- France

- /

- Capital Markets

- /

- ENXTPA:ENX

Is Euronext Fairly Priced After Recent Market Rally in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your Euronext shares? You are not alone. Whether you are weighing a new investment or simply tracking your returns, it is hard to ignore how this stock has made waves on the market. Euronext is up just over 19% year-to-date and has soared more than 31% during the past 12 months. Zoom out even further, and the three-year performance of 123% puts it solidly ahead of many market peers. The last month did bring a softer patch with a 5.7% pullback. Such moves often reflect shifting investor sentiment, as recent positive momentum is influenced by ongoing market reforms across Europe that support regional exchanges like Euronext. The short-term dip could hint at investors pausing to reassess future risks or opportunities.

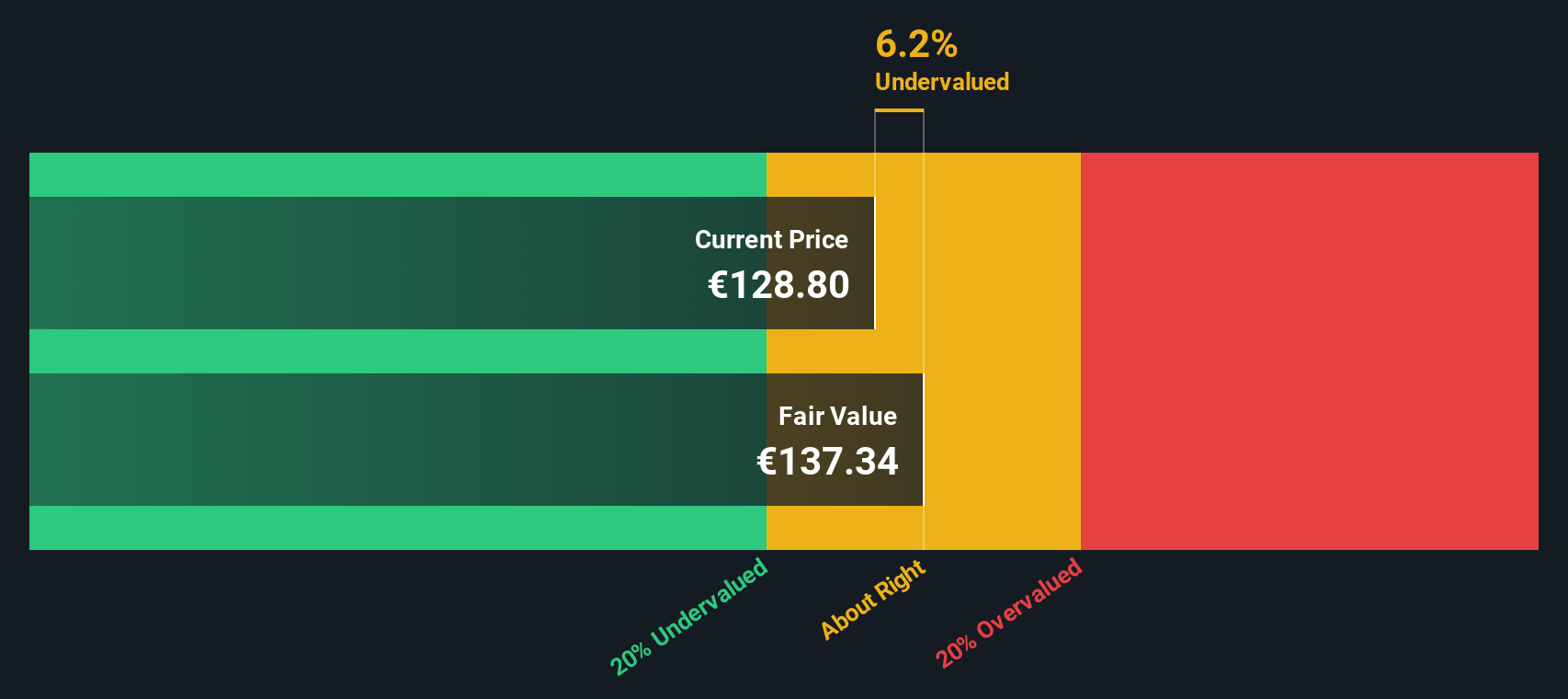

Does this mean Euronext is undervalued and offers hidden upside, or are we seeing fair value becoming clearer after a robust surge? To answer that, let us look at Euronext’s valuation score: it checks 2 out of 6 boxes that signal undervaluation. This sets the stage for a deeper dive into different valuation models, each with its own strengths and blind spots. There is an even sharper approach to assessing value that goes beyond the usual checks, which we will get to at the end of the article.

Euronext scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Euronext Excess Returns Analysis

The Excess Returns valuation model estimates a company’s intrinsic value by measuring how much it earns over and above its cost of equity on invested capital. This approach focuses on the returns generated from shareholders’ funds and the prospects for maintaining those returns over time, which is particularly relevant for financial firms like Euronext.

For Euronext, the key inputs are:

- Book Value: €40.90 per share

- Stable Earnings per Share (EPS): €7.87, derived from 12 analysts’ forward-looking Return on Equity assessments

- Cost of Equity: €3.42 per share

- Excess Return: €4.45 per share

- Average Return on Equity: 16.14%

- Stable Book Value projection: €48.78 per share (from 7 analyst estimates)

According to the model, the estimated intrinsic value for Euronext is €135.81 per share. With the excess returns discount suggesting the stock is 5.2% undervalued compared to its current price, the analysis indicates Euronext is fairly valued at this level. There is a slight upside, but not enough to call it a bargain or a risk.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Euronext's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

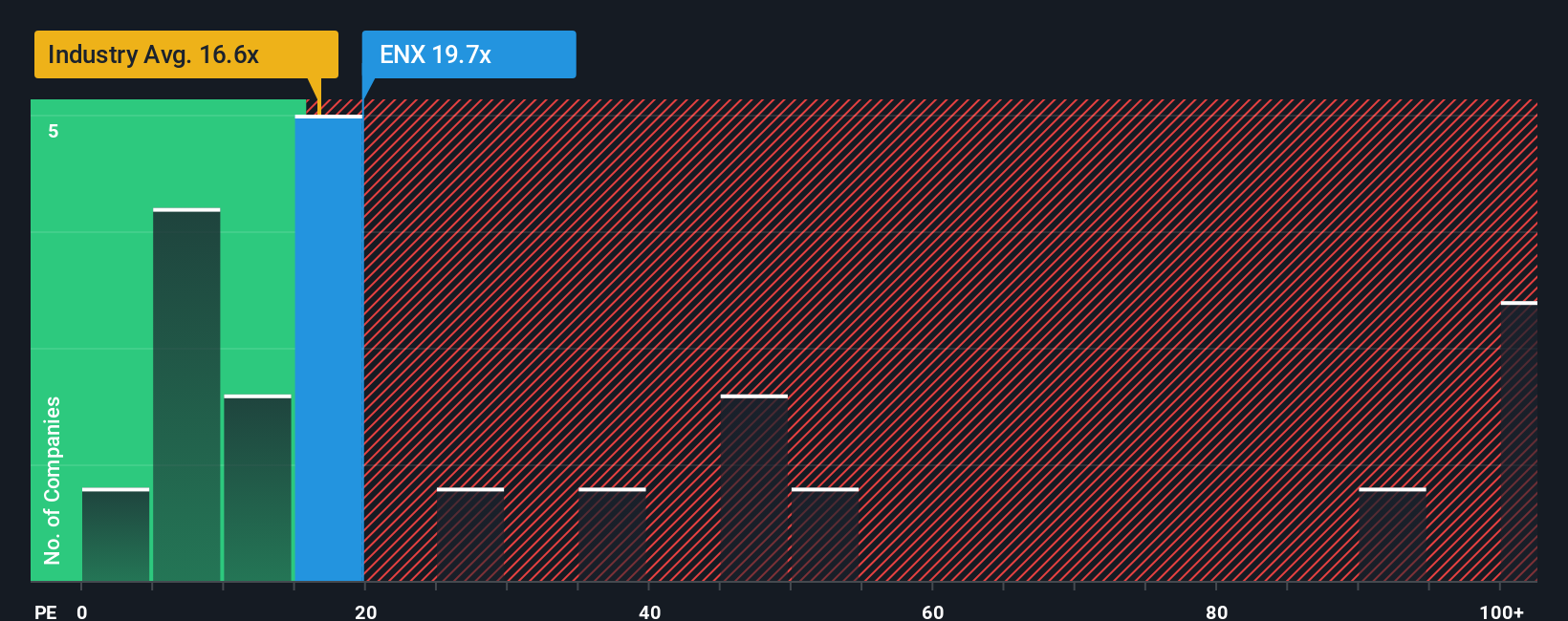

Approach 2: Euronext Price vs Earnings

The Price-to-Earnings (PE) ratio is widely regarded as one of the best metrics for valuing profitable companies, since it directly ties the market price to the earnings a business generates. For companies like Euronext that are consistently profitable, the PE ratio offers a straightforward way to compare market expectations and profitability across similar businesses.

What counts as a “normal” or “fair” PE depends on several factors, most notably growth prospects and risk. Companies with higher expected earnings growth typically trade at higher PE multiples, while riskier or slower-growing firms command lower multiples.

Euronext is currently trading at a PE ratio of 19.7x. For context, the average PE for its Capital Markets industry peers is 19.4x. Among its closest competitors, the peer average sits at 12.9x. These benchmarks suggest Euronext is valued at a premium both to its direct peers and to the broader industry average. This may reflect expectations of stronger, more stable growth.

To get a more nuanced perspective, Simply Wall St has developed its own “Fair Ratio.” This metric estimates what the PE multiple should be after considering the company’s earnings growth, profit margins, risk factors, market capitalisation and industry context. It does not rely solely on superficial comparisons to competitors. This proprietary approach can highlight mismatches between perception and reality by controlling for strengths, weaknesses and unique circumstances.

For Euronext, the Fair Ratio stands at 21.4x versus the current PE of 19.7x. Since the difference between these ratios is within 0.10, it suggests the market is accurately reflecting Euronext's underlying value based on current fundamentals and future prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

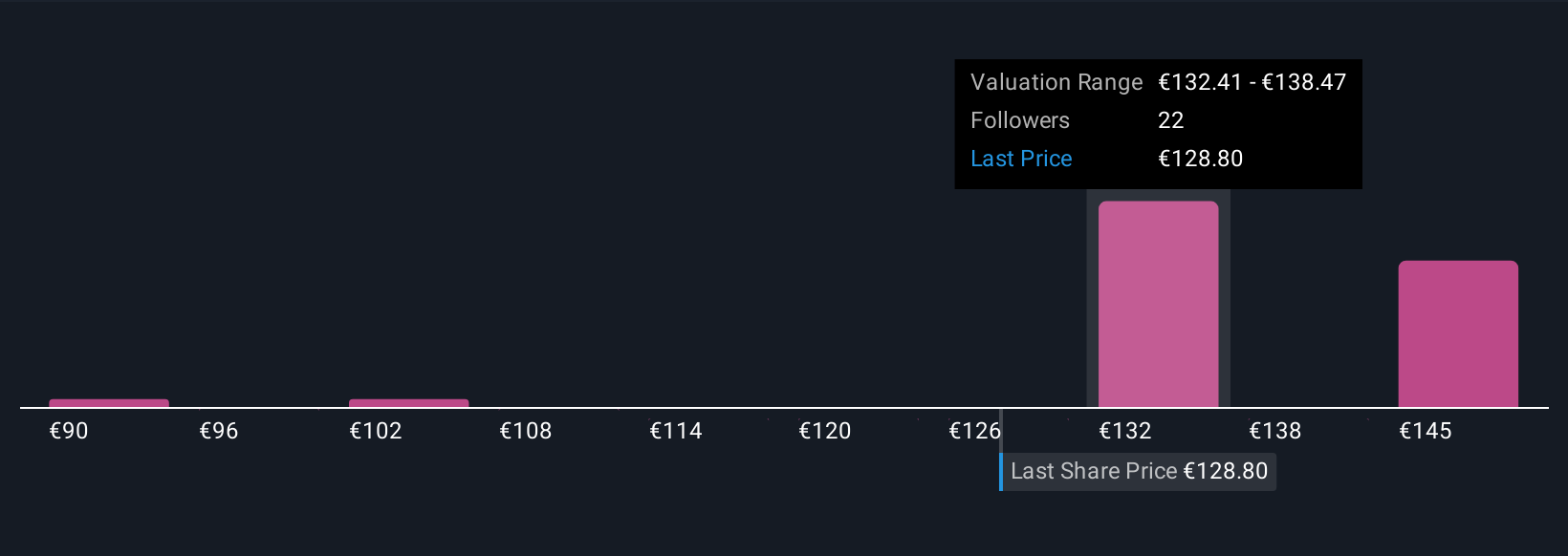

Upgrade Your Decision Making: Choose your Euronext Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple yet powerful framework that lets you create a story around a company, reflecting your view of how Euronext will perform, anchored by your assumptions for future revenue, earnings, and margins. Narratives link this story to a financial forecast and then connect your outlook to a fair value for the stock.

Best of all, Narratives are intuitive and accessible to everyone on Simply Wall St's platform within the Community page, already used by millions of investors. They help you decide when to buy or sell by comparing the Fair Value derived from your Narrative to the current market Price, making your investment decision data-driven but grounded in your own perspective.

Narratives are dynamic and automatically update when new information, such as earnings or market news, comes in. This ensures your story and fair value stay relevant. For example, one investor might be most optimistic but see a fair value of €174.0 per share, while another is more cautious, setting theirs at €114.0, all based on differing views of Euronext’s growth and risks.

Do you think there's more to the story for Euronext? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Euronext might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ENX

Euronext

Operates securities and derivatives exchanges in the Netherlands, France, Italy, Belgium, Portugal, Ireland, the United States, Norway, Denmark, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives