- France

- /

- Consumer Services

- /

- ENXTPA:ALLPL

Some Confidence Is Lacking In Lepermislibre Société anonyme (EPA:ALLPL) As Shares Slide 25%

Unfortunately for some shareholders, the Lepermislibre Société anonyme (EPA:ALLPL) share price has dived 25% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 69% share price decline.

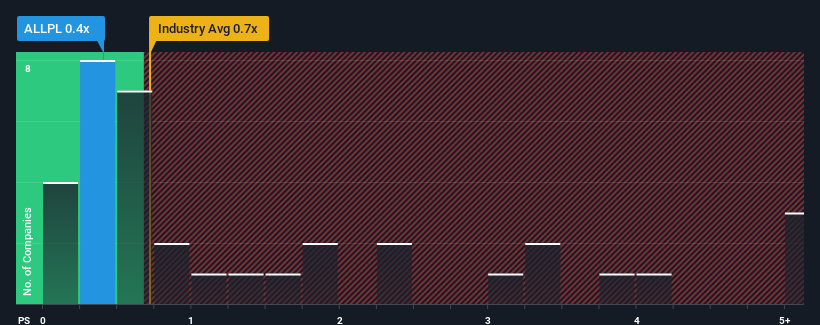

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Lepermislibre Société anonyme's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Consumer Services industry in France is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Lepermislibre Société anonyme

How Has Lepermislibre Société anonyme Performed Recently?

Recent times have been pleasing for Lepermislibre Société anonyme as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Lepermislibre Société anonyme.Is There Some Revenue Growth Forecasted For Lepermislibre Société anonyme?

The only time you'd be comfortable seeing a P/S like Lepermislibre Société anonyme's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 291% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 1.2% each year as estimated by the lone analyst watching the company. That's shaping up to be materially lower than the 7.8% each year growth forecast for the broader industry.

In light of this, it's curious that Lepermislibre Société anonyme's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Lepermislibre Société anonyme's P/S Mean For Investors?

Lepermislibre Société anonyme's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that Lepermislibre Société anonyme's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Lepermislibre Société anonyme (of which 1 makes us a bit uncomfortable!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALLPL

Lepermislibre Société anonyme

Operates online driving school primarily in France.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives