- France

- /

- Oil and Gas

- /

- ENXTPA:MAU

Exploring Etablissements Maurel & Prom And 2 Other European Small Cap Gems

Reviewed by Simply Wall St

As the European markets continue to navigate a landscape marked by mixed performances in major stock indexes and evolving trade tensions, small-cap stocks have shown resilience with the STOXX Europe 600 Index rising for a fourth consecutive week. In this environment, investors often seek out companies that exhibit strong fundamentals and growth potential despite broader market uncertainties. This article explores three such European small-cap gems, including Etablissements Maurel & Prom, which may offer intriguing opportunities amidst these dynamic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Evergent Investments | 5.59% | 5.88% | 16.36% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Value Rating: ★★★★★★

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, Colombia, and France with a market capitalization of approximately €945.63 million.

Operations: The primary revenue stream for Etablissements Maurel & Prom S.A. is from production activities, generating $641.49 million, followed by drilling services at $34.68 million.

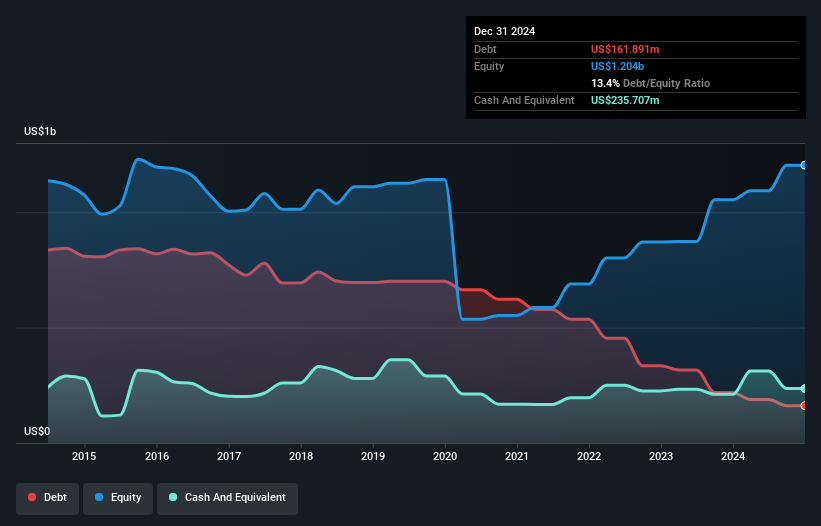

Etablissements Maurel & Prom, a notable player in the oil and gas sector, showcases robust financial health with earnings growing 10.9% last year, surpassing industry averages. Their debt-to-equity ratio impressively fell from 61.4% to 13.4% over five years, indicating prudent financial management. The company reported US$808 million in sales for 2024, up from US$682 million previously, while net income rose to US$233 million from US$210 million. With interest payments well-covered at 16.3 times by EBIT and free cash flow positive at $152.84 million as of September 2024, MAU seems well-positioned for future growth prospects.

Olvi Oyj (HLSE:OLVAS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Olvi Oyj is a beverage company that produces and distributes alcoholic and non-alcoholic drinks across Finland, Estonia, Latvia, Lithuania, Denmark, and Belarus with a market cap of €720.40 million.

Operations: Olvi Oyj generates revenue primarily from its alcoholic beverages segment, which accounts for €659.34 million. The company's net profit margin has shown notable variability over recent periods, reflecting changes in operational efficiency and market conditions.

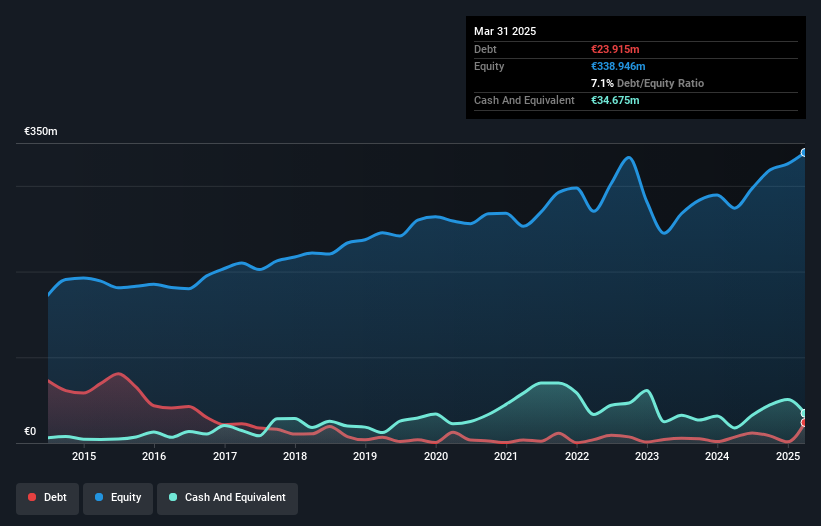

Olvi Oyj, a notable player in the beverage sector, has shown impressive financial performance with earnings growth of 14.8% over the past year, outpacing the industry's 9%. Despite an increase in its debt to equity ratio from 4.8% to 7.1% over five years, Olvi remains financially sound with more cash than total debt and trades at a significant discount of about 71.9% below estimated fair value. The company's recent quarterly results highlight steady revenue growth to €132.81 million and net income rising to €9.58 million, reflecting high-quality earnings that bolster investor confidence in its future prospects.

- Click here and access our complete health analysis report to understand the dynamics of Olvi Oyj.

Understand Olvi Oyj's track record by examining our Past report.

Plejd (NGM:PLEJD)

Simply Wall St Value Rating: ★★★★★★

Overview: Plejd AB (publ) is a technology company that specializes in developing products and services for smart lighting control across several countries including Sweden, Norway, Finland, the Netherlands, and Germany, with a market cap of SEK6.95 billion.

Operations: Plejd generates revenue primarily from its electronic security devices segment, amounting to SEK839.34 million. The company's financial performance includes a focus on managing its cost structure to optimize profitability.

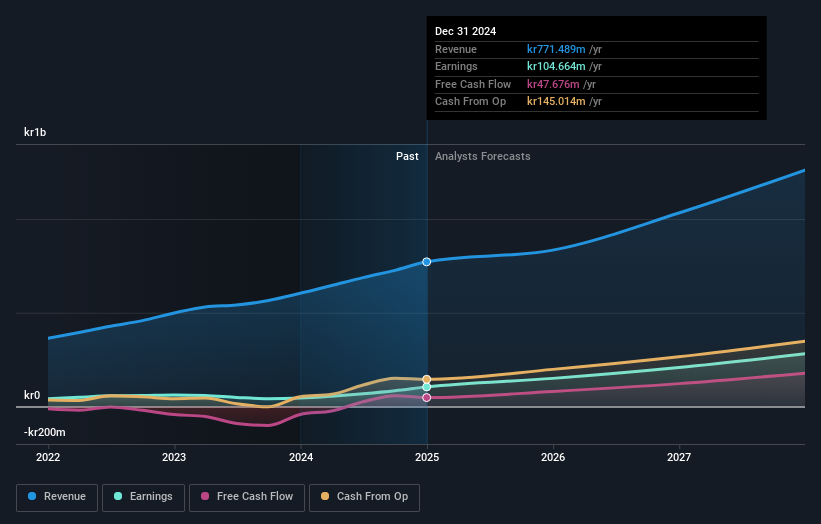

Plejd, a nimble player in the electrical industry, has shown impressive growth with earnings expanding by 130% over the past year, outpacing the industry's -24%. The company reported first-quarter sales of SEK 253.53 million and net income of SEK 44.99 million, both significantly up from last year. Despite recent significant insider selling, Plejd's high-quality earnings and debt-free status bolster its financial health. With basic earnings per share doubling to SEK 4.02 from SEK 2.03 a year ago, Plejd seems well-positioned for continued profitability amidst forecasts of a 28% annual growth in earnings.

- Delve into the full analysis health report here for a deeper understanding of Plejd.

Review our historical performance report to gain insights into Plejd's's past performance.

Key Takeaways

- Click this link to deep-dive into the 329 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Etablissements Maurel & Prom, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Etablissements Maurel & Prom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MAU

Etablissements Maurel & Prom

Engages in exploration and production of oil and gas, and hydrocarbons in Gabon, Tanzania, Angola, Colombia, and France.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives