- France

- /

- Oil and Gas

- /

- ENXTPA:TTE

What Does OPEC’s Steady Oil Demand Forecast Mean for TotalEnergies Stock in 2025?

Reviewed by Bailey Pemberton

If you are considering what to do with your TotalEnergies stock right now, you are definitely not alone. Whether you are a long-term holder, an investor eyeing an entry point, or just curious about where the oil giant stands amid all the market chatter, there is plenty to think about. TotalEnergies has had a bumpy ride lately. The stock is up 1.9% over the last week, but still down 0.9% for the past month, and down 3% so far this year. Over the last year, it has dropped 6.8%, but if you zoom out to a three-year return, you will see a healthy 18.2%. The real eye-opener is its five-year performance, where it has soared 154.1%.

What is behind these moves? Global oil headlines have certainly played a part, with steady demand signals from OPEC and slight increases in production throughout October and November. Traders have been reading these news updates carefully, weighing the risk of a supply glut against the stability of long-term demand. All of these factors have kept sentiment moving back and forth, and they put the spotlight squarely on valuation. Is TotalEnergies undervalued right now?

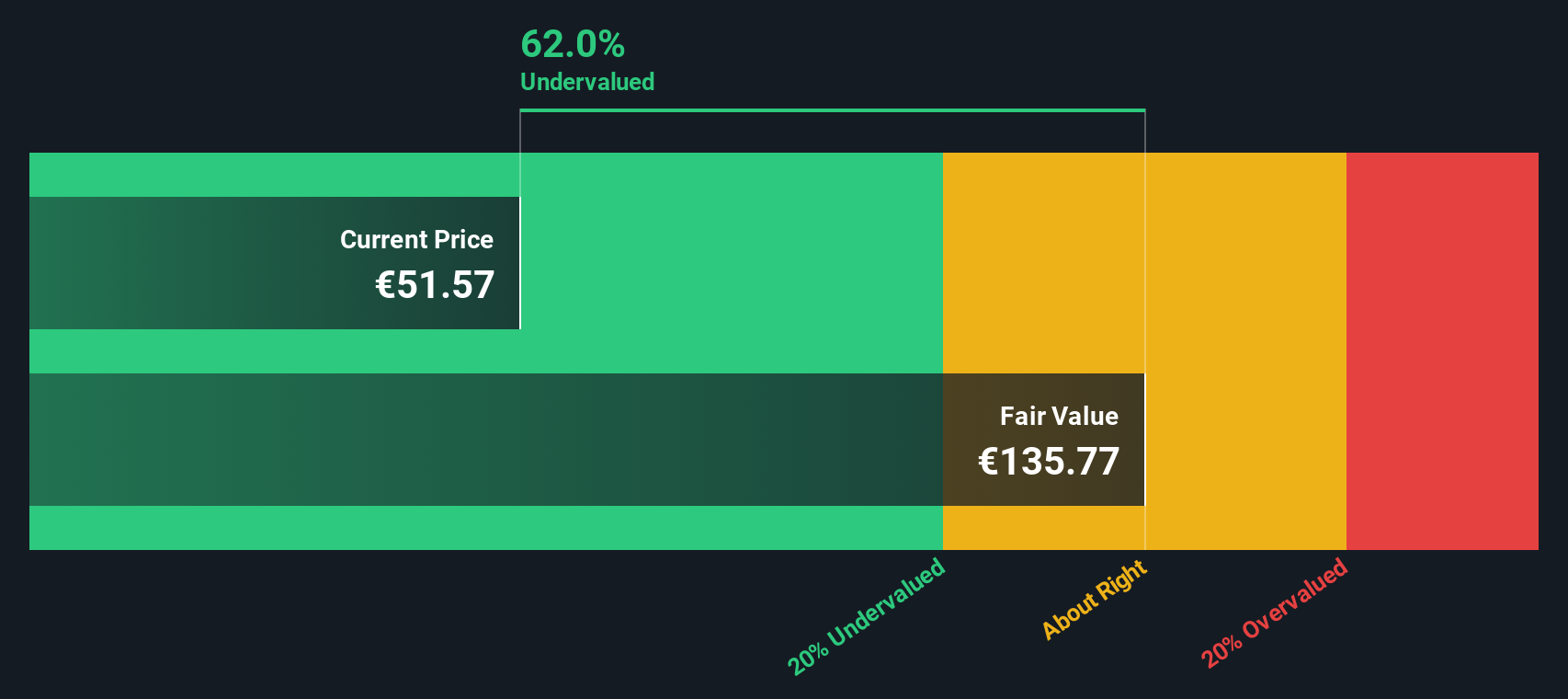

According to the latest valuation checks, TotalEnergies earns a value score of 6 out of 6, indicating it passes every single metric for undervaluation that we typically look for. But what are those checks, and how do they really paint the bigger picture? In the next section, I will break down each valuation approach, and later on, share an even sharper way to frame the company's true worth.

Why TotalEnergies is lagging behind its peers

Approach 1: TotalEnergies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting them back to today’s value. For TotalEnergies, this involves evaluating how much cash the company is expected to generate and what that is worth in present terms.

Currently, TotalEnergies generates Free Cash Flow of approximately $13.40 Billion annually. Analyst estimates suggest that this figure will continue to grow, reaching $17.65 Billion by 2029. For the years beyond analyst coverage, cash flow projections are extrapolated using industry growth assumptions. The 10-year outlook projects Free Cash Flow to rise steadily, supported by stable demand and prudent capital management.

According to the DCF calculation, the estimated intrinsic value for TotalEnergies stock is $152.81 per share. This represents a significant discount of 65.9 percent compared to the current market price, indicating that the stock is deeply undervalued based on future cash flow expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests TotalEnergies is undervalued by 65.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

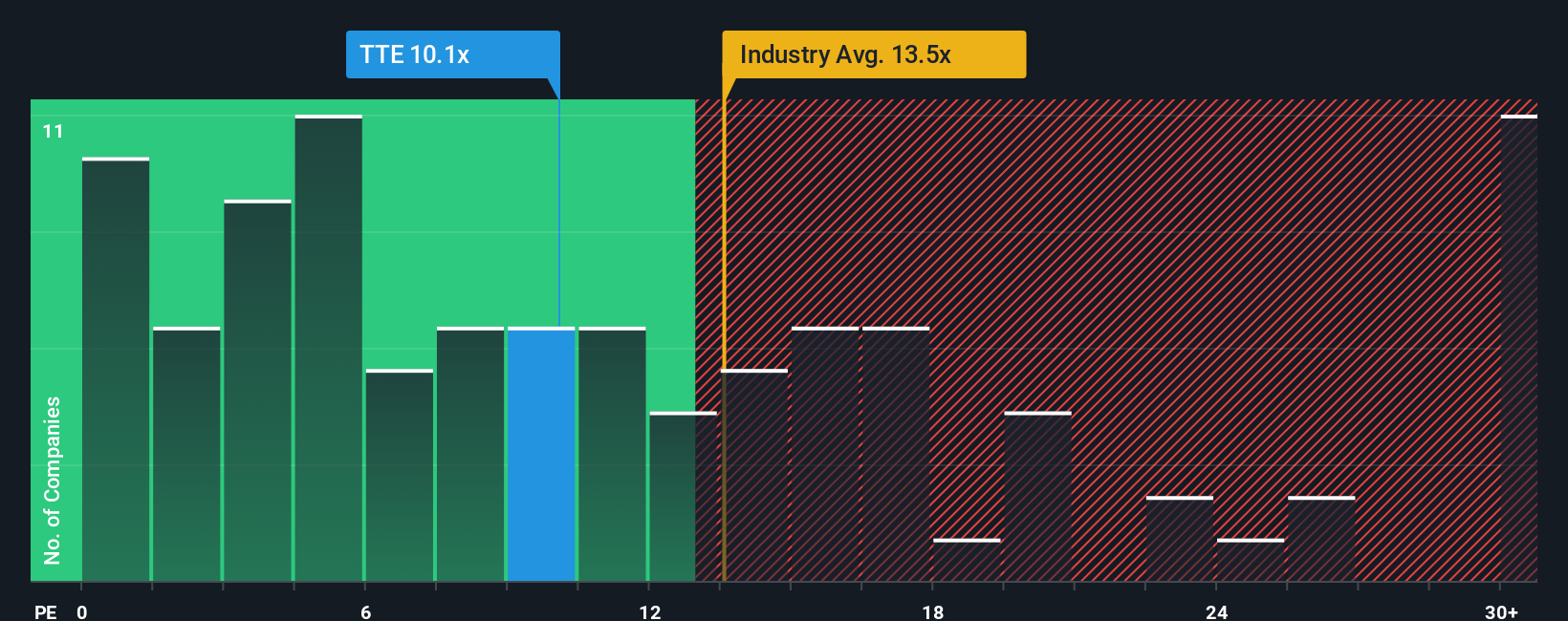

Approach 2: TotalEnergies Price vs Earnings

For profitable companies like TotalEnergies, the Price-to-Earnings (PE) ratio is widely considered a reliable yardstick for valuation because it directly relates the share price to actual profits. The higher a company's growth prospects and the lower its risks, the more investors are generally willing to pay for each euro of earnings, reflected in a higher "fair" PE ratio.

TotalEnergies currently trades at a PE ratio of 10.3x. To put this in perspective, the average PE for the Oil and Gas industry stands at 12.9x, and the average for its closest peers is even higher at 46.5x. So at first glance, TotalEnergies appears to be valued quite conservatively compared to both its industry and peer group.

Rather than just relying on broad benchmarks, Simply Wall St’s Fair Ratio dives deeper by evaluating the company’s earnings growth, profit margins, market cap and sector risks. This tailored Fair Ratio for TotalEnergies comes in at 15.6x, offering a more precise target valuation specific to the company’s actual strengths and challenges. Because it is customized, the Fair Ratio avoids the pitfalls of one-size-fits-all industry comparisons and gives a clearer signal for investors.

With TotalEnergies trading at 10.3x, which is well below the 15.6x Fair Ratio, the stock looks undervalued using this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TotalEnergies Narrative

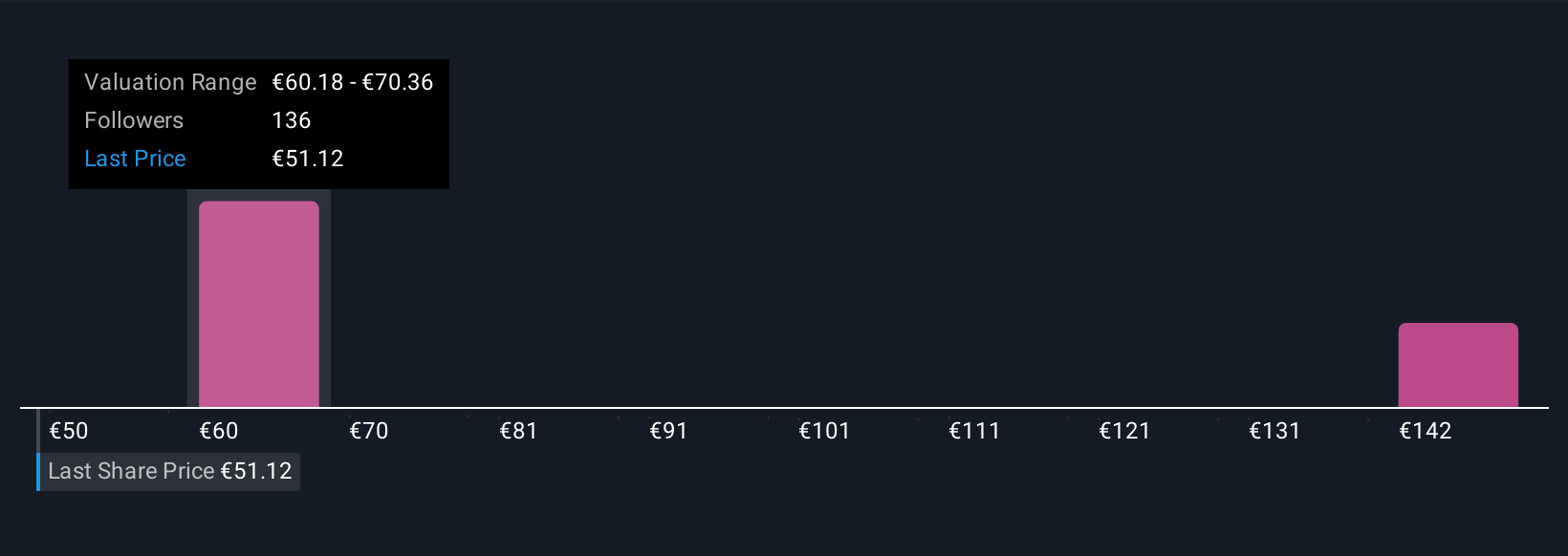

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful tool where you combine your own story about a company with numbers, including your assumed fair value and forecasts for its future growth and margins. Rather than just looking at ratios and price targets, a Narrative connects what you believe about TotalEnergies, such as the impact of LNG expansion, renewables growth, or market risks, to a concrete financial outlook and fair value estimate.

Narratives are accessible to everyone on Simply Wall St's Community page, where millions of investors use them to bring their unique insights to life and see different possibilities play out in real time. With Narratives, you can compare your fair value for TotalEnergies to the live market price to help decide when it makes sense to buy or sell. Your view is dynamically updated as fresh news, earnings, or data come in.

For example, some investors see strong renewables expansion and efficient capital allocation driving fair values as high as €77.57. Others take a more cautious stance because of oil market risks, resulting in fair values as low as €52.82. Narratives let you easily track, adjust, and defend your investment decisions, all grounded in your own perspective and not just the consensus.

Do you think there's more to the story for TotalEnergies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TotalEnergies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TTE

TotalEnergies

A multi-energy company, produces and markets oil and biofuels, natural gas, biogas and low-carbon hydrogen, renewables, and electricity in France, rest of Europe, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives