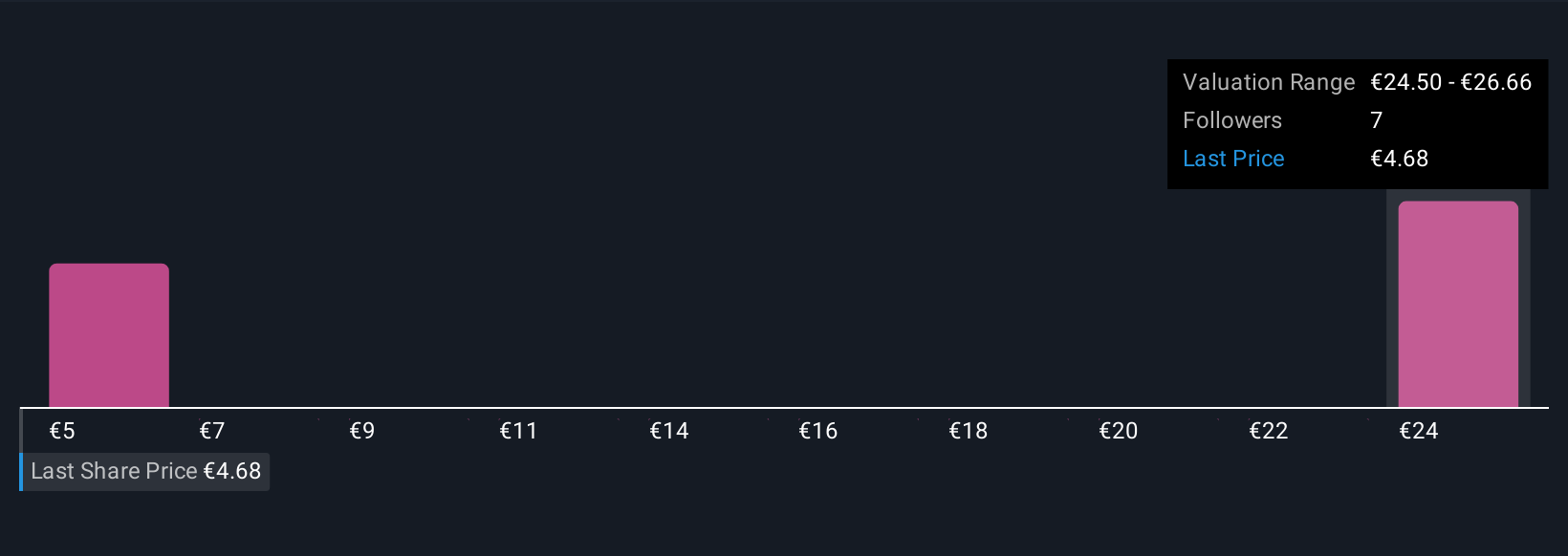

This approach is especially powerful on Simply Wall St’s Community page, where millions of investors can create and share Narratives in minutes. Narratives let you visualize exactly when a stock might be undervalued or overvalued by comparing your own Fair Value to the current market price. They update automatically when new information is released, so you can adjust your thinking in real time as news, results, or regulations change the picture.

For Clariane, for example, some investors build an optimistic Narrative around margin improvements and ESG momentum, arriving at a fair value as high as €6.8 per share. Others focus on regulatory risks and tighter growth, leading to a more conservative estimate of €4.0 per share. Narratives make these different outlooks transparent and help you invest in line with your own convictions, not just the headlines.

Do you think there's more to the story for Clariane? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CLARI

Clariane

Provides care home, healthcare facilities and services, and shared living solutions in France, Germany, Benelux, Italy, Spain, and the United Kingdom.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives