- France

- /

- Professional Services

- /

- ENXTPA:TEP

A Piece Of The Puzzle Missing From Teleperformance SE's (EPA:TEP) 25% Share Price Climb

Those holding Teleperformance SE (EPA:TEP) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 31% in the last twelve months.

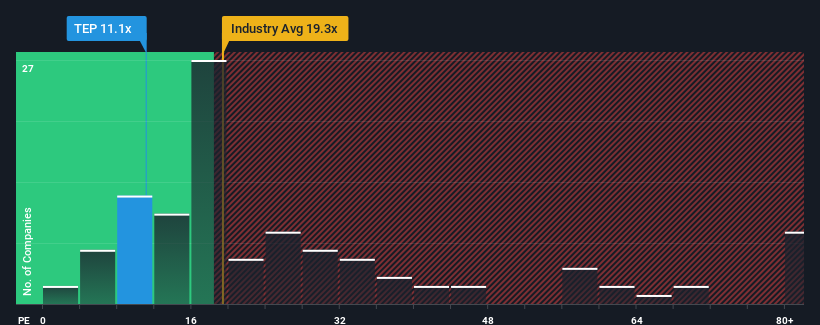

Even after such a large jump in price, Teleperformance's price-to-earnings (or "P/E") ratio of 11.1x might still make it look like a buy right now compared to the market in France, where around half of the companies have P/E ratios above 17x and even P/E's above 29x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings that are retreating more than the market's of late, Teleperformance has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Teleperformance

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Teleperformance's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 5.9% decrease to the company's bottom line. Even so, admirably EPS has lifted 80% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Looking ahead now, EPS is anticipated to climb by 13% each year during the coming three years according to the analysts following the company. With the market predicted to deliver 13% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Teleperformance's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Despite Teleperformance's shares building up a head of steam, its P/E still lags most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Teleperformance currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Teleperformance (1 is a bit concerning!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Teleperformance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:TEP

Teleperformance

Operates as a digital business services company in France and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives