- Ireland

- /

- Healthcare Services

- /

- ISE:UPR

Cairo Communication Among 3 European Penny Stocks To Watch

Reviewed by Simply Wall St

European markets have recently faced challenges, with the pan-European STOXX Europe 600 Index snapping a five-week streak of gains amid new tariff threats from the U.S. and economic growth concerns. For investors exploring beyond well-known stocks, penny stocks—often involving smaller or newer companies—continue to capture interest due to their potential for growth at accessible price points. Despite being an older term, penny stocks remain relevant as they can offer unique opportunities when backed by strong financials and fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.28 | SEK2.18B | ✅ 4 ⚠️ 1 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.24 | SEK215.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.69 | SEK276.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.44 | SEK209.29M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN4.05 | PLN137.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.74 | €57.79M | ✅ 3 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.95 | €31.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.75 | €17.76M | ✅ 2 ⚠️ 3 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.145 | €296.15M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 452 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Cairo Communication (BIT:CAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cairo Communication S.p.A. operates as a communication company in Italy and Spain, with a market cap of €452.31 million.

Operations: Cairo Communication S.p.A. has not reported any specific revenue segments, focusing its operations in the communication sector across Italy and Spain.

Market Cap: €452.31M

Cairo Communication S.p.A. demonstrates a mixed profile within the penny stock landscape. The company has shown consistent earnings growth, with a 14.5% increase over the past year, surpassing industry averages despite a low return on equity of 7.5%. It operates debt-free and recently completed a significant share buyback, enhancing shareholder value by repurchasing 10.61% of its shares for €41.35 million. However, short-term liabilities significantly exceed assets by €68.9 million, and recent earnings reports indicate persistent net losses despite stable revenues around €235 million in Q1 2025 compared to the previous year.

- Click here and access our complete financial health analysis report to understand the dynamics of Cairo Communication.

- Gain insights into Cairo Communication's outlook and expected performance with our report on the company's earnings estimates.

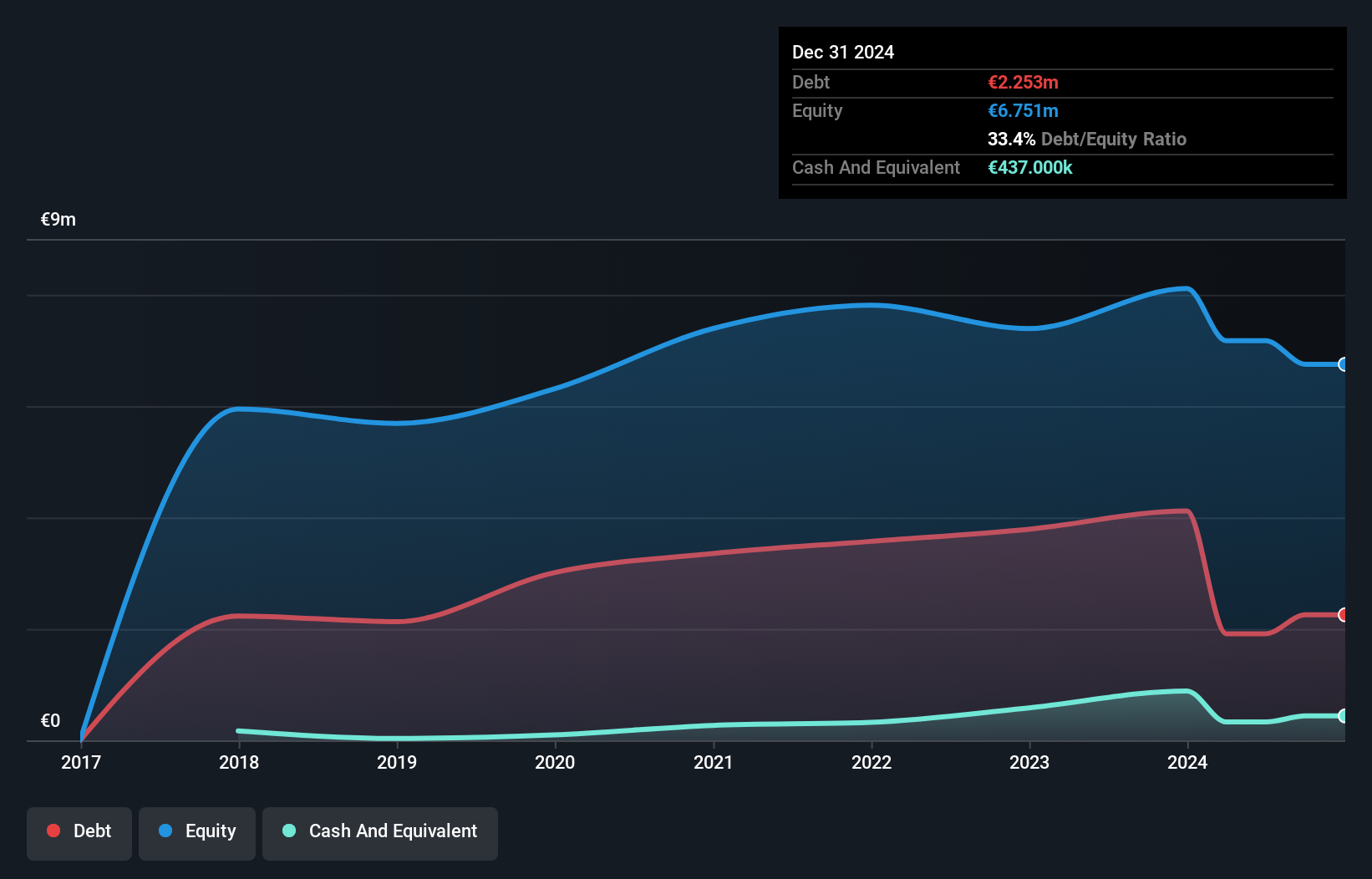

One Experience Société anonyme (ENXTPA:ALEXP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: One Experience Société anonyme operates in the hospitality and real estate sectors by owning and managing event and tourist sites, hotels, as well as co-working and co-living spaces, with a market cap of €9.44 million.

Operations: The company generates revenue of €4.24 million from its business services segment.

Market Cap: €9.44M

One Experience Société anonyme presents a challenging profile among European penny stocks. Despite generating €4.24 million in revenue, the company remains unprofitable with increasing net losses of €1.33 million for 2024, up from €0.706 million the previous year. Its short-term assets (€3.1M) fall short of covering its liabilities (€7.3M), yet it maintains a satisfactory net debt to equity ratio of 26.9%. The board's average tenure is experienced at 3.4 years, and while the company has reduced its debt over five years, its share price remains highly volatile with weekly volatility rising to 41%.

- Unlock comprehensive insights into our analysis of One Experience Société anonyme stock in this financial health report.

- Assess One Experience Société anonyme's previous results with our detailed historical performance reports.

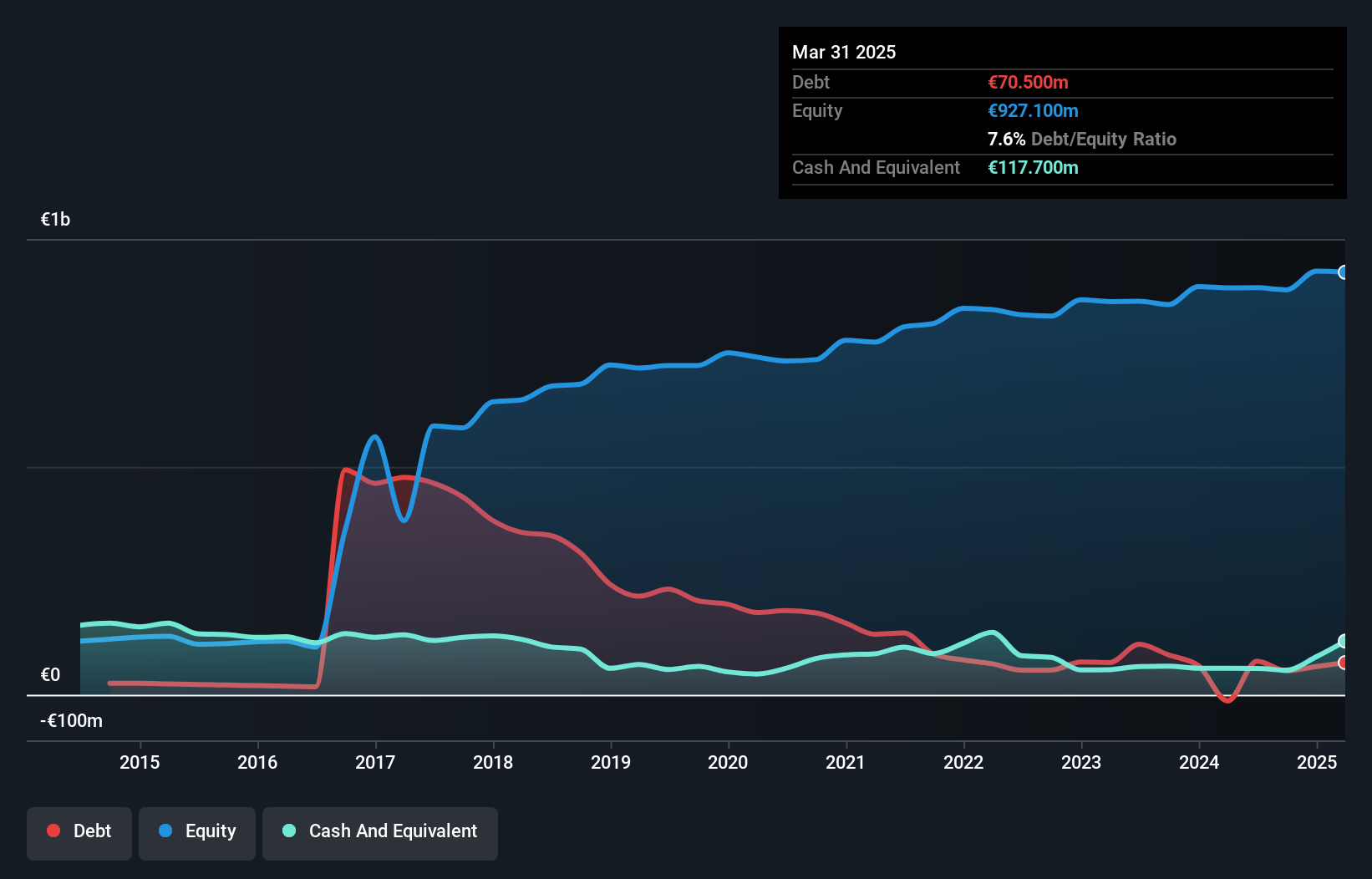

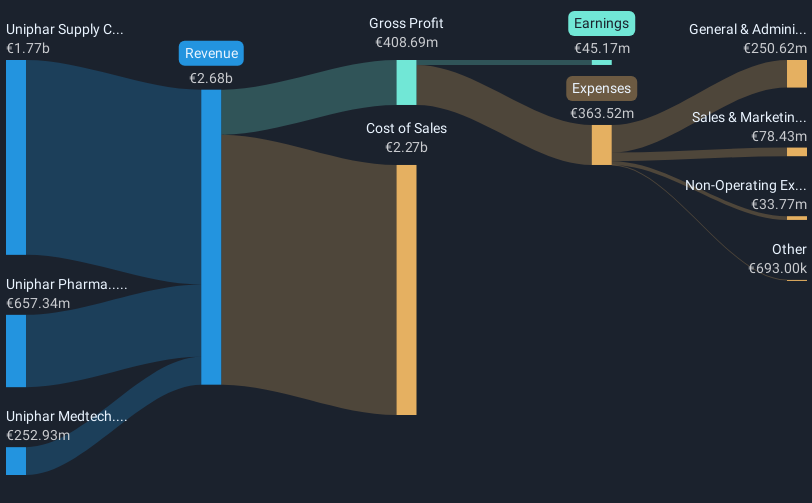

Uniphar (ISE:UPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Uniphar plc is a diversified healthcare services company operating in the Republic of Ireland, the United Kingdom, the Netherlands, and internationally, with a market cap of €896.83 million.

Operations: The company generates revenue through three main segments: Pharma (€658.81 million), Medtech (€267.97 million), and Supply Chain & Retail (€1.84 billion).

Market Cap: €896.83M

Uniphar plc demonstrates a solid position with its diversified revenue streams across Pharma, Medtech, and Supply Chain & Retail segments. The company has shown robust earnings growth of 43.3% over the past year, outpacing the industry average significantly. Despite this growth, Uniphar's Return on Equity is considered low at 16%. Its financial health is supported by well-covered interest payments and satisfactory net debt to equity ratio of 36.8%, although short-term liabilities exceed short-term assets by €76.9 million. Recent actions include a share buyback program worth up to €35 million aimed at reducing share capital, reflecting confidence in future performance.

- Take a closer look at Uniphar's potential here in our financial health report.

- Evaluate Uniphar's prospects by accessing our earnings growth report.

Summing It All Up

- Explore the 452 names from our European Penny Stocks screener here.

- Ready For A Different Approach? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ISE:UPR

Uniphar

Operates as a diversified healthcare services company in the Republic of Ireland, the United Kingdom, the Netherlands, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives