Chausseria (EPA:CHSR) Looks Inexpensive After Falling 29% But Perhaps Not Attractive Enough

Chausseria (EPA:CHSR) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Longer-term, the stock has been solid despite a difficult 30 days, gaining 22% in the last year.

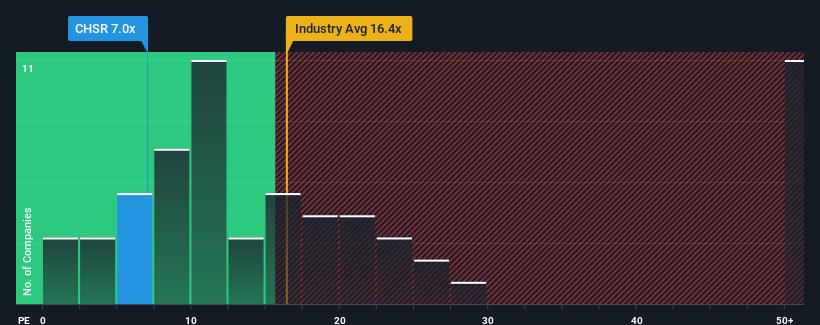

In spite of the heavy fall in price, Chausseria's price-to-earnings (or "P/E") ratio of 7x might still make it look like a strong buy right now compared to the market in France, where around half of the companies have P/E ratios above 16x and even P/E's above 27x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Chausseria has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Chausseria

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Chausseria would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 147% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 17% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Chausseria is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Bottom Line On Chausseria's P/E

Shares in Chausseria have plummeted and its P/E is now low enough to touch the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Chausseria maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Chausseria (at least 3 which make us uncomfortable), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CHSR

Flawless balance sheet slight.

Market Insights

Community Narratives