- France

- /

- Diversified Financial

- /

- ENXTPA:PLX

3 Prominent Stocks Estimated To Be Trading At Discounts Of Up To 49.9% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, investors are increasingly focused on identifying opportunities amid fluctuating indices. Despite recent contractions in manufacturing indices and revised GDP forecasts, the S&P 500 and Nasdaq Composite have managed to post significant gains over the past two years, highlighting potential areas of value. In this context, a good stock is often characterized by its ability to withstand market volatility while being priced below its intrinsic value, offering a potential margin of safety for investors seeking long-term growth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1888.00 | ¥3757.10 | 49.7% |

| Decisive Dividend (TSXV:DE) | CA$5.98 | CA$11.88 | 49.7% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.725 | €5.45 | 50% |

| EnomotoLtd (TSE:6928) | ¥1450.00 | ¥2887.97 | 49.8% |

| Elekta (OM:EKTA B) | SEK61.45 | SEK122.25 | 49.7% |

| W5 Solutions (OM:W5) | SEK46.85 | SEK93.57 | 49.9% |

| Mr. Cooper Group (NasdaqCM:COOP) | US$93.54 | US$186.41 | 49.8% |

| Exosens (ENXTPA:EXENS) | €22.42 | €44.72 | 49.9% |

| Cicor Technologies (SWX:CICN) | CHF59.80 | CHF118.90 | 49.7% |

| Vogo (ENXTPA:ALVGO) | €2.93 | €5.85 | 49.9% |

We'll examine a selection from our screener results.

Exosens (ENXTPA:EXENS)

Overview: Exosens develops, manufactures, and sells electro-optical technologies focused on amplification, detection, and imaging across France and internationally, with a market cap of €1.14 billion.

Operations: Exosens generates revenue through its development, manufacturing, and sales activities in the electro-optical sector, specializing in amplification, detection, and imaging technologies across various regions including France, Europe, North America, Asia, Oceania, Africa, and other international markets.

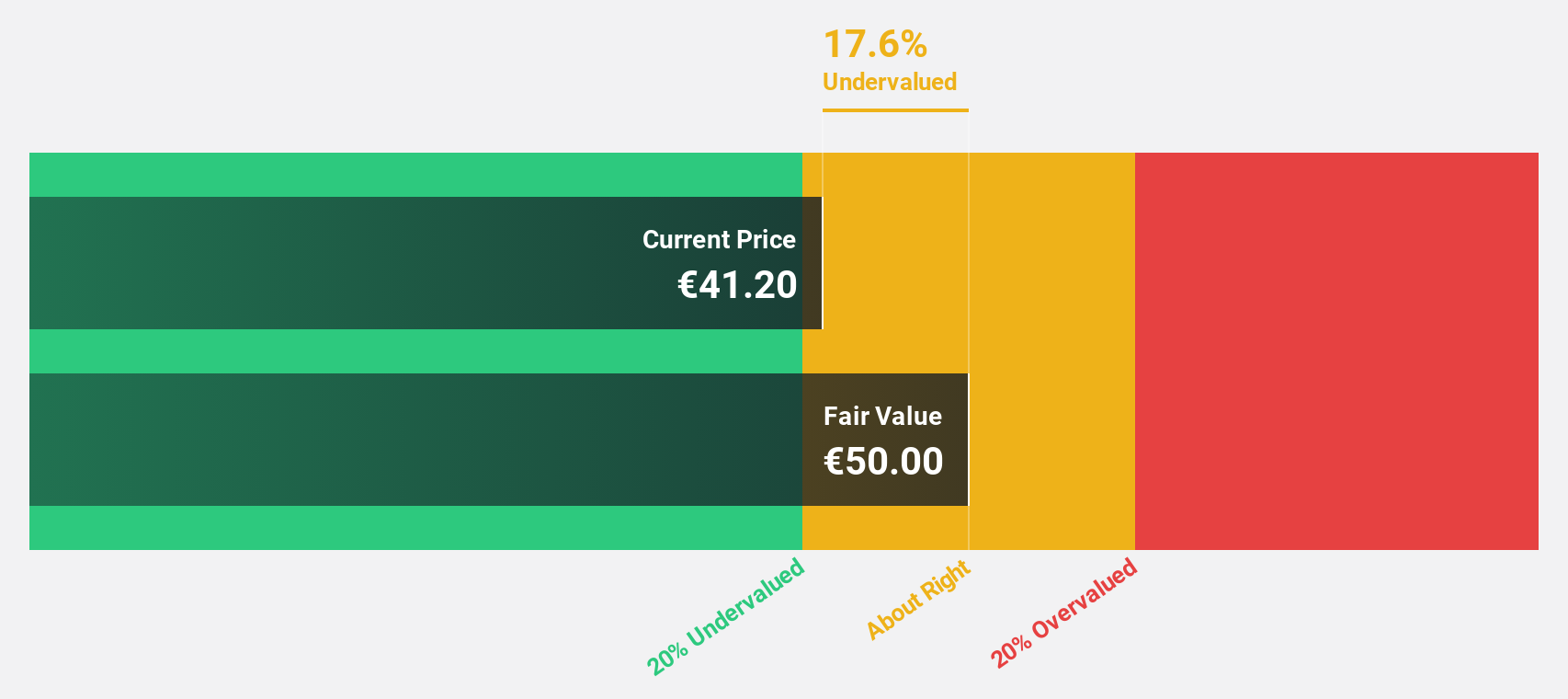

Estimated Discount To Fair Value: 49.9%

Exosens is trading at €22.42, significantly below its estimated fair value of €44.72, suggesting it may be undervalued based on discounted cash flow analysis. Despite a decline in profit margins, the company forecasts strong earnings growth of 33.9% annually, outpacing the French market's 12.2%. Recent revenue guidance indicates growth exceeding 34% for 2024 compared to the previous year, with high-teens growth expected in 2025.

- Upon reviewing our latest growth report, Exosens' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Exosens.

Pluxee (ENXTPA:PLX)

Overview: Pluxee N.V. provides employee benefits and engagement solutions services across France, Latin America, Continental Europe, and internationally with a market cap of €3.18 billion.

Operations: The company's revenue segments are comprised of €460 million from Latin America, €216 million from the Rest of The World, and €534 million from Continental Europe.

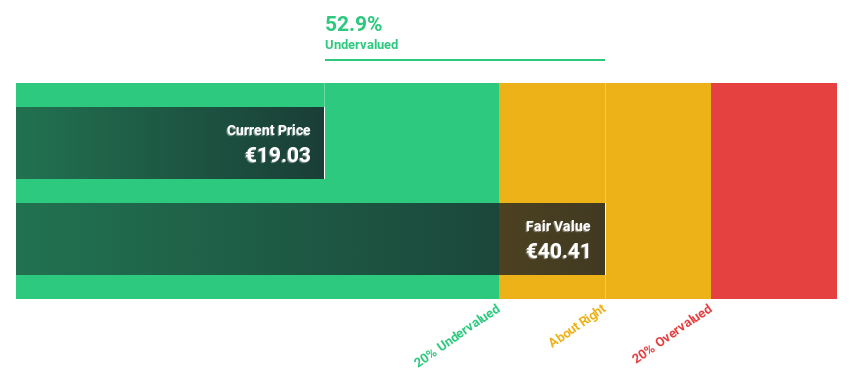

Estimated Discount To Fair Value: 48.4%

Pluxee is trading at €21.77, significantly below its estimated fair value of €42.17, indicating it may be undervalued based on cash flow analysis. Recent earnings grew by 64.2% year-on-year, and future earnings are projected to rise by 19.96% annually, surpassing the French market's growth rate of 12.2%. Despite a highly volatile share price recently, Pluxee confirmed low double-digit organic revenue growth for fiscal years 2025 and 2026 in its latest guidance.

- The analysis detailed in our Pluxee growth report hints at robust future financial performance.

- Get an in-depth perspective on Pluxee's balance sheet by reading our health report here.

Qt Group Oyj (HLSE:QTCOM)

Overview: Qt Group Oyj provides cross-platform solutions for the software development lifecycle across multiple countries, with a market cap of €1.84 billion.

Operations: Revenue Segments (in millions of €): Software Development Tools: 199.85

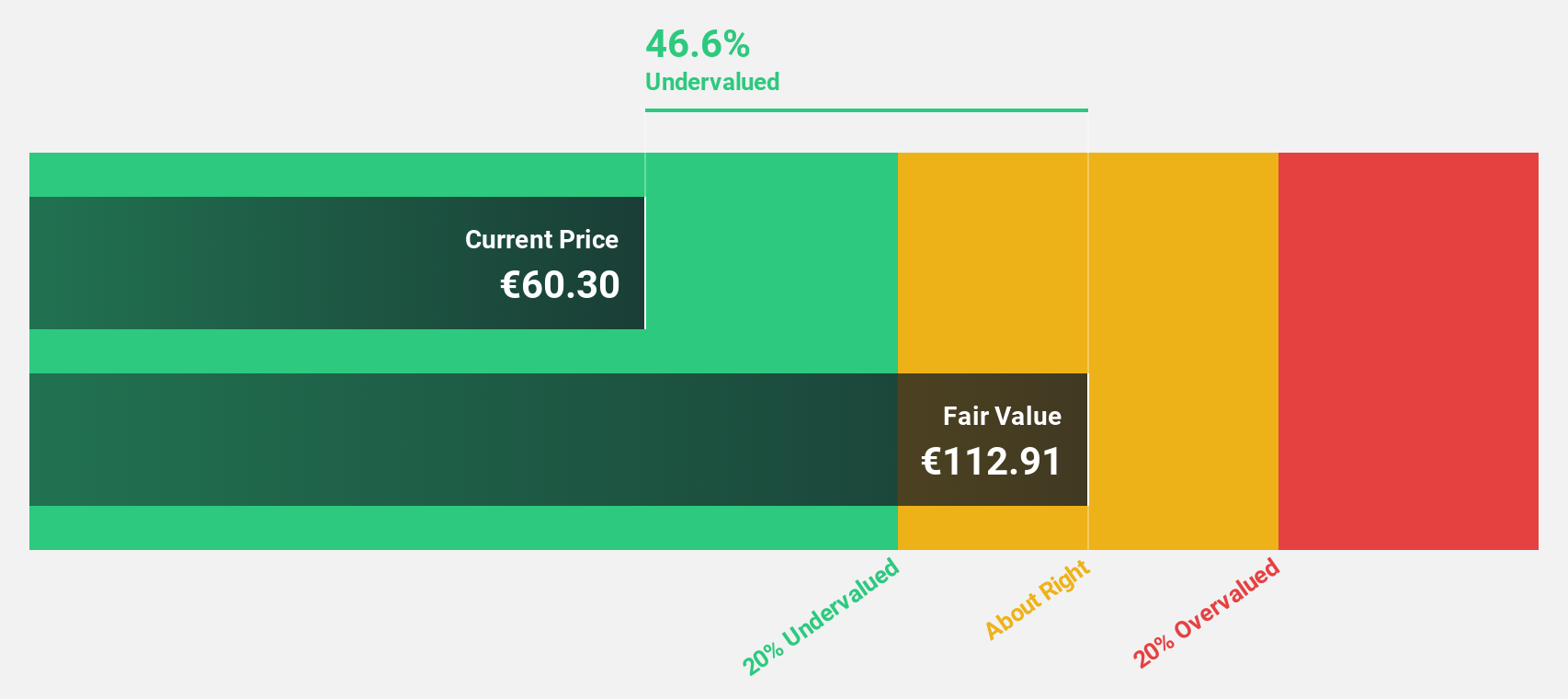

Estimated Discount To Fair Value: 42.5%

Qt Group Oyj, trading at €72.45, is currently valued below its fair value estimate of €126.09, suggesting potential undervaluation based on cash flow analysis. Despite recent volatility and lowered guidance due to deal postponements, earnings grew by 49% last year and are expected to rise significantly over the next three years, outpacing the Finnish market's growth rates. Revenue projections also indicate faster growth than the local market average.

- In light of our recent growth report, it seems possible that Qt Group Oyj's financial performance will exceed current levels.

- Take a closer look at Qt Group Oyj's balance sheet health here in our report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 881 Undervalued Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Pluxee, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:PLX

Pluxee

Offers employee benefits and engagement solutions services in France, Latin America, Continental Europe, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives