- France

- /

- Oil and Gas

- /

- ENXTPA:MAU

3 European Dividend Stocks Offering Yields Up To 7.2%

Reviewed by Simply Wall St

As European markets experience a lift from easing trade tensions and optimism surrounding potential U.S. interest rate cuts, investors are increasingly looking towards dividend stocks as a means to capture steady income amidst the fluctuating economic backdrop. In such an environment, selecting stocks with robust dividend yields can provide a reliable income stream while potentially offering some resilience against market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.21% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.64% | ★★★★★☆ |

| Telekom Austria (WBAG:TKA) | 4.18% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 6.99% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.63% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.99% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.06% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.57% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 6.29% | ★★★★★☆ |

| Afry (OM:AFRY) | 4.00% | ★★★★★☆ |

Click here to see the full list of 216 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across multiple countries including Gabon, Tanzania, Angola, Colombia, Venezuela, Italy, Nigeria, and France with a market cap of €1.07 billion.

Operations: Etablissements Maurel & Prom S.A.'s revenue primarily comes from its Production segment, which generated $554.05 million.

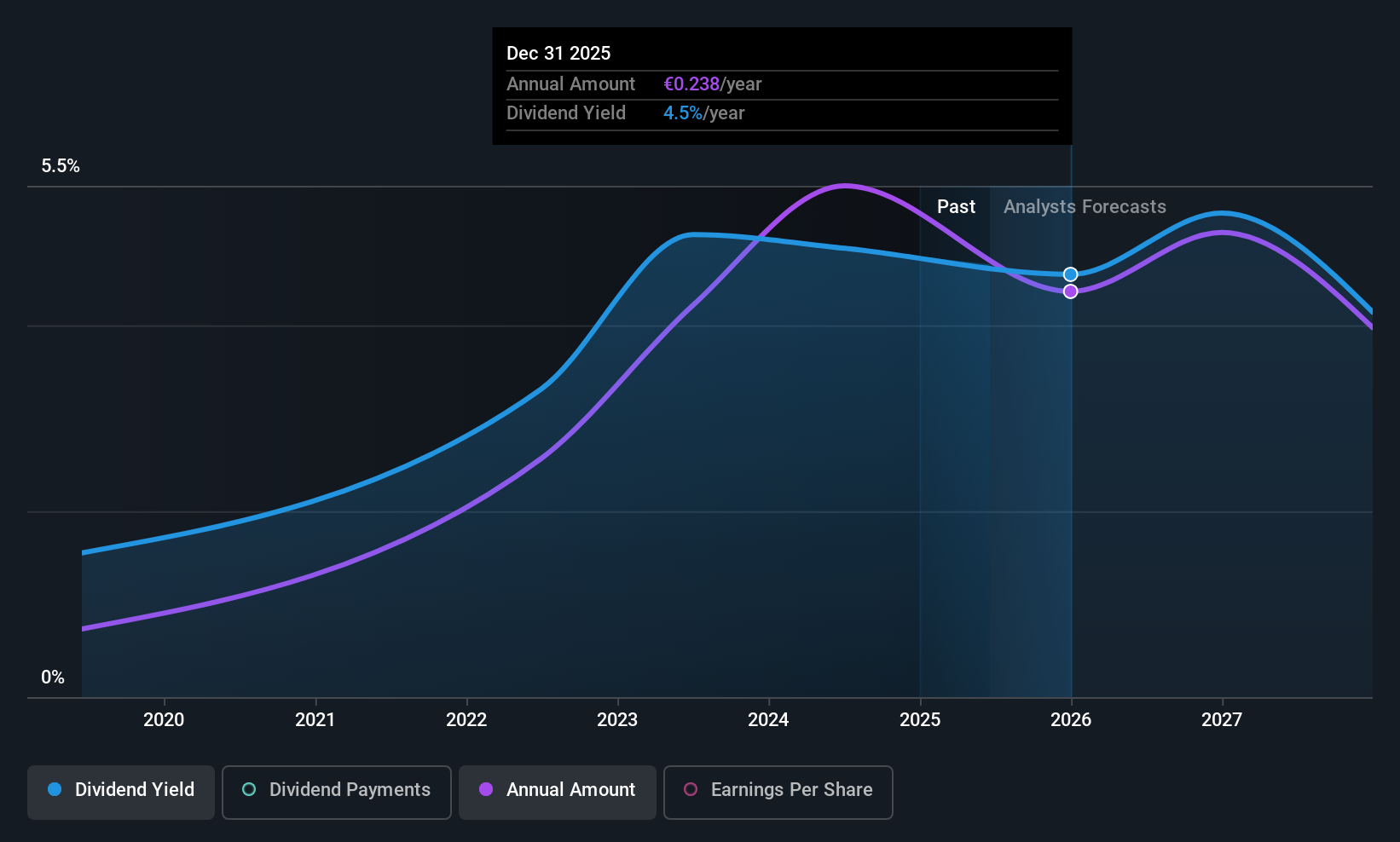

Dividend Yield: 5.8%

Etablissements Maurel & Prom's dividend payments are covered by cash flows, with a cash payout ratio of 76.1%, and earnings, with a payout ratio of 28.9%. However, the dividends have been unreliable over the past six years due to volatility. Despite this, MAU offers a competitive yield in France's market and trades below its estimated fair value. Recent business expansions in Colombia and Angola may impact future financial performance but do not directly address dividend stability concerns.

- Take a closer look at Etablissements Maurel & Prom's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Etablissements Maurel & Prom is priced lower than what may be justified by its financials.

BioGaia (OM:BIOG B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB is a healthcare company that develops, manufactures, markets, and sells probiotic products for gut, oral, and immune health across various global regions with a market cap of approximately SEK9.98 billion.

Operations: BioGaia AB's revenue is primarily derived from its Pediatrics segment, which accounts for SEK1.08 billion, followed by the Adult Health segment at SEK352.62 million.

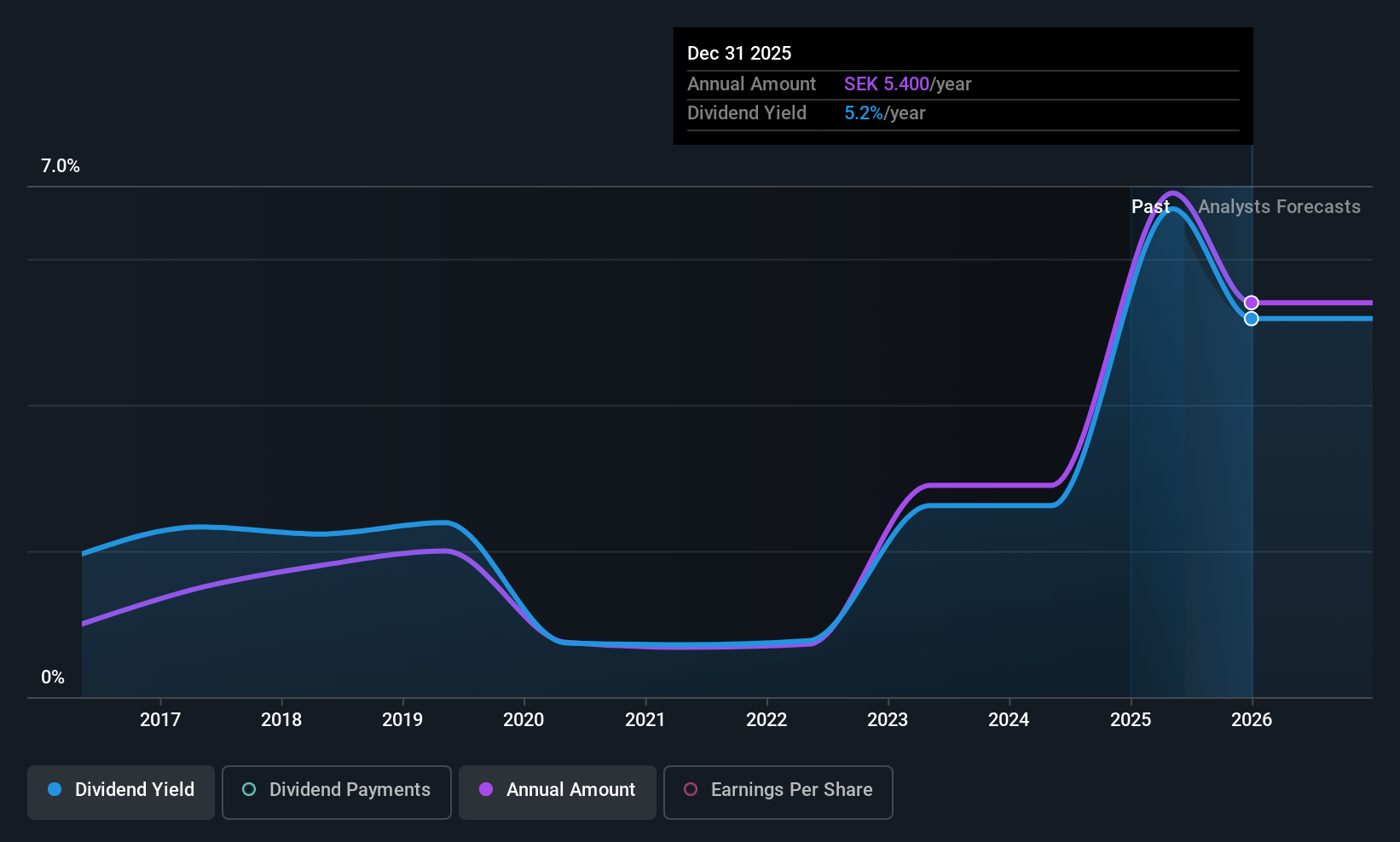

Dividend Yield: 7.0%

BioGaia's dividend yield is among the top 25% in Sweden, yet its high cash payout ratio of 225.1% indicates dividends aren't well covered by cash flows, suggesting sustainability issues. Despite a reasonable earnings payout ratio of 68.8%, dividends have been volatile over the past decade. The recent launch of BioGaia New Sciences expands into skin health but doesn't materially impact financials or address dividend reliability concerns amid declining profit margins and leadership changes.

- Click here and access our complete dividend analysis report to understand the dynamics of BioGaia.

- The analysis detailed in our BioGaia valuation report hints at an deflated share price compared to its estimated value.

Orlen (WSE:PKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orlen S.A. is a diversified company involved in refining, petrochemical, energy, retail, gas, and upstream operations with a market cap of PLN96.59 billion.

Operations: Orlen S.A.'s revenue is derived from its operations in refining, petrochemical, energy, retail, gas, and upstream sectors.

Dividend Yield: 7.2%

Orlen's dividend yield is among the top 25% in Poland, but its high payout ratio of 234.5% suggests dividends aren't well covered by earnings, raising sustainability concerns. Although cash flows cover the dividends with a reasonable cash payout ratio of 62%, past volatility and unreliability over the last decade persist. Recent earnings show improved net income despite lower sales, but profit margins have declined, adding complexity to Orlen's dividend outlook amid ongoing M&A discussions with GA Polyolefins.

- Navigate through the intricacies of Orlen with our comprehensive dividend report here.

- Our valuation report unveils the possibility Orlen's shares may be trading at a premium.

Where To Now?

- Unlock our comprehensive list of 216 Top European Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etablissements Maurel & Prom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MAU

Etablissements Maurel & Prom

Engages in exploration and production of oil and gas, and hydrocarbons in Gabon, Tanzania, Angola, and Venezuela.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives