- France

- /

- Oil and Gas

- /

- ENXTPA:ALEO2

It's Down 26% But Eo2 Société Anonyme (EPA:ALEO2) Could Be Riskier Than It Looks

Unfortunately for some shareholders, the Eo2 Société Anonyme (EPA:ALEO2) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 52% share price decline.

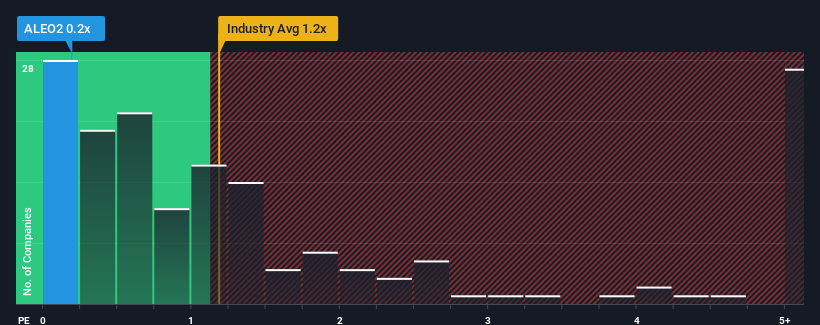

After such a large drop in price, Eo2 Société Anonyme's price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Oil and Gas industry in France, where around half of the companies have P/S ratios above 1.5x and even P/S above 8x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Eo2 Société Anonyme

What Does Eo2 Société Anonyme's Recent Performance Look Like?

For example, consider that Eo2 Société Anonyme's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Eo2 Société Anonyme's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Eo2 Société Anonyme's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 38% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to shrink 0.6% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this information, we find it very odd that Eo2 Société Anonyme is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Eo2 Société Anonyme's P/S

Eo2 Société Anonyme's recently weak share price has pulled its P/S back below other Oil and Gas companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at the figures, it's surprising to see Eo2 Société Anonyme currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors think future revenue could see a lot of volatility.

You need to take note of risks, for example - Eo2 Société Anonyme has 3 warning signs (and 2 which don't sit too well with us) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eo2 Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALEO2

Eo2 Société Anonyme

Designs, produces, and distributes wood heating products under the EO2 and PIKS brands in France.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)