- Switzerland

- /

- Banks

- /

- SWX:LLBN

Top European Dividend Stocks To Consider In December 2025

Reviewed by Simply Wall St

As European markets continue to show resilience, with the STOXX Europe 600 Index climbing 2.35% and major single-country indexes also posting gains, investors are increasingly looking toward dividend stocks as a stable income source amid subdued inflation rates across the eurozone. In this environment, selecting stocks that offer reliable dividend yields can be an effective strategy for those seeking consistent returns while navigating the current economic landscape.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.36% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.61% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.17% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.98% | ★★★★★★ |

| Evolution (OM:EVO) | 4.83% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.19% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 9.72% | ★★★★★☆ |

| Credito Emiliano (BIT:CE) | 5.12% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.37% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.64% | ★★★★★★ |

Click here to see the full list of 214 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, and Venezuela with a market cap of €998.01 million.

Operations: Etablissements Maurel & Prom S.A. generates revenue primarily from its Production segment, which accounts for $554.05 million, and also from its Drilling activities totaling $22.23 million.

Dividend Yield: 6.3%

Etablissements Maurel & Prom's dividend yield of 6.25% ranks in the top 25% of French market payers, though its track record is unstable with payments being volatile over six years. Dividends are well-covered by earnings (28.9% payout ratio) but more strained by cash flows (76.1%). Recent sales dropped to $489 million for nine months ending September 2025, down from $559 million year-on-year, while production slightly increased. Leadership changes may influence future strategic direction and dividend stability.

- Unlock comprehensive insights into our analysis of Etablissements Maurel & Prom stock in this dividend report.

- According our valuation report, there's an indication that Etablissements Maurel & Prom's share price might be on the cheaper side.

Sparebanken Norge (OB:SBNOR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sparebanken Vest, operating under the ticker OB:SBNOR, is a financial services company offering banking and financing services in Vestland and Rogaland, Norway, with a market cap of NOK20.04 billion.

Operations: Sparebanken Vest generates its revenue primarily through Banking Operations in the Retail Market (NOK3.86 billion), Corporate Market (NOK2.74 billion), Real Estate (NOK465 million), and Bulder Bank (NOK425 million).

Dividend Yield: 4.7%

Sparebanken Norge's dividends are well-covered by earnings with a payout ratio of 50.3%, though the track record has been volatile over the past decade. Its recent addition to the Euronext 150 Index highlights its market relevance, while net income for Q3 2025 rose to NOK 1.77 billion from NOK 1.24 billion year-on-year. Despite trading below estimated fair value and offering growth potential, its dividend yield of 4.65% is modest compared to top-tier Norwegian payers.

- Delve into the full analysis dividend report here for a deeper understanding of Sparebanken Norge.

- Insights from our recent valuation report point to the potential undervaluation of Sparebanken Norge shares in the market.

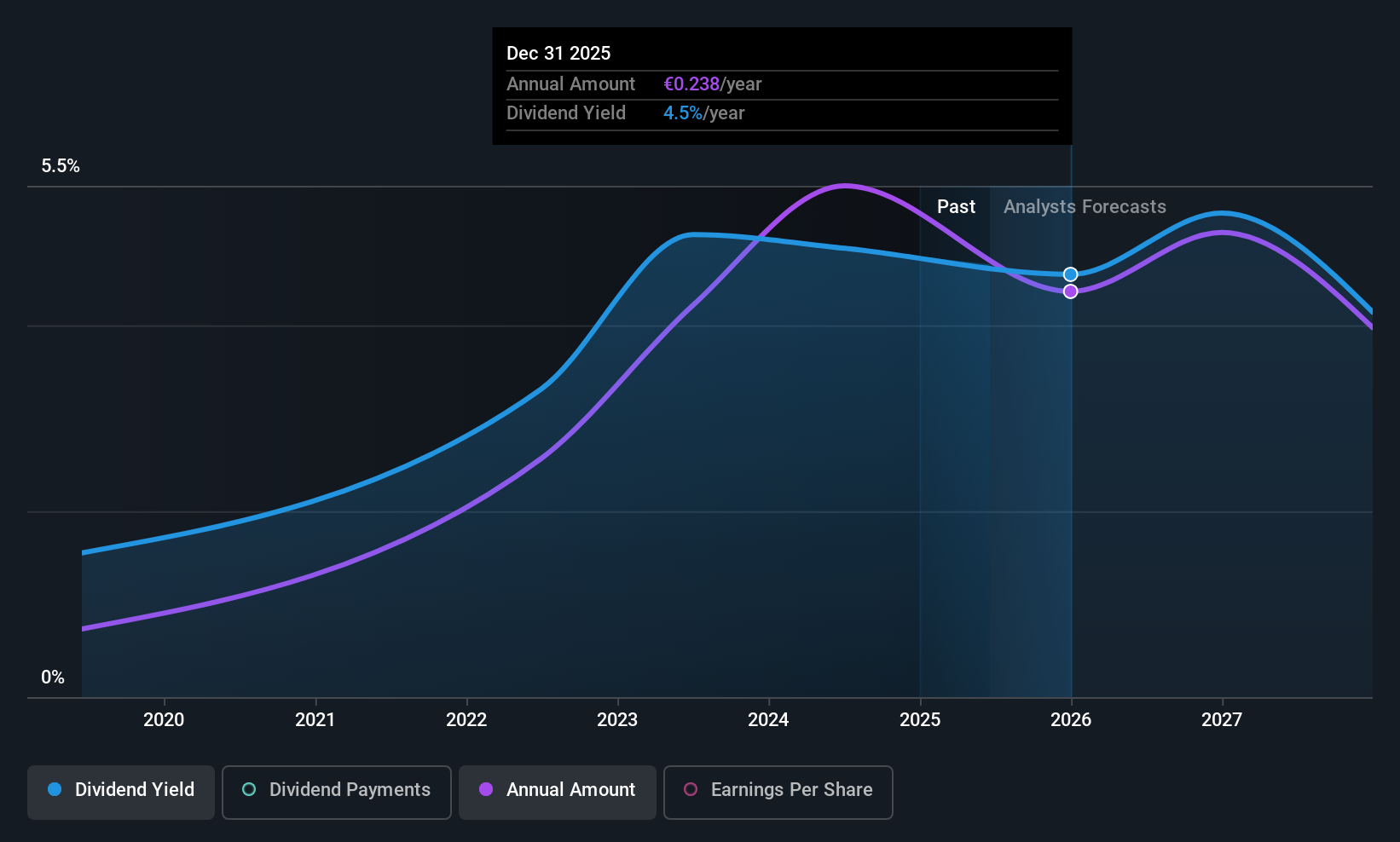

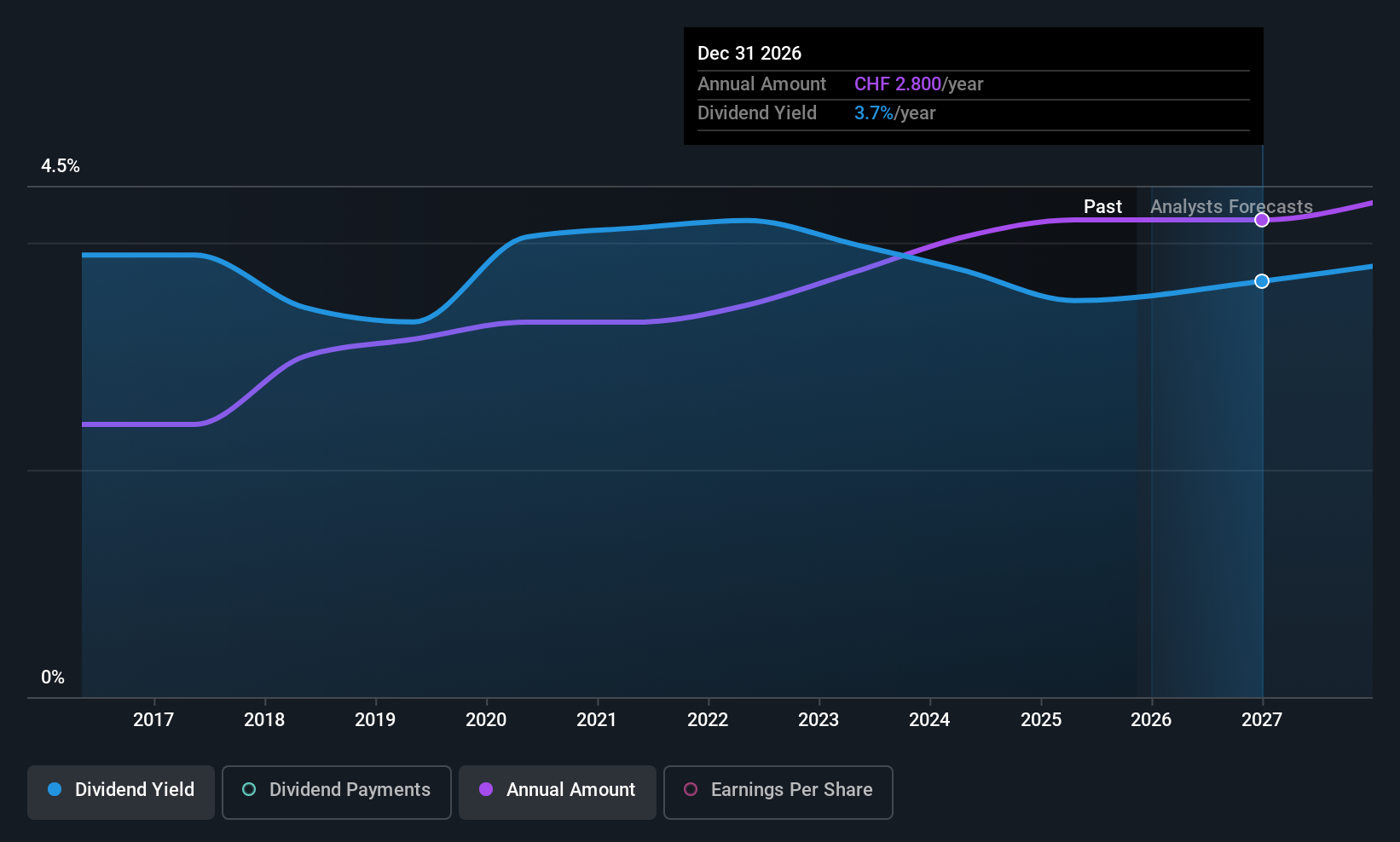

Liechtensteinische Landesbank (SWX:LLBN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liechtensteinische Landesbank Aktiengesellschaft offers banking products and services in Liechtenstein, Switzerland, Germany, and Austria, with a market cap of CHF2.39 billion.

Operations: The company's revenue segments include Retail & Corporate Banking with CHF306.49 million and International Wealth Management with CHF250.77 million.

Dividend Yield: 3.6%

Liechtensteinische Landesbank's dividends are covered by earnings, with a payout ratio of 50.8%, and forecasted to remain sustainable in three years at 53.9%. Despite a history of volatility over the past decade, dividend payments have increased. The bank's recent CHF 200 million bond issue reflects strong market confidence, supported by solid financial metrics like an Aa2 Moody’s rating and CHF 2.3 billion equity capital. However, its current yield of 3.57% is below the Swiss top-tier average of 3.9%.

- Click here to discover the nuances of Liechtensteinische Landesbank with our detailed analytical dividend report.

- Our valuation report here indicates Liechtensteinische Landesbank may be overvalued.

Make It Happen

- Delve into our full catalog of 214 Top European Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LLBN

Liechtensteinische Landesbank

Provides banking products and services in Liechtenstein, Switzerland, Germany, and Austria.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026