- France

- /

- Diversified Financial

- /

- ENXTPA:WLN

Lacklustre Performance Is Driving Worldline SA's (EPA:WLN) 25% Price Drop

Unfortunately for some shareholders, the Worldline SA (EPA:WLN) share price has dived 25% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 78% loss during that time.

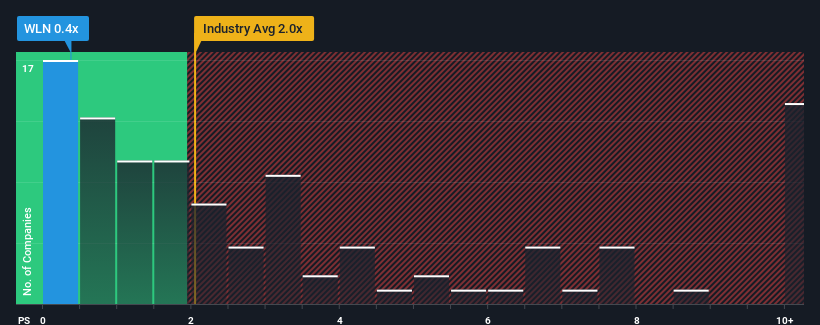

After such a large drop in price, Worldline's price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Diversified Financial industry in France, where around half of the companies have P/S ratios above 2.4x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Worldline

What Does Worldline's P/S Mean For Shareholders?

Worldline certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Worldline.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Worldline's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 52% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Turning to the outlook, the next three years should generate growth of 3.7% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 28% each year, which is noticeably more attractive.

With this information, we can see why Worldline is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Worldline's P/S Mean For Investors?

Worldline's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Worldline's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Worldline, and understanding should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Worldline might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:WLN

Worldline

Provides payments and transactional services for financial institutions, merchants, corporations, and government agencies in Northern Europe, Central and Eastern Europe, Southern Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026