- France

- /

- Construction

- /

- ENXTPA:DG

European Dividend Stocks To Watch Now

Reviewed by Simply Wall St

As European markets experience a pullback from record highs amid political turmoil in France and ongoing international trade tensions, investors are paying close attention to dividend stocks for their potential stability and income generation. In such uncertain times, a good dividend stock is often characterized by its consistent payout history and the financial strength to maintain dividends even when broader market conditions are challenging.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.61% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.79% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.67% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.07% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.27% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.62% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.05% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.69% | ★★★★★☆ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.91% | ★★★★★☆ |

Click here to see the full list of 226 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

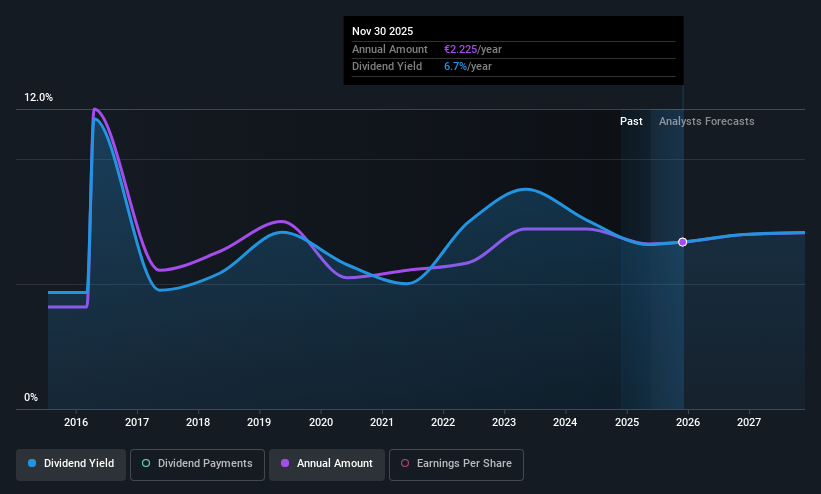

Viscofan (BME:VIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Viscofan, S.A., along with its subsidiaries, is involved in the manufacturing, production, and distribution of casings and has a market capitalization of €2.71 billion.

Operations: Viscofan, S.A.'s revenue from its wrapping segment amounts to €1.23 billion.

Dividend Yield: 5.3%

Viscofan's dividend yield of 5.31% ranks among the top 25% in Spain, though its high cash payout ratio of 107.9% raises concerns about sustainability from free cash flows. Despite this, dividends have been stable and reliable over the past decade, supported by a reasonable earnings payout ratio of 49.1%. Recent earnings growth and a trading price below fair value suggest potential for appreciation, yet dividend coverage remains a critical consideration for investors.

- Dive into the specifics of Viscofan here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Viscofan is trading behind its estimated value.

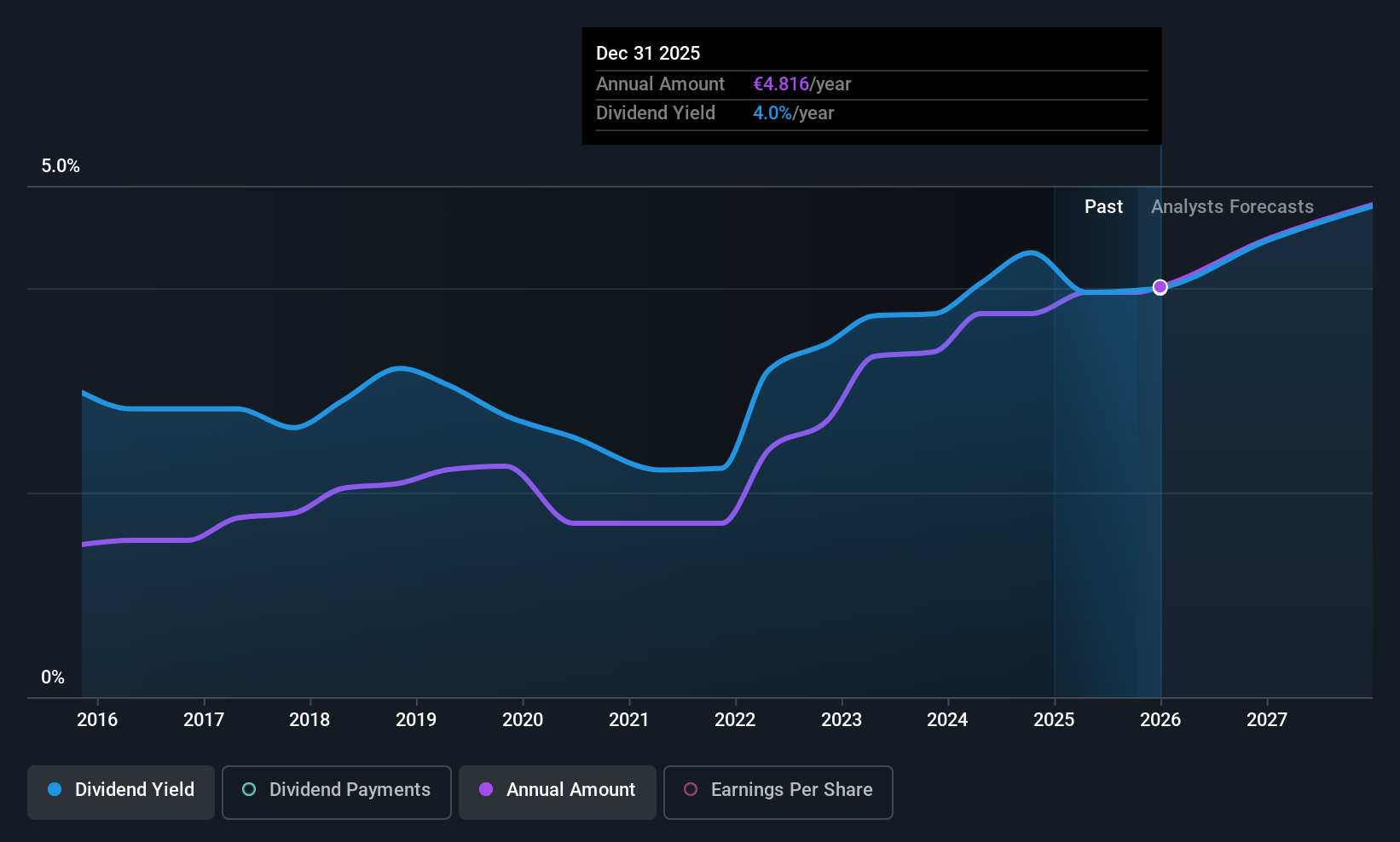

Vinci (ENXTPA:DG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vinci SA operates in concessions, energy, and construction sectors both in France and internationally, with a market cap of €64.06 billion.

Operations: Vinci SA generates revenue from several segments, including Cobra IS (€7.40 billion), VINCI Energies (€20.87 billion), Concessions such as VINCI Airports (€5.00 billion) and VINCI Autoroutes (€7.21 billion), and VINCI Construction, which includes Eurovia (€31.67 billion).

Dividend Yield: 4%

Vinci's dividend yield of 4.01% is below the top 25% in France, but its payout ratio of 56.4% indicates dividends are well-covered by earnings. Despite a volatile dividend history, recent growth and a low cash payout ratio of 34.3% suggest sustainability from cash flows. Vinci's price-to-earnings ratio (13.4x) is attractive compared to the French market average, though high debt levels warrant caution for long-term stability amidst ongoing infrastructure projects like the €1.2 billion biofuel plant in Spain.

- Click here and access our complete dividend analysis report to understand the dynamics of Vinci.

- The analysis detailed in our Vinci valuation report hints at an deflated share price compared to its estimated value.

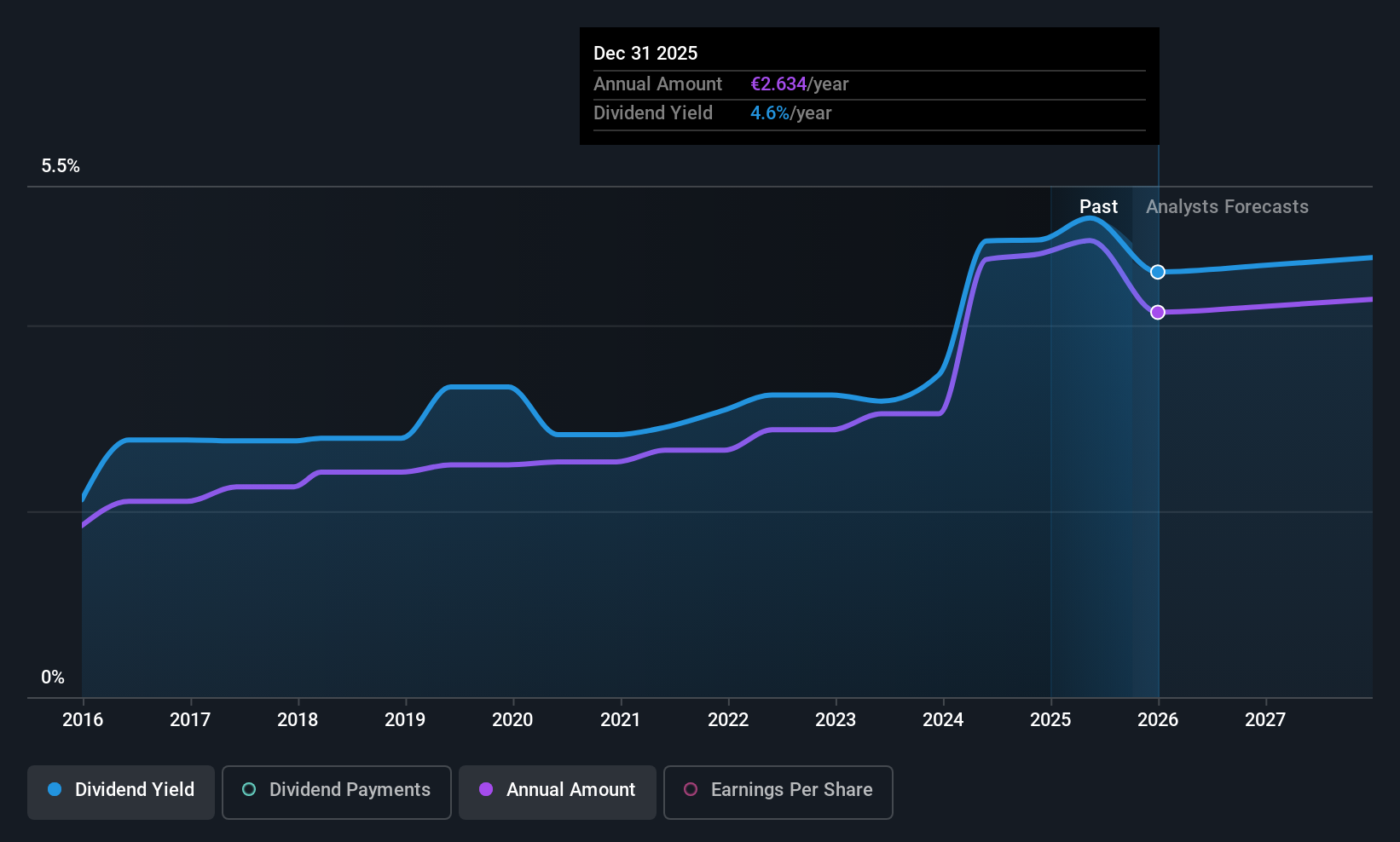

Kaufman & Broad (ENXTPA:KOF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kaufman & Broad S.A. is a French property developer and builder with a market capitalization of €563.84 million.

Operations: Kaufman & Broad S.A. generates its revenue primarily from property development and construction activities in France.

Dividend Yield: 7.7%

Kaufman & Broad offers a high dividend yield of 7.65%, placing it among the top 25% in France, but its payout ratio of 91.2% raises concerns about coverage from earnings. Despite this, cash flow coverage is strong with a low cash payout ratio of 17.9%. The company's dividends have been volatile over the past decade, though they have increased overall. Recent earnings guidance suggests stable revenue growth and operating income margins between 7.5% and 8%.

- Unlock comprehensive insights into our analysis of Kaufman & Broad stock in this dividend report.

- Our valuation report here indicates Kaufman & Broad may be undervalued.

Turning Ideas Into Actions

- Take a closer look at our Top European Dividend Stocks list of 226 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DG

Vinci

Engages in concessions, energy, and construction businesses in France and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives