- France

- /

- Consumer Durables

- /

- ENXTPA:SK

Why SEB (ENXTPA:SK) Is Down 19.0% After Lowering Its 2025 Guidance Amid Soft Demand

Reviewed by Sasha Jovanovic

- In the past week, Groupe SEB revised its full-year 2025 guidance, expecting stable to slightly positive organic sales growth and lowering its operating result forecast to €550 million–€600 million due to increased competition and softer demand in Europe and the US.

- This guidance update represents a meaningful shift as it reflects heightened pressures in key geographic markets, prompting a more cautious stance for year-end performance.

- We'll examine how SEB's reduced outlook, especially the lower operating result forecast, impacts its previously optimistic investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

SEB Investment Narrative Recap

At the core, investors in Groupe SEB must believe in the company’s ability to leverage its global brand portfolio and continued innovation to maintain steady growth despite economic headwinds. The recent downward revision in annual guidance, due to rising competition and lackluster demand in Europe and the US, could weigh on what was previously seen as a potential short-term earnings recovery; this now emerges as the key catalyst and the biggest risk for the business in the near term.

The third-quarter 2025 sales outlook, indicating a slight organic decline and results below expectations, is especially relevant here. It not only supports the revised full-year guidance but also underscores the market pressures currently facing SEB, reinforcing the need for caution as Q3 results approach and signaling to investors the importance of tracking near-term performance shifts.

However, against expectations of innovation-led growth, investors should pay close attention to ongoing margin pressures arising from...

Read the full narrative on SEB (it's free!)

SEB's narrative projects €9.3 billion revenue and €529.7 million earnings by 2028. This requires 4.1% yearly revenue growth and a €397 million earnings increase from the current €132.7 million.

Uncover how SEB's forecasts yield a €101.60 fair value, a 96% upside to its current price.

Exploring Other Perspectives

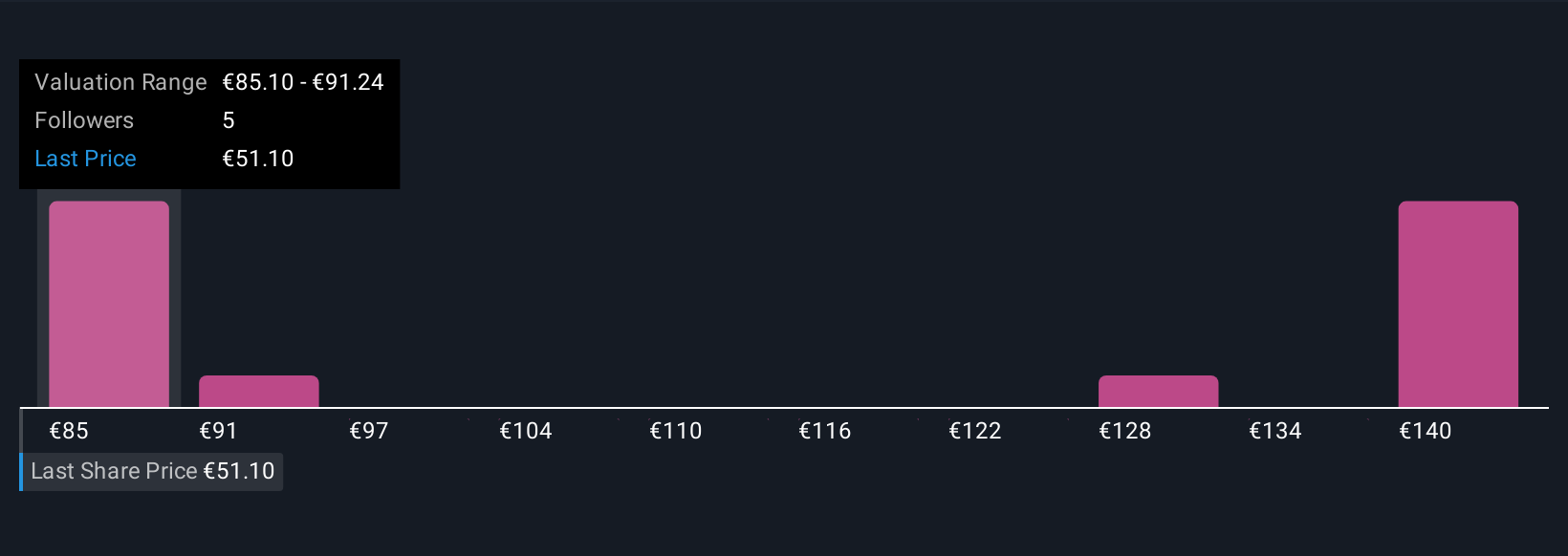

Four members of the Simply Wall St Community see fair value for SEB shares ranging from €95 to €153.37. Market participants weigh this diversity against rising competition and lower forecasts, which could reshape the outlook for sustainable growth, explore several perspectives before making your call.

Explore 4 other fair value estimates on SEB - why the stock might be worth over 2x more than the current price!

Build Your Own SEB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SEB research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free SEB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SEB's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SK

SEB

Designs, manufactures, and markets small domestic equipment in Western Europe, rest of Europe, the Middle East, Africa, North and South America, China, and rest of Asia.

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)