- France

- /

- Professional Services

- /

- ENXTPA:CEN

Top European Dividend Stocks To Consider In March 2025

Reviewed by Simply Wall St

As the European markets navigate a complex landscape of economic uncertainties and trade tensions, the pan-European STOXX Europe 600 Index has shown resilience, ending higher after two weeks of losses. In this environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive consideration for those looking to balance growth headwinds with reliable returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 5.02% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.13% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.58% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.57% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.25% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.61% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.63% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.49% | ★★★★★★ |

| Sonae SGPS (ENXTLS:SON) | 5.60% | ★★★★★☆ |

Click here to see the full list of 241 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

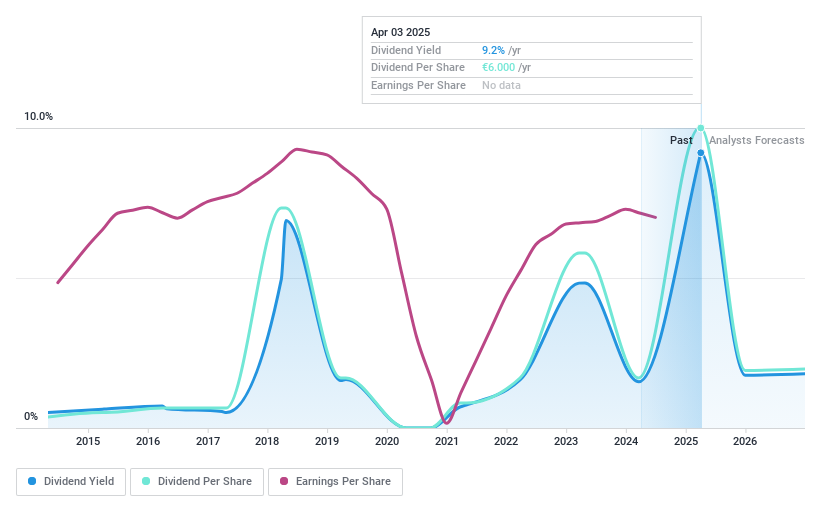

Groupe CRIT (ENXTPA:CEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe CRIT SA offers temporary work and recruitment services both in France and internationally, with a market cap of €727.08 million.

Operations: Groupe CRIT SA generates revenue through its Temporary Work segment (€2.60 billion), Multiservices - Airport services (€422.80 million), and Multiservices - Other Services (€130.30 million).

Dividend Yield: 8.7%

Groupe CRIT recently announced an annual dividend of €6.00 per share, reflecting a high yield of 8.7%, placing it among the top 25% of dividend payers in France. Despite trading at a significant discount to its estimated fair value, the company faces challenges with sustainability as its dividends are not covered by cash flows, evidenced by a high cash payout ratio of 127.2%. Additionally, while dividends have grown over the past decade, they have been volatile and unreliable.

- Get an in-depth perspective on Groupe CRIT's performance by reading our dividend report here.

- Our valuation report here indicates Groupe CRIT may be undervalued.

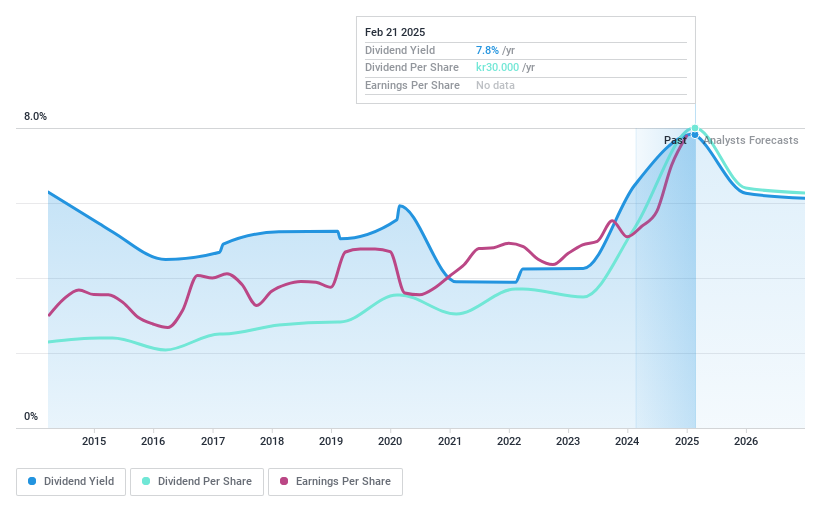

SpareBank 1 Ringerike Hadeland (OB:RING)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 Ringerike Hadeland is a financial institution offering a range of banking products and services to private and corporate customers in Norway, with a market cap of NOK6.49 billion.

Operations: SpareBank 1 Ringerike Hadeland generates revenue through its Retail Market segment (NOK456 million), Business Market segment (NOK467 million), Property Management services (NOK56 million), and IT and Accounting Services (NOK87 million).

Dividend Yield: 7.2%

SpareBank 1 Ringerike Hadeland's dividend yield of 7.23% is below the top quartile in Norway, yet it maintains a stable and reliable payout history over the past decade. With a payout ratio of 68.5%, dividends are well-covered by earnings. The bank reported significant net income growth to NOK 704 million for 2024, although future earnings are expected to decline annually by 4.4%. Trading at a discount to its fair value suggests potential investment appeal despite forecasted challenges.

- Delve into the full analysis dividend report here for a deeper understanding of SpareBank 1 Ringerike Hadeland.

- The valuation report we've compiled suggests that SpareBank 1 Ringerike Hadeland's current price could be quite moderate.

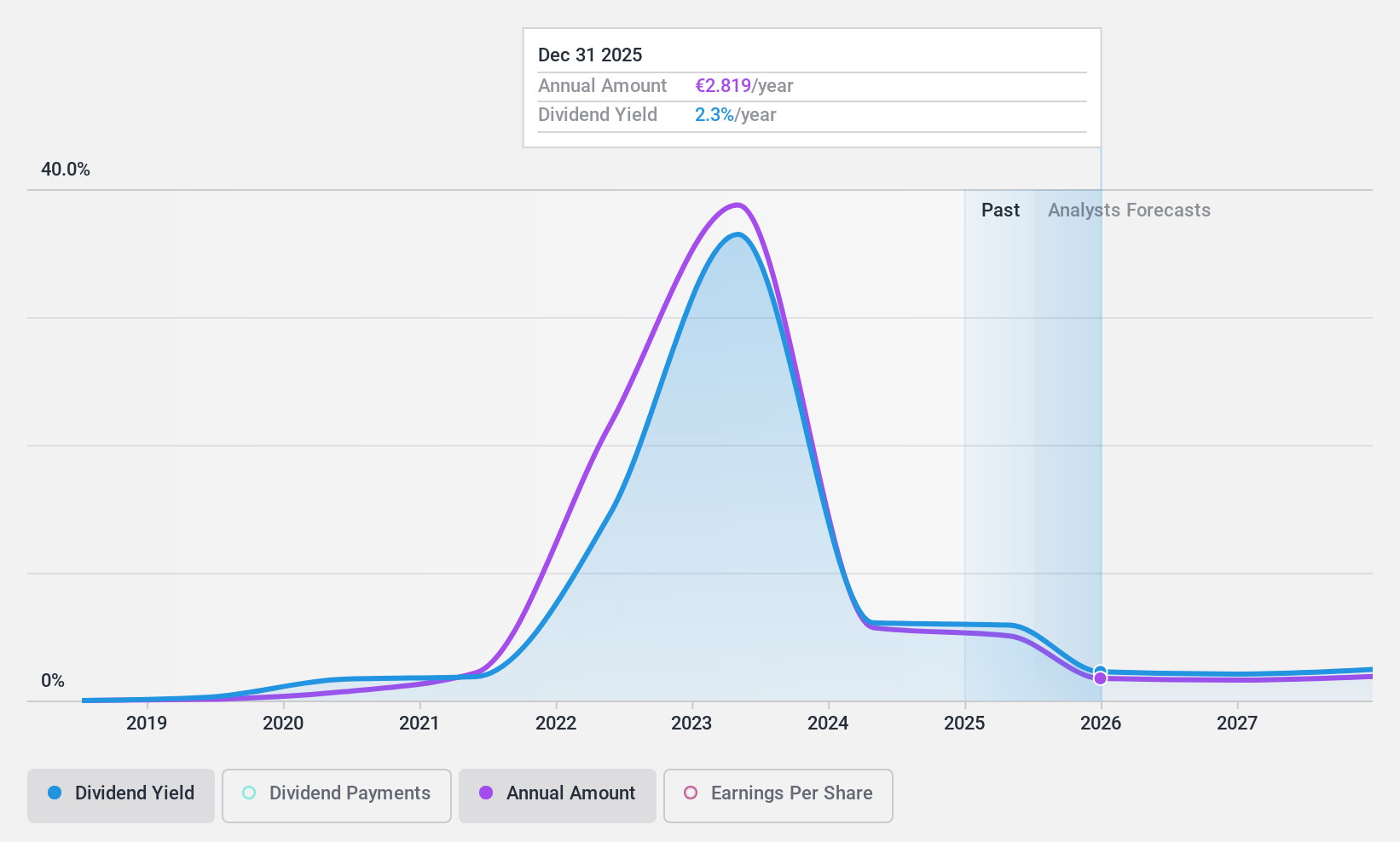

Hapag-Lloyd (XTRA:HLAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hapag-Lloyd Aktiengesellschaft, along with its subsidiaries, operates as a global liner shipping company and has a market cap of €26.19 billion.

Operations: Hapag-Lloyd's revenue is primarily derived from its Liner Shipping segment at €18.75 billion, with an additional contribution of €401.10 million from Terminal & Infrastructure activities.

Dividend Yield: 5.5%

Hapag-Lloyd's dividend yield of 5.5% ranks in the top 25% of German dividend payers, supported by a payout ratio of 60.4%, indicating dividends are well-covered by earnings and cash flows. However, its dividend history is less stable, with recent volatility and a decrease to EUR 8.20 per share announced for May 2025. The company's earnings guidance for 2025 suggests potential challenges, with EBIT expected between EUR 0 to 1.5 billion amidst declining net income trends.

- Click here to discover the nuances of Hapag-Lloyd with our detailed analytical dividend report.

- According our valuation report, there's an indication that Hapag-Lloyd's share price might be on the expensive side.

Summing It All Up

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 238 more companies for you to explore.Click here to unveil our expertly curated list of 241 Top European Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CEN

Groupe CRIT

Provides temporary staffing and recruitment services in France and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)