- France

- /

- Consumer Durables

- /

- ENXTPA:NACON

Improved Earnings Required Before Nacon S.A. (EPA:NACON) Stock's 25% Jump Looks Justified

Those holding Nacon S.A. (EPA:NACON) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 64% share price drop in the last twelve months.

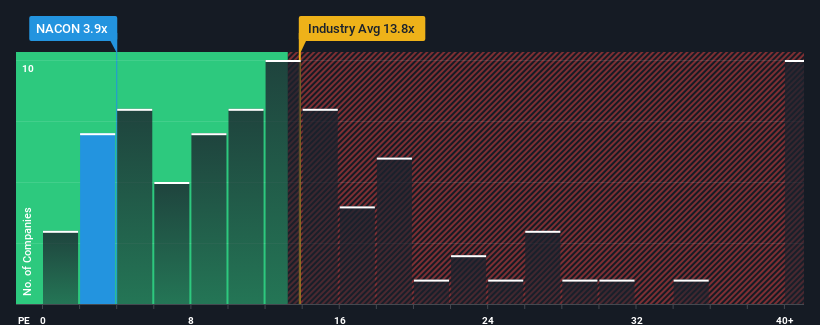

In spite of the firm bounce in price, Nacon's price-to-earnings (or "P/E") ratio of 3.9x might still make it look like a strong buy right now compared to the market in France, where around half of the companies have P/E ratios above 14x and even P/E's above 25x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times have been pleasing for Nacon as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Nacon

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Nacon would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 108%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 4.5% per year as estimated by the four analysts watching the company. That's not great when the rest of the market is expected to grow by 14% per year.

In light of this, it's understandable that Nacon's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Nacon's P/E

Shares in Nacon are going to need a lot more upward momentum to get the company's P/E out of its slump. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Nacon's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Nacon you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nacon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:NACON

Nacon

Designs and distributes games and gaming accessories in France and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)