- France

- /

- Consumer Services

- /

- ENXTPA:ALLPL

Lepermislibre Société anonyme's (EPA:ALLPL) Shares Not Telling The Full Story

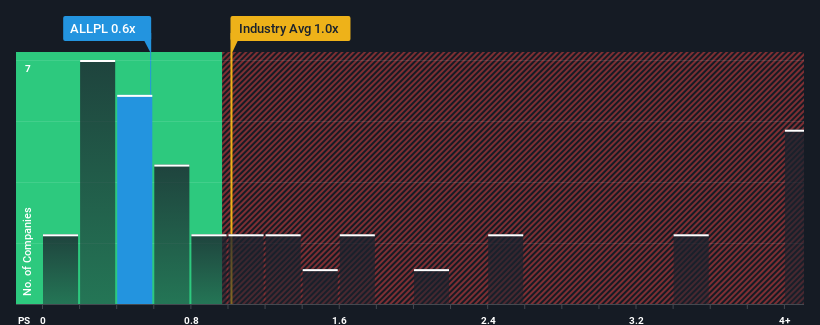

There wouldn't be many who think Lepermislibre Société anonyme's (EPA:ALLPL) price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S for the Consumer Services industry in France is similar at about 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Lepermislibre Société anonyme

How Has Lepermislibre Société anonyme Performed Recently?

Recent times have been advantageous for Lepermislibre Société anonyme as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Lepermislibre Société anonyme.How Is Lepermislibre Société anonyme's Revenue Growth Trending?

In order to justify its P/S ratio, Lepermislibre Société anonyme would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. This was backed up an excellent period prior to see revenue up by 291% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 13% per annum as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 3.8% each year, which is noticeably less attractive.

With this information, we find it interesting that Lepermislibre Société anonyme is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Lepermislibre Société anonyme currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Lepermislibre Société anonyme that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALLPL

Lepermislibre Société anonyme

Operates online driving school primarily in France.

Moderate and slightly overvalued.

Market Insights

Community Narratives