3 European Stocks Estimated To Be Up To 47.2% Below Intrinsic Value

Reviewed by Simply Wall St

The European stock market has experienced a modest rise, buoyed by optimism surrounding potential trade agreements between the EU and the U.S., despite underlying economic uncertainties. In this environment, identifying undervalued stocks can present unique opportunities for investors seeking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Westwing Group (XTRA:WEW) | €9.20 | €18.21 | 49.5% |

| STMicroelectronics (ENXTPA:STMPA) | €22.245 | €43.94 | 49.4% |

| RVRC Holding (OM:RVRC) | SEK46.12 | SEK91.42 | 49.5% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €55.55 | €109.69 | 49.4% |

| KebNi (OM:KEBNI B) | SEK2.75 | SEK5.43 | 49.4% |

| Echo Investment (WSE:ECH) | PLN5.36 | PLN10.70 | 49.9% |

| ATON Green Storage (BIT:ATON) | €2.13 | €4.22 | 49.5% |

| Atea (OB:ATEA) | NOK142.40 | NOK282.80 | 49.6% |

| adidas (XTRA:ADS) | €198.95 | €393.88 | 49.5% |

| Absolent Air Care Group (OM:ABSO) | SEK242.00 | SEK482.63 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

Lectra (ENXTPA:LSS)

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, furniture markets, and other industries globally, with a market cap of €986.24 million.

Operations: The company's revenue segments are distributed as follows: €176.26 million from the Americas, €134.84 million from the Asia-Pacific region, and €220.46 million from EMEA (Europe, Middle East, and Africa).

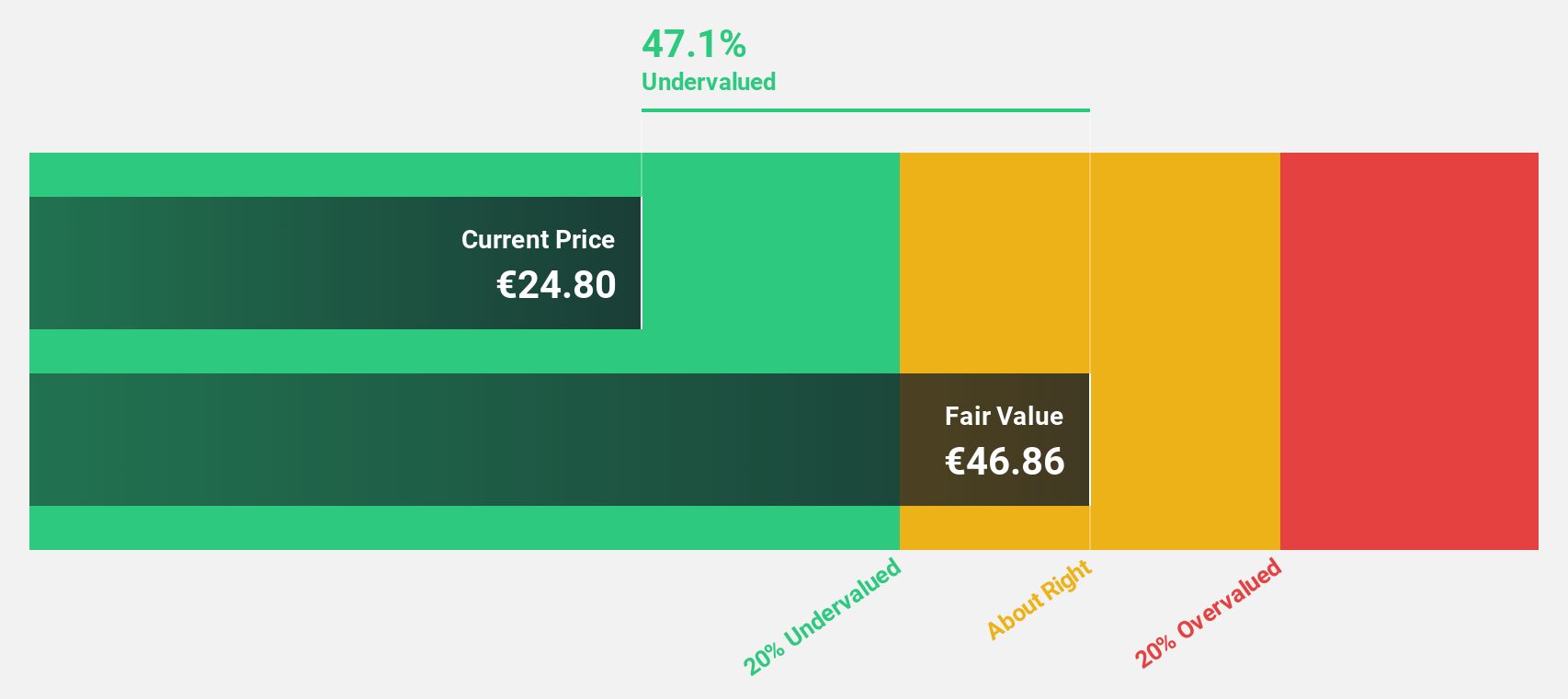

Estimated Discount To Fair Value: 47.2%

Lectra is trading at €25.95, significantly below its fair value estimate of €49.12, suggesting it is highly undervalued based on cash flows. The company's earnings are expected to grow 21.81% annually, outpacing the French market average of 12.7%. Recent strategic initiatives include the expansion of Lectra's Valia platforms into new markets and partnerships with companies like Edgecombe Furniture, enhancing operational efficiency and supporting future growth prospects through innovative solutions in manufacturing automation.

- Our growth report here indicates Lectra may be poised for an improving outlook.

- Navigate through the intricacies of Lectra with our comprehensive financial health report here.

Pluxee (ENXTPA:PLX)

Overview: Pluxee N.V. provides employee benefits and engagement solutions services across France, Latin America, Continental Europe, and internationally with a market cap of €2.72 billion.

Operations: The company's revenue segments are comprised of €0.47 billion from Latin America, €0.24 billion from the Rest of the World, and €0.55 billion from Continental Europe.

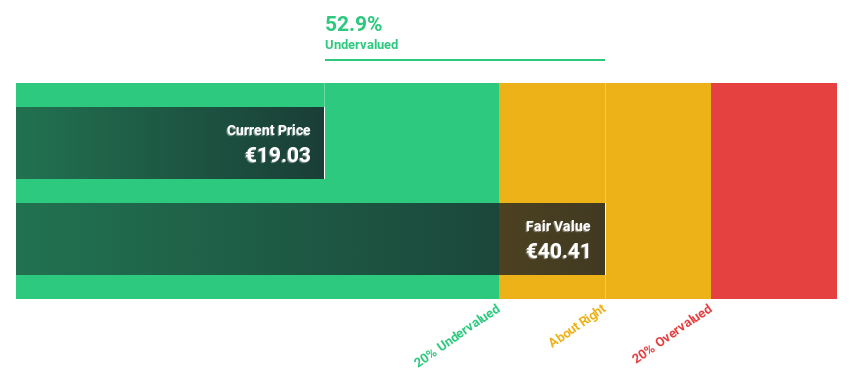

Estimated Discount To Fair Value: 45.4%

Pluxee, trading at €18.69, is significantly undervalued with a fair value estimate of €34.21. Earnings grew by 182.1% last year and are projected to increase by 16.06% annually, surpassing the French market's growth rate of 12.7%. The company confirmed low double-digit revenue growth for fiscal years 2025 and 2026, supported by its resilient business model and strong performance in early fiscal 2025, indicating robust cash flow potential despite modest revenue growth forecasts of 7%.

- The analysis detailed in our Pluxee growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Pluxee.

Vimian Group (OM:VIMIAN)

Overview: Vimian Group AB (publ) operates in the global animal health industry with a market capitalization of SEK19.52 billion.

Operations: The company's revenue segments consist of Medtech (€142.10 million), Diagnostics (€22.50 million), Specialty Pharma (€178.20 million), and Veterinary Services (€61.60 million).

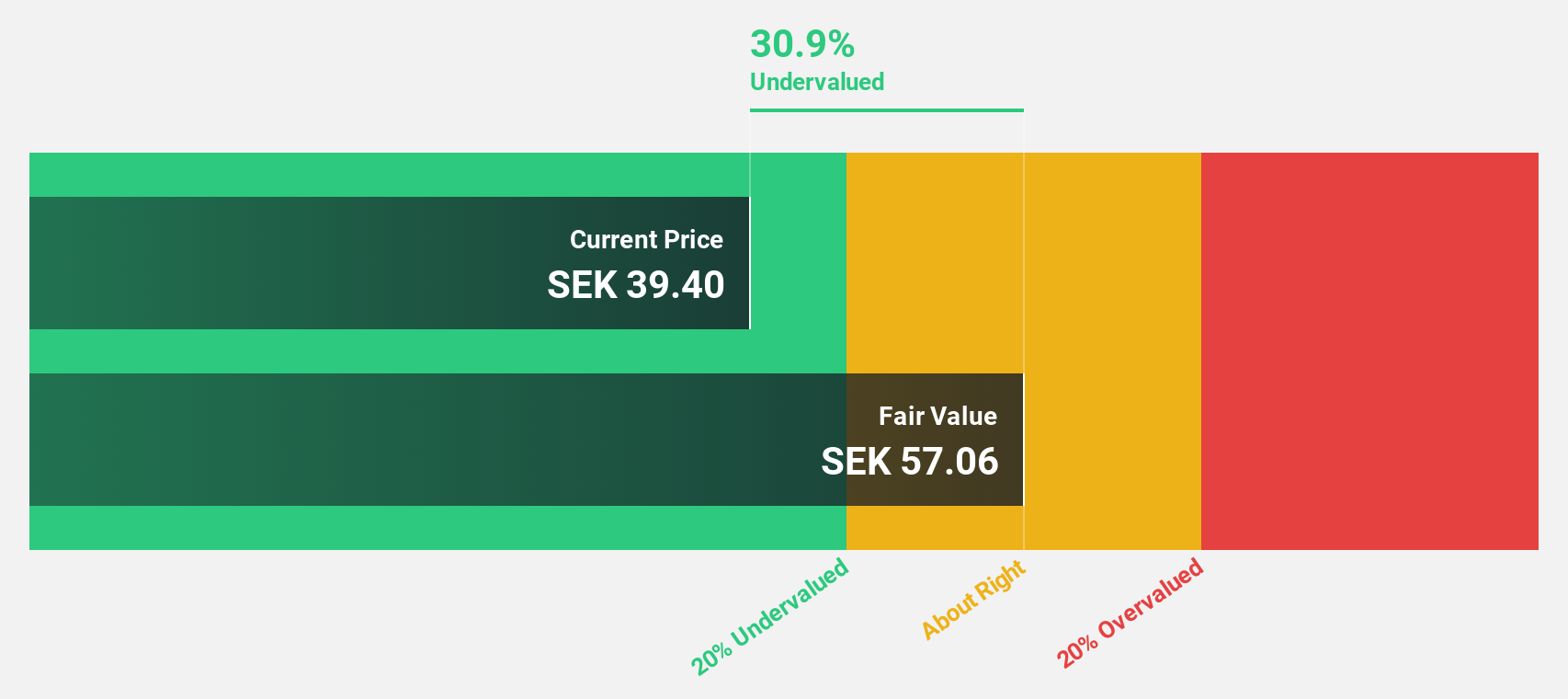

Estimated Discount To Fair Value: 13.5%

Vimian Group, trading at SEK36.7, is slightly undervalued with a fair value estimate of SEK42.45. The company's earnings grew by 132.6% last year and are expected to grow significantly over the next three years, outpacing the Swedish market's growth rate of 16.9%. Recent earnings reports show strong sales growth from EUR 91 million to EUR 104.3 million in Q2 2025, reflecting robust cash flow potential despite recent executive changes and low forecasted return on equity.

- Our expertly prepared growth report on Vimian Group implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Vimian Group stock in this financial health report.

Turning Ideas Into Actions

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 197 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LSS

Lectra

Provides industrial intelligence solutions for fashion, automotive, furniture markets, and other industries in Europe, the Americas, the Asia Pacific, and internationally.

Good value with reasonable growth potential.

Market Insights

Community Narratives