- France

- /

- Hospitality

- /

- ENXTPA:PARP

It Might Not Be A Great Idea To Buy Groupe Partouche SA (EPA:PARP) For Its Next Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Groupe Partouche SA (EPA:PARP) is about to go ex-dividend in just 3 days. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Meaning, you will need to purchase Groupe Partouche's shares before the 26th of June to receive the dividend, which will be paid on the 30th of June.

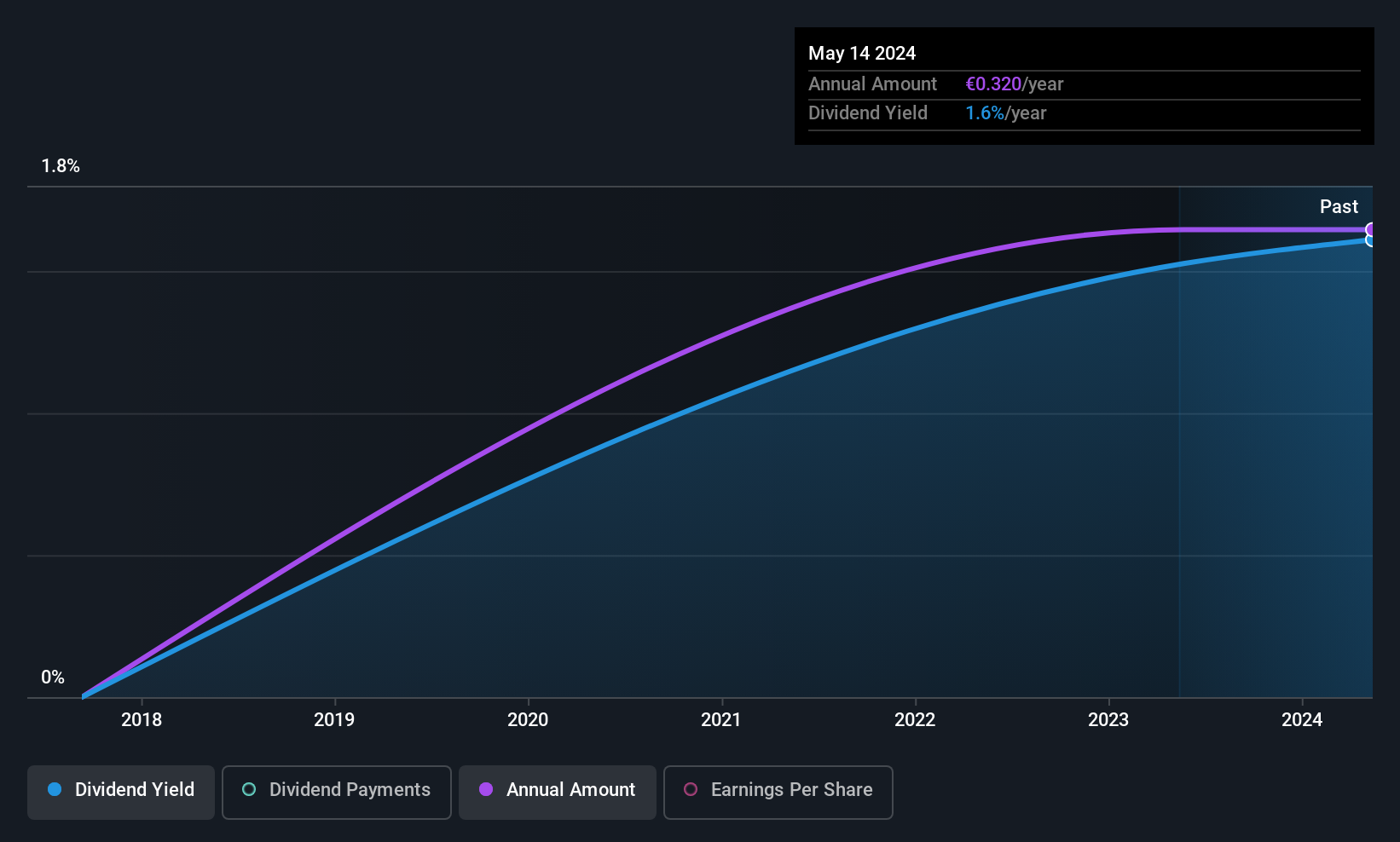

The company's next dividend payment will be €0.32 per share, and in the last 12 months, the company paid a total of €0.32 per share. Looking at the last 12 months of distributions, Groupe Partouche has a trailing yield of approximately 1.7% on its current stock price of €19.10. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! As a result, readers should always check whether Groupe Partouche has been able to grow its dividends, or if the dividend might be cut.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Last year, Groupe Partouche paid out 281% of its profit to shareholders in the form of dividends. This is not sustainable behaviour and requires a closer look on behalf of the purchaser. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Groupe Partouche paid a dividend despite reporting negative free cash flow over the last twelve months. This may be due to heavy investment in the business, but this is still suboptimal from a dividend sustainability perspective.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Groupe Partouche fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

See our latest analysis for Groupe Partouche

Click here to see how much of its profit Groupe Partouche paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Groupe Partouche's earnings have collapsed faster than Wile E Coyote's schemes to trap the Road Runner; down a tremendous 43% a year over the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. It looks like the Groupe Partouche dividends are largely the same as they were two years ago. If a company's dividend stays flat while earnings are in decline, this is typically a sign that it is paying out a larger percentage of its earnings. This can become unsustainable if earnings fall far enough.

Final Takeaway

Is Groupe Partouche an attractive dividend stock, or better left on the shelf? Not only are earnings per share declining, but Groupe Partouche is paying out an uncomfortably high percentage of both its earnings and cashflow to shareholders as dividends. Unless there are grounds to believe a turnaround is imminent, this is one of the least attractive dividend stocks under this analysis. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

Although, if you're still interested in Groupe Partouche and want to know more, you'll find it very useful to know what risks this stock faces. Every company has risks, and we've spotted 2 warning signs for Groupe Partouche you should know about.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:PARP

Groupe Partouche

Through its subsidiaries, operates casinos, hotels, restaurants, dancehalls, leisure facilities, and bars in France, other European countries, and internationally.

Acceptable track record with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)