- France

- /

- Capital Markets

- /

- ENXTPA:TKO

European Market Gems: Tikehau Capital And Two More Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

Amidst recent profit-taking and political challenges in Europe, the pan-European STOXX Europe 600 Index saw a decline of 1.10% after reaching record highs. As investors navigate these turbulent times marked by trade tensions and economic uncertainties, identifying stocks that are trading below their intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Siltronic (XTRA:WAF) | €55.90 | €111.17 | 49.7% |

| SBO (WBAG:SBO) | €26.85 | €53.66 | 50% |

| Nexam Chemical Holding (OM:NEXAM) | SEK3.78 | SEK7.49 | 49.5% |

| Micro Systemation (OM:MSAB B) | SEK62.00 | SEK122.87 | 49.5% |

| Lingotes Especiales (BME:LGT) | €5.75 | €11.32 | 49.2% |

| DigiTouch (BIT:DGT) | €1.92 | €3.79 | 49.3% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.34 | €6.65 | 49.8% |

| Allegro.eu (WSE:ALE) | PLN33.52 | PLN66.16 | 49.3% |

| Aker BioMarine (OB:AKBM) | NOK85.80 | NOK170.24 | 49.6% |

| Absolent Air Care Group (OM:ABSO) | SEK253.00 | SEK502.83 | 49.7% |

Let's uncover some gems from our specialized screener.

Tikehau Capital (ENXTPA:TKO)

Overview: Tikehau Capital is an alternative asset management group with €46.1 billion in assets under management and a market cap of approximately €3.27 billion.

Operations: The company's revenue is derived from €240.19 million in investment activities and €371.55 million in asset management activities.

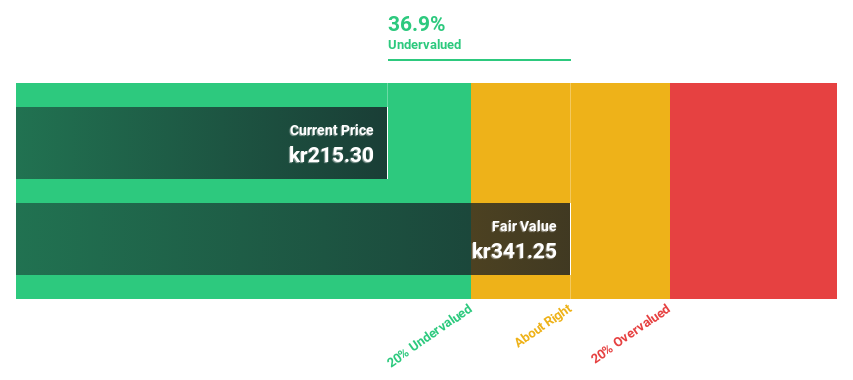

Estimated Discount To Fair Value: 17.3%

Tikehau Capital's current valuation presents a potential opportunity for investors focused on cash flows. Trading at €18.98, it's below the estimated fair value of €22.95, though not by a significant margin. The company's earnings are forecast to grow significantly at 29.9% annually, outpacing the French market average of 12.2%. However, its dividend yield of 4.22% is not well covered by free cash flows and debt coverage through operating cash flow remains a concern.

- Our earnings growth report unveils the potential for significant increases in Tikehau Capital's future results.

- Click here to discover the nuances of Tikehau Capital with our detailed financial health report.

Mowi (OB:MOWI)

Overview: Mowi ASA is a seafood company that produces and sells Atlantic salmon products globally, with a market capitalization of NOK115.42 billion.

Operations: The company's revenue segments include Feed (€1.12 billion), Farming (€3.59 billion), Sales & Marketing - Markets (€4.16 billion), and Sales and Marketing - Consumer Products (€3.73 billion).

Estimated Discount To Fair Value: 48.4%

Mowi's current valuation offers potential for investors focusing on cash flows, trading at NOK223.2, significantly below the estimated fair value of NOK432.88. Despite a lower net profit margin this year, its earnings are expected to grow substantially at 40.8% annually, surpassing the Norwegian market average of 13.4%. Recent results show increased sales and net income for Q2 2025, though high debt levels remain a concern amidst strong harvest volume growth projections for the coming years.

- Our comprehensive growth report raises the possibility that Mowi is poised for substantial financial growth.

- Navigate through the intricacies of Mowi with our comprehensive financial health report here.

Vossloh (XTRA:VOS)

Overview: Vossloh AG is a company that offers rail infrastructure products and services both in Germany and internationally, with a market cap of €1.70 billion.

Operations: The company generates revenue through various segments, including €151.80 million from Tie Technologies, €327.40 million from Core Components - Fastening Systems, €579.90 million from Customized Modules - Switch Systems, and €216.90 million from Lifecycle Solutions - Rail Services.

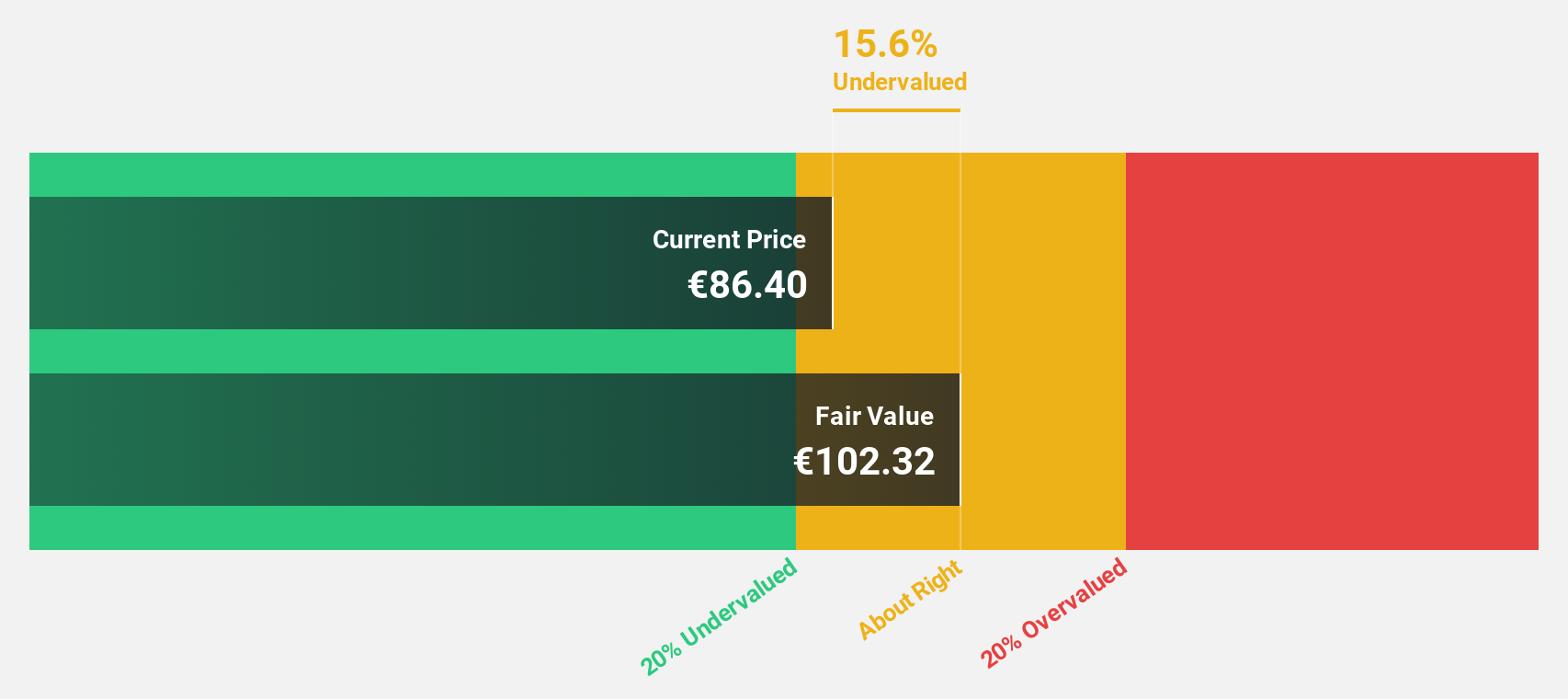

Estimated Discount To Fair Value: 12.8%

Vossloh's valuation presents an opportunity for cash flow-focused investors, trading at €88.1, slightly below its fair value of €101.07. With anticipated earnings growth of 23% annually, it outpaces the German market average of 16.6%. Despite a modest decrease in net income for Q2 2025 compared to the previous year, recent guidance revisions show increased sales projections due to strategic acquisitions and expansion efforts in key markets like China and Germany.

- According our earnings growth report, there's an indication that Vossloh might be ready to expand.

- Get an in-depth perspective on Vossloh's balance sheet by reading our health report here.

Seize The Opportunity

- Get an in-depth perspective on all 214 Undervalued European Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tikehau Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TKO

Tikehau Capital

An alternative asset management group with €46.1 billion of assets under management (as of 30 June 2024).

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives