- France

- /

- Oil and Gas

- /

- ENXTPA:ALHAF

Haffner Energy (EPA:ALHAF) one-year losses have grown faster than shareholder returns have fallen, but the stock jumps 10% this past week

Haffner Energy S.A. (EPA:ALHAF) shareholders should be happy to see the share price up 10% in the last week. But that doesn't change the fact that the returns over the last year have been stomach churning. Specifically, the stock price nose-dived 76% in that time. Arguably, the recent bounce is to be expected after such a bad drop. The bigger issue is whether the company can sustain the momentum in the long term.

On a more encouraging note the company has added €8.0m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

Check out our latest analysis for Haffner Energy

SWOT Analysis for Haffner Energy

- Debt is well covered by earnings.

- No major weaknesses identified for ALHAF.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Debt is not well covered by operating cash flow.

We don't think Haffner Energy's revenue of €1,098,000 is enough to establish significant demand. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that Haffner Energy finds fossil fuels with an exploration program, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Haffner Energy has already given some investors a taste of the bitter losses that high risk investing can cause.

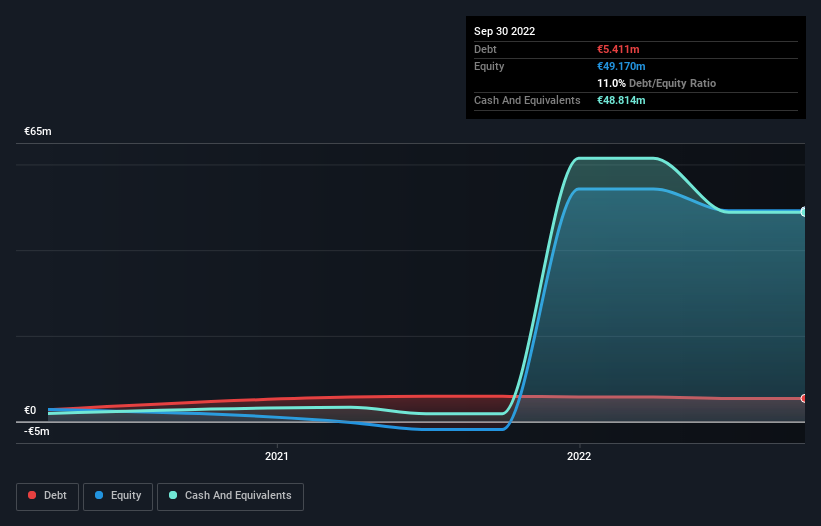

Haffner Energy has plenty of cash in the bank, with cash in excess of all liabilities sitting at €34m, when it last reported (September 2022). That allows management to focus on growing the business, and not worry too much about raising capital. But since the share price has dropped 76% in the last year , it seems like the market might have been over-excited previously. You can see in the image below, how Haffner Energy's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. You can click here to see if there are insiders selling.

A Different Perspective

While Haffner Energy shareholders are down 76% for the year, the market itself is up 15%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 11% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Haffner Energy is showing 4 warning signs in our investment analysis , you should know about...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Haffner Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALHAF

Haffner Energy

Designs and builds HYNOCA, a carbon-negative solution for producing renewable hydrogen in France.

Medium-low with mediocre balance sheet.

Market Insights

Community Narratives